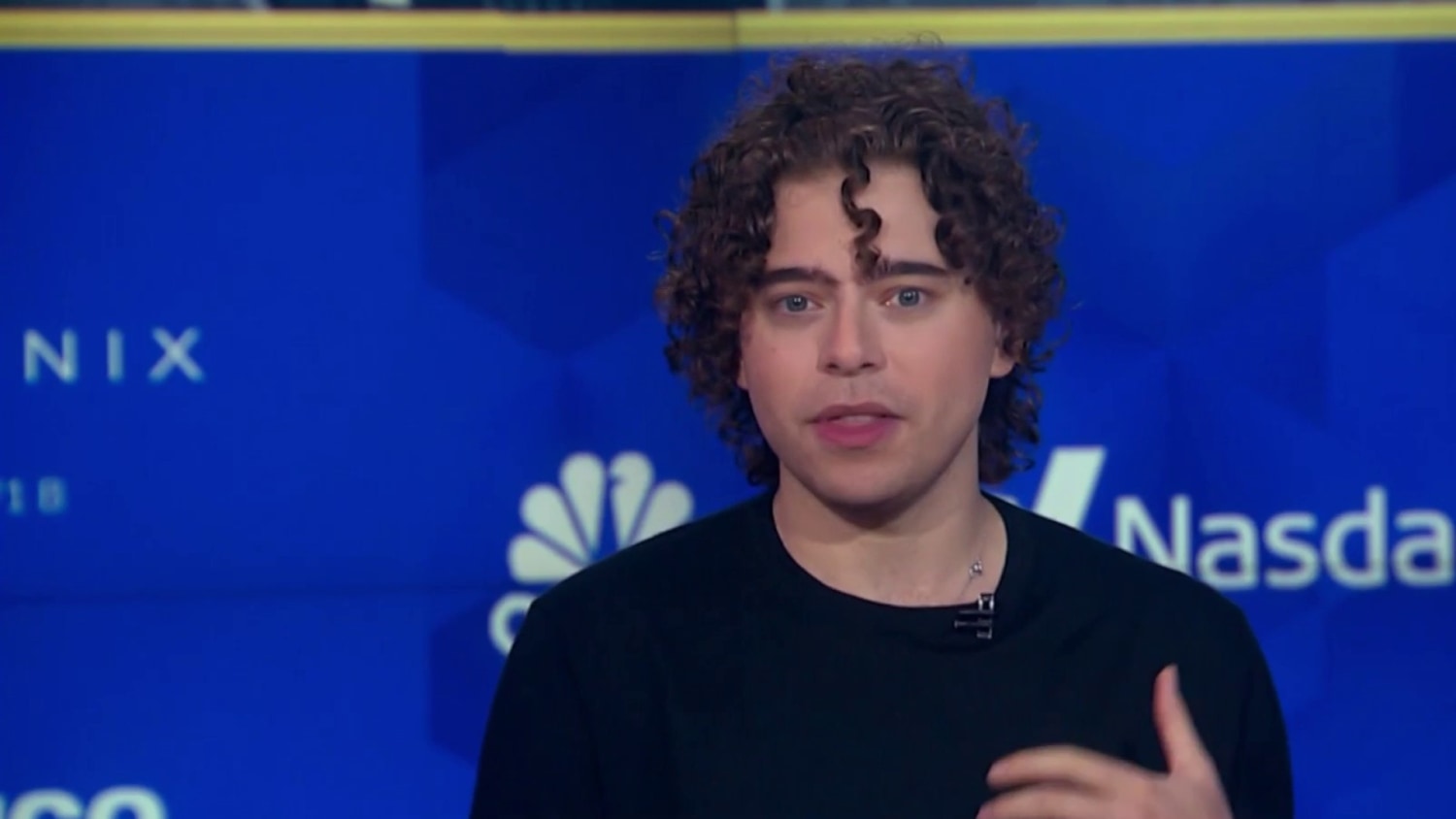

FBI agents conducted a high-profile raid at the New York home of Shayne Coplan, CEO of Polymarket, an offshore cryptocurrency betting platform, in connection with alleged U.S. violations involving election betting. Law enforcement officials reportedly seized electronic devices, including Coplan’s phone, during the early-morning operation. This raid follows recent controversies surrounding Polymarket’s betting markets for the 2024 U.S. presidential election, which had placed significantly higher odds on Donald Trump than on Vice President Kamala Harris, diverging sharply from conventional polling.

Early Morning Raid Raises Eyebrows Amid Election Aftermath

On Wednesday at 6 a.m., FBI agents arrived unannounced at Coplan’s SoHo apartment in downtown Manhattan, demanding his electronic devices as part of a federal investigation. Coplan, the 26-year-old founder of Polymarket, was taken by surprise as agents conducted the search. Although Coplan was not detained, the FBI confiscated his phone and other electronics, signaling a new level of scrutiny over Polymarket’s operations. The company later confirmed the raid, though it refrained from commenting directly on the nature of the investigation.

The timing of the raid has raised questions, occurring shortly after the U.S. presidential election and amidst Polymarket’s controversial predictions. Unlike conventional polling, Polymarket’s betting markets had consistently favored Trump’s chances, drawing widespread attention in the media and from betting circles. The offshore site, which operates via cryptocurrency and prohibits U.S. users from betting, is being probed by the Department of Justice (DOJ) for allegedly allowing U.S.-based users to place wagers.

Allegations of Political Retribution and Offshore Betting Violations

Polymarket issued a statement characterizing the raid as “obvious political retribution” by the current administration for the platform’s market predictions regarding the election. According to a Polymarket spokesperson, the platform’s correct forecasting of the election outcome may have drawn political ire. The company denied any wrongdoing, asserting that the allegations lacked substance. However, Polymarket’s refusal to address DOJ allegations directly has left some questions unanswered.

In recent weeks, Polymarket drew attention for its bold predictions on the U.S. election. While traditional polls had shown Harris and Trump in a tight race, Polymarket’s betting lines consistently assigned much higher odds to Trump, sparking curiosity and suspicion. This divergence between Polymarket’s odds and public polling fueled theories around whether offshore bettors, or potentially influential traders, were affecting the platform’s outcomes.

The focus on Polymarket intensified following large-scale bets from an enigmatic French trader dubbed the “Polymarket whale,” who placed massive wagers on Trump’s victory. This trader’s stakes coincided with a sudden increase in Trump’s odds on Polymarket’s platform. Ultimately, the trader reportedly profited over $46 million as a result of these bets, adding a new dimension to Polymarket’s high-profile role in election betting.

International Scrutiny Amid Polymarket’s Growing Influence

Polymarket’s activities have also caught the attention of foreign regulators. Last week, France’s gambling oversight agency announced it would review the legality of Polymarket’s operations to assess compliance with French regulations. Polymarket’s unregulated status in the U.S. is of particular interest to international regulators, given its rising popularity and ability to influence perceived odds in major events like national elections. The platform’s use of cryptocurrency and offshore operation has placed it in a legal gray area, challenging conventional boundaries in gambling and financial regulation.

While Polymarket’s interface does not permit U.S. residents to trade directly, the DOJ’s investigation appears to be centered on whether American users have found ways to circumvent these restrictions. Legal experts suggest that if the DOJ confirms U.S. access to Polymarket, the company could face significant penalties and potentially severe legal consequences.

The DOJ’s interest in Polymarket comes amidst heightened scrutiny of cryptocurrency-fueled betting markets. Unlike conventional stock or commodity markets, betting on election outcomes remains legally restricted in many jurisdictions. In the U.S., election betting has historically been barred under anti-gambling laws. Polymarket’s emergence as a high-stakes betting platform with major election outcomes at stake has set a new precedent, pushing the limits of traditional gambling laws.

The Broader Implications of Polymarket’s Case on Crypto Betting Platforms

The Polymarket case illustrates broader regulatory concerns about the role of technology and cryptocurrency in reshaping the betting landscape. As an offshore platform operating with minimal regulation, Polymarket’s use of blockchain technology has enabled it to skirt U.S. gambling laws, allowing users outside the country to place large-scale bets on major global events. However, with U.S. authorities now actively investigating potential law violations, the case could redefine how government agencies approach cryptocurrency platforms that delve into financial markets traditionally regulated by state and federal entities.

For the broader crypto-betting industry, the outcome of this investigation may carry lasting consequences. Should the DOJ pursue charges, Polymarket’s case could inspire similar investigations into other cryptocurrency-based betting and trading platforms, setting a precedent for how these platforms operate within U.S. jurisdiction. The nature of the investigation could further impact the future of crypto betting markets as regulators weigh the legality of allowing U.S.-based participants to engage in betting practices facilitated by offshore companies.

In the wake of the FBI raid, Polymarket’s fate hangs in the balance as the company faces mounting legal challenges both domestically and internationally. The DOJ’s investigation signals an era of tighter scrutiny over digital and crypto-fueled betting operations, especially those that operate outside the boundaries of traditional financial and gambling regulations. As regulators move to assert greater control over crypto-based platforms, Polymarket’s legal battles could set a defining standard for the future of crypto betting on high-stakes events like presidential elections.