China‘s economic challenges have led to a marked reduction in its billionaire count, although it still boasts one of the highest numbers of ultra-wealthy individuals globally. The Hurun China Rich List for 2024 has highlighted an alarming trend: the number of China’s dollar billionaires has been on a consistent decline for three years, dropping by a staggering 25% since its peak in 2021. Despite the setbacks, artificial intelligence (AI) and new technology industries are becoming powerful sources of wealth in China, shifting the landscape and adding new names to the country’s elite ranks.

Why China’s Rich List is Shrinking: Key Economic and Regulatory Challenges

The recent Hurun report, headed by Rupert Hoogewerf, paints a clear picture of China’s shifting wealth landscape. Once-dominant sectors like real estate are now waning in influence, with tech, healthcare, and AI-related industries moving to the forefront as primary wealth generators. Hoogewerf commented, “The Hurun China Rich List has shrunk for an unprecedented third year running, as China’s economy and stock markets had a difficult year.”

One major reason for this contraction is the decline in China’s stock market, which has been struggling under the weight of economic pressures and regulatory changes. Although there was a recent surge in stock activity driven by anticipation of government stimulus packages, the relief was short-lived and did little to improve the long-term outlook for traditional sectors. The impact has been especially hard on real estate, an industry once synonymous with wealth creation in China. Regulatory changes and debt crackdowns have further reduced opportunities in the sector, with prominent real estate tycoons falling from the ranks of the ultra-wealthy.

How Google and AI-related Ventures are Influencing China’s Wealth Landscape

As traditional sectors like real estate and manufacturing experience downturns, technology and AI are increasingly driving new wealth. According to the Hurun report, more than half of the “new money” in China now originates from AI and tech-related businesses. The pivot to AI and digital innovation has been spurred by China’s ambitions to lead globally in AI development—a sector where major players like Google have also heavily invested.

In the AI sector, China is positioning itself to compete globally, with companies in digital health, consumer electronics, and autonomous vehicles reshaping the landscape. Chinese entrepreneurs, similar to their counterparts in the West, are focusing on AI applications that offer transformative potential across various sectors. This new wave is reflected in the Hurun Rich List’s latest entrants, many of whom come from AI-related industries, marking a shift from the older generation of real estate and manufacturing moguls.

