Following the recent announcement by the Reserve Bank of India (RBI) to withdraw the highest-value currency notes from circulation, banks have begun accepting ₹2,000 Banknotes for exchange. In an effort to ensure a smooth transition, the RBI has advised banks to maintain daily data on deposit and exchange of these Banknotes, as well as provide suitable facilities such as waiting spaces with shade and drinking water for customers.

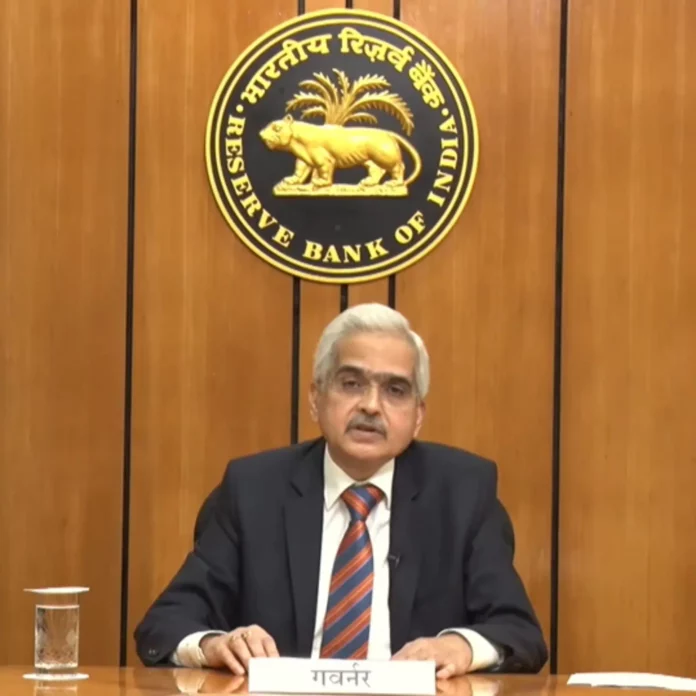

Despite the withdrawal, the ₹2,000 notes will retain their legal tender status, enabling individuals to use them for transactions. While there has been no major rush observed at banks in certain areas, customers are gradually depositing these notes, and banks are prepared to establish separate counters if necessary. RBI Governor Shaktikanta Das has reassured the public of the availability of smaller denomination notes and the extended exchange window of over four months.

However, discussions continue regarding the legal tender status of the ₹2,000 notes beyond September 30, taking into account the needs and concerns of individuals, including those residing outside India. The RBI’s decision to set a deadline aims to underscore the importance of the matter, but it remains open to review.

Withdrawal Measures: RBI’s Instructions for Banks and Facilities Provided to Customers

This move is part of the RBI’s ongoing efforts in currency management, with the expectation that the majority of ₹2,000 notes in circulation will be returned to the banking system by September 30.

The decision by the Reserve Bank of India (RBI) to withