Oil prices experienced a modest increase on Wednesday as concerns grew that escalating conflicts in the Middle East could disrupt oil supplies from the region, which is the world’s largest producer. However, a significant rise in U.S. crude inventories limited these gains. Brent crude futures increased by 34 cents, or 0.46%, closing at $73.90 per barrel. Meanwhile, U.S. West Texas Intermediate (WTI) crude rose by 27 cents, or 0.39%, settling at $70.10 per barrel.

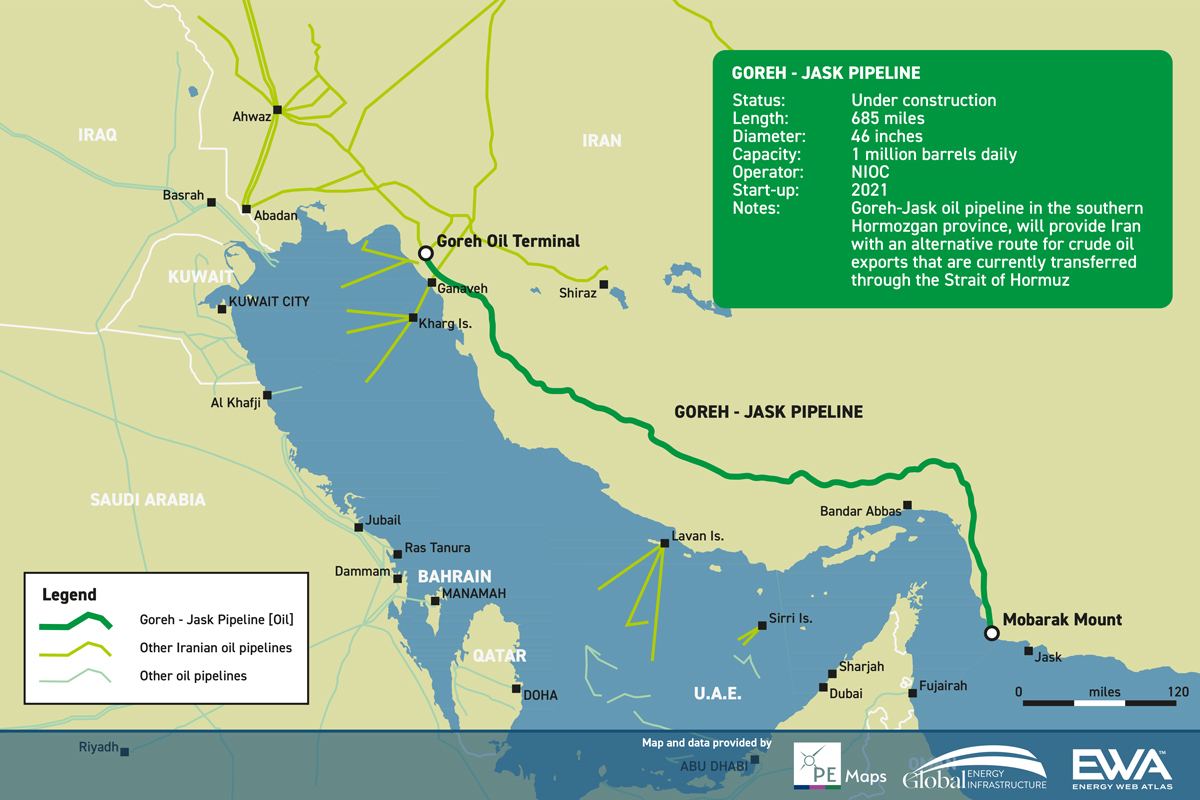

On Tuesday, Iran launched over 180 missiles at Israel, marking its most extensive direct assault on the nation to date. In response, both Israel and the United States pledged retaliation, indicating a further escalation in regional tensions. Reports from U.S. news outlet Axios suggested that Israel’s counterattacks might target Iranian oil production facilities among other strategic locations.

Iran claimed on Wednesday that its missile assault was concluded, contingent upon no further provocations. The Iranian government also warned that any Israeli retaliation would face severe consequences. Tamas Varga from oil brokerage PVM noted that an attack on Iran’s oil infrastructure could provoke Tehran to retaliate against Saudi oil facilities, reminiscent of a 2019 strike on Saudi crude processing sites. “Any such events could push oil prices significantly higher,” he stated.

In an additional escalation, the Israeli military deployed regular infantry and armoured units for ground operations in southern Lebanon against Iran-supported Hezbollah. During a United Nations Security Council meeting focused on the Middle East, Israel and Iran exchanged threats of retaliation. Capital Economics highlighted the potential for a major escalation involving Iran to draw the U.S. into the conflict. While Iran accounts for approximately 4% of global oil production, analysts emphasized that Saudi Arabia’s response to disruptions in Iranian supplies will also be a key factor.

U.S. Crude Inventories Increase

Iran’s oil production recently reached a six-year high of 3.7 million barrels per day in August, according to ANZ analysts. However, U.S. crude inventories rose by 3.9 million barrels to 417 million barrels for the week ending September 27, as reported by the Energy Information Administration. This increase contrasted with analysts’ expectations of a 1.3 million-barrel decline. Gasoline stocks also grew, while distillate inventories fell.

Matt Smith, lead oil analyst at Kpler, explained, “As we enter the seasonal refinery maintenance period, a significant drop in refining activity has led to an increase in crude inventories.” At a meeting on Wednesday, OPEC+ ministers decided to maintain their current oil output policy. The group is scheduled to increase production by 180,000 barrels per day starting in December. Analysts from ANZ noted, “Any indication that production increases will continue could alleviate concerns about supply disruptions in the Middle East.”

Additionally, The Wall Street Journal reported that Saudi Arabia’s oil minister cautioned that oil prices could plummet to $50 per barrel if OPEC+ members fail to adhere to their output cuts. OPEC dismissed this claim, labelling the report as “wholly inaccurate and misleading”.