How Wealth Concentration is Changing in China’s Economic Elite

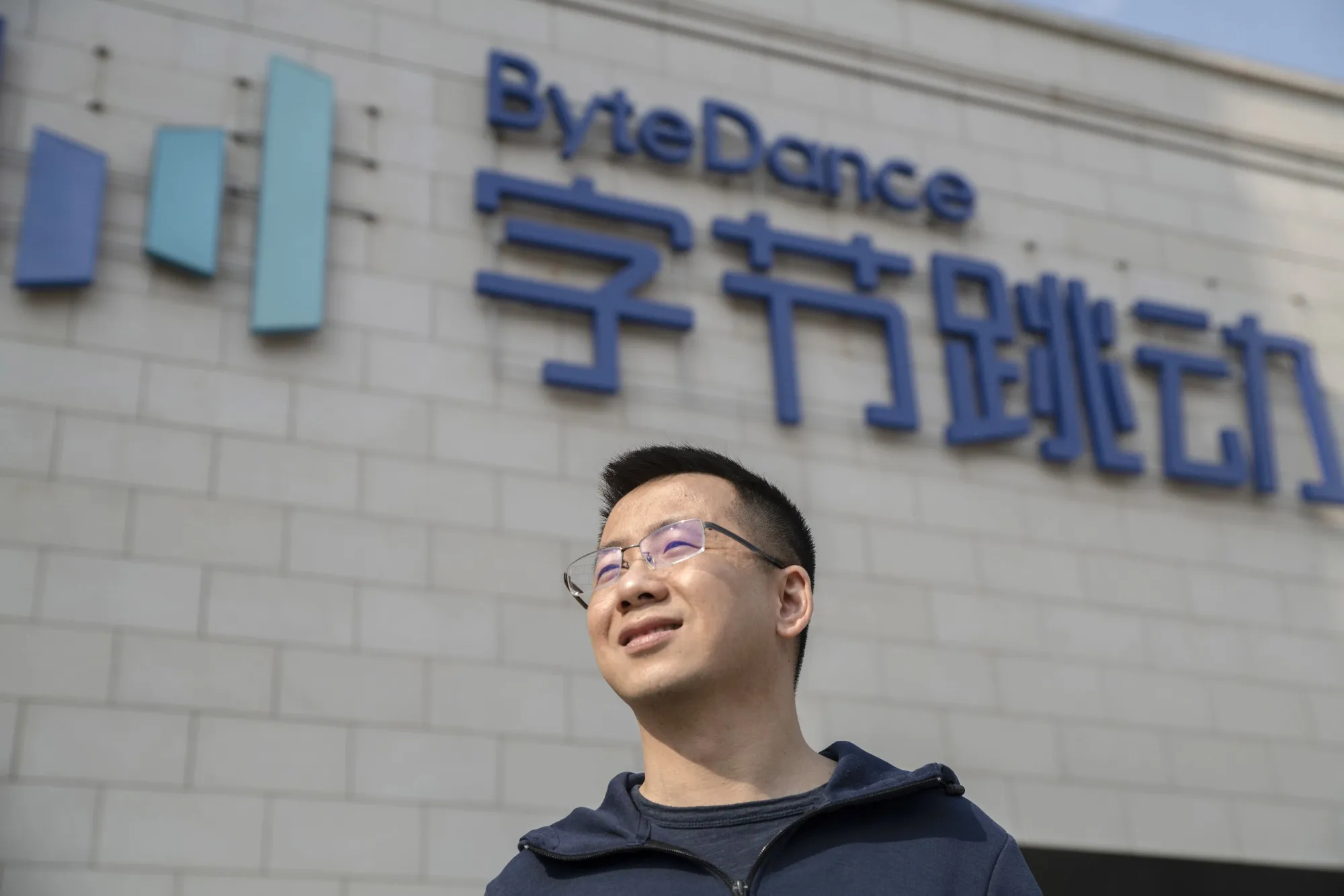

An intriguing element in China’s evolving billionaire landscape is the concentration of wealth among the top echelon of rich individuals. The Hurun report reveals that the growth in wealth among China’s top 10 richest individuals accounts for 60% of the overall wealth growth. Zhang Yiming, founder of ByteDance, stands out as a leading example of this trend, topping the Hurun list for the first time with a personal wealth of $49.3 billion, surpassing Zhong Shanshan of Nongfu Spring, who held the position for the past three years.

However, the total wealth of those on the Hurun list has declined this year, dropping to approximately $3 trillion. This reflects the overall economic stress in China as well as the effect of tighter regulatory measures that have impacted tech and real estate sectors most acutely. With top entrepreneurs facing greater scrutiny from regulators, fewer new entrants are appearing on the rich list; only 1,094 individuals with wealth over $700 million remain, down 12% from last year.

What is Driving the Transformation in China’s Wealth Hierarchy?

China’s current situation shows an interesting churn in its list of wealthy individuals, with the Hurun report noting that half of this year’s entrepreneurs weren’t on the list just five years ago. This is due to both economic pressures and a dramatic shift in sectors driving wealth creation. In contrast to established Western tech giants like Google, Chinese firms have had to navigate more restrictive domestic regulations while pursuing growth in high-stakes, innovative areas.

As regulatory crackdowns continue, newer players from emerging sectors like AI, renewable energy, and biotechnology are gaining prominence. These sectors not only represent China’s aspirations to modernize its economy but also reflect the government’s strategic focus on fostering industries that promise sustainable, long-term growth. While the churn of wealthy individuals on the list might seem alarming, it speaks to an economic shift that favors technology over traditional industries.

Can AI Offset Economic Pressures on China’s Wealthy?

With China’s AI sector attracting investment and interest worldwide, analysts predict that AI and tech-related wealth could surpass that of other sectors if current trends continue. For instance, Google’s strategic shift toward AI aligns with China’s ambitions, and similar partnerships between Chinese tech companies and international giants could further catalyze AI growth. China has already made significant advancements in areas like machine learning, natural language processing, and robotics, all of which are gaining momentum in its economic framework.

Despite the challenges, tech entrepreneurs are optimistic. The Hurun report underscores that 8 out of 10 individuals currently on the list were not there 10 years ago, indicating that new industries are reshaping China’s wealth demographics. This transformation hints that, with the right policies and investments, AI and tech could counterbalance the declining influence of traditional sectors like real estate.

What Does the Future Hold for Wealth Creation in China?

The shrinking billionaire list and shifting sources of wealth creation reflect China’s current economic challenges and evolving strategies. The Hurun report suggests that while traditional sectors might struggle, the momentum in AI and tech industries could make up for the shortfall. China is well-positioned to benefit from its continued investments in AI, just as Google and other global tech companies are capitalizing on the AI boom in their respective markets.

With the number of new names joining the list at its lowest in two decades, the road ahead may be less about rapid growth and more about navigating an economically challenging environment. China’s ongoing regulatory reforms and the global focus on AI mean that its wealth creation patterns may look very different a decade from now.

Conclusion: China’s Billionaire Landscape in Flux

The Hurun report captures a crucial moment in China’s economic evolution, where AI is emerging as a new wealth driver amid setbacks in traditional sectors. As companies align with global leaders like Google in prioritizing AI, there is potential for significant growth, albeit with a more concentrated distribution of wealth. The Hurun list, once dominated by real estate tycoons, is now increasingly filled with AI and tech innovators, marking a new chapter in China’s wealth narrative. The next few years will likely see China continue to adapt to this changing landscape, balancing economic ambitions with strategic sector shifts.

For China’s wealthy, staying at the top may mean embracing innovation and navigating tighter regulations, while for the economy, AI could serve as a bridge to a more resilient and diversified future.