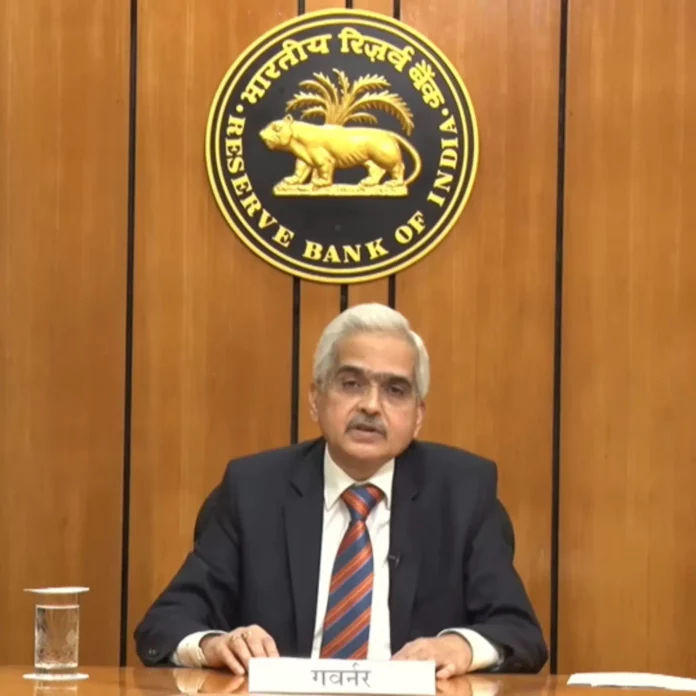

In a significant currency management move, the Reserve Bank of India (RBI) has announced the withdrawal of ₹2000 denomination banknotes. RBI Governor Shaktikanta Das, during a recent event organized by the Confederation of Indian Industry (CII), expressed confidence in the smooth and non-disruptive completion of the entire process. The RBI has set a four-month timeline for the exchange and deposit of ₹2000 currency notes, ensuring that individuals face no hardships during this transition.

Governor Das emphasized that the withdrawal process has been carefully planned to minimize any inconvenience. He stated that the RBI is closely monitoring the situation and noted that there have been no reports of significant issues or disruptions thus far. Business activities continue to function normally, and the public response to the withdrawal has been calm.

Governor Das emphasized that the withdrawal process has been carefully planned to minimize any inconvenience. He stated that the RBI is closely monitoring the situation and noted that there have been no reports of significant issues or disruptions thus far. Business activities continue to function normally, and the public response to the withdrawal has been calm.

Withdrawal of ₹2000 Denomination Banknotes: Smooth and Non-Disruptive Transition

The decision to set a deadline for the exchange and deposit of ₹2000 notes was driven by the need for an effective and streamlined process. Governor Das explained that providing a timeline ensures the smooth functioning of the transition, allowing individuals sufficient time to exchange their notes without causing disruptions to the economy.

Regarding concerns about the withdrawal of high-denomination currency, Governor Das reassured the public that the entire process will be non-disruptive. The RBI has conducted a thorough analysis and concluded that the withdrawal of ₹2000 notes will not have any adverse effects on the financial system or day-to-day transactions.

The ₹2000 notes, which currently constitute approximately 10.8% of the total currency in circulation (equivalent to ₹3.6 lakh crore), have fulfilled their purpose and have reached the end of their lifecycle. Governor Das highlighted that these notes are not actively used in regular transactions, but rather tend to remain dormant. Their withdrawal addresses several collateral issues associated with high-denomination notes.

The fate of the ₹2000 currency note was predetermined even before its introduction, as it was intended for temporary circulation following the demonetization of ₹500 and ₹1000 notes in 2016. The process of reducing the circulation of ₹2000 notes began shortly after demonetization, with the printing of these notes being completely halted in 2018-19.

It is important to note that the RBI has provided ample time and opportunity for individuals to exchange or deposit their ₹2000 notes, thereby ensuring a smooth transition. The exchange or deposit window will remain open until September 30, 2023, providing individuals with sufficient flexibility to manage their currency holdings.

The withdrawal of ₹2000 notes is a strategic step in currency management, aimed at optimising the overall currency ecosystem and facilitating transactions in a more efficient manner. The move aligns with the RBI’s broader objective of maintaining the stability of the financial system and promoting the use of denominations that better serve the needs of the economy.

Withdrawal of ₹2000 Denomination Banknotes: Smooth and Non-Disruptive Transition Assured by RBI Governor Shaktikanta Das

In conclusion, RBI Governor Shaktikanta Das’ assurance of a smooth and non-disruptive transition during the withdrawal of ₹2000 denomination banknotes provides confidence and reassurance to the public. The carefully planned timeline for exchange and deposit, coupled with the monitoring of the situation, demonstrates the RBI’s commitment to ensuring a seamless process. By withdrawing the ₹2000 notes, the RBI aims to enhance the efficiency of the currency ecosystem and address associated collateral issues, all while safeguarding the interests of the public.

Additionally, Governor Das emphasized the rationale behind withdrawing the ₹2000 notes, highlighting their diminishing utility in everyday transactions. He emphasized that these high-denomination notes were primarily used as a temporary measure for the quick replacement of currencies that lost their legal tender status in 2016. With their purpose fulfilled, these notes have been rendered less relevant in the current economic landscape.

The decision to withdraw the ₹2000 notes was made well in advance, as the RBI had ceased printing them in 2018-19. This proactive approach ensured that the phase-out process could be initiated promptly, aligning with the broader objective of maintaining a robust and efficient currency system.

It is worth noting that the total value of ₹2000 currency notes was around ₹7 lakh crore when the decision to discontinue their printing was initially taken in July-August 2017. Since then, the RBI has been gradually reducing their circulation, leading up to the recent announcement of their withdrawal. This measured approach has allowed for a controlled transition while minimizing any potential disruptions.

By setting a four-month window for the exchange and deposit of ₹2000 notes, the RBI has exhibited its commitment to facilitating a smooth process for individuals. This extended timeline ensures that people have ample opportunity to convert their holdings without facing undue hardships. It reflects the RBI‘s dedication to ensuring financial inclusivity and addressing any concerns that may arise during this transition period.

Governor Das’s assurance of a non-disruptive withdrawal and exchange process underscores the central bank’s proactive and vigilant approach to currency management. The RBI’s careful monitoring of the situation, coupled with the well-defined timeline, instills confidence in the public and the financial system at large.

The withdrawal of ₹2000 denomination banknotes marks a significant step in optimizing the currency ecosystem, streamlining transactions, and addressing collateral issues associated with high-denomination notes. As the RBI continues to implement effective currency management strategies, it remains committed to promoting the stability and efficiency of the financial system, ultimately benefiting the Indian economy as a whole.

In conclusion, Governor Shaktikanta Das’ reassurances regarding the withdrawal of ₹2000 notes underscore the RBI’s commitment to a seamless transition. The phased approach, ample exchange and deposit window, and constant monitoring of the situation demonstrate the central bank’s dedication to maintaining stability and facilitating a smooth currency management process. By taking proactive steps and ensuring public convenience, the RBI aims to enhance the overall efficiency of the currency system and promote a thriving economic environment.

Furthermore, Governor Das acknowledged the absence of crowds or major concerns during the initial stages of the withdrawal process. He reassured the public that the situation is being closely monitored to address any potential issues promptly. This proactive stance highlights the RBI’s commitment to ensuring a seamless transition and the continuity of business activities without disruption.

Governor Das justified the presence of a deadline, stating that it is crucial for the effectiveness of any process. By providing a specific timeline for the exchange and deposit of ₹2000 notes, the RBI aims to facilitate a structured and organised approach. This approach allows individuals sufficient time to complete the necessary transactions while minimising any potential inconvenience.

Addressing queries at an event organized by the Confederation of Indian Industry (CII), Governor Das expressed confidence in the non-disruptive nature of the entire withdrawal process. He assured that the RBI has conducted a thorough analysis to ensure a smooth transition. This careful assessment indicates the central bank’s commitment to minimizing any disruptions in the economy or financial system.

It is important to note that the ₹2000 notes constitute approximately 10.8% of the total currency in circulation, amounting to ₹3.6 lakh crore. Governor Das highlighted that these high-denomination notes have fulfilled their purpose and are no longer extensively used in regular transactions. Their reduced relevance and the presence of collateral issues associated with their circulation have contributed to the decision to withdraw them.

The fate of the ₹2000 currency note was essentially sealed even before its introduction, as the intention was always to phase it out as soon as possible. Following the demonetisation move in 2016, where 86% of the currency in circulation was invalidated, the process of reducing the circulation of ₹2000 notes commenced. This decision aligns with the larger objective of streamlining the currency system and maintaining its efficiency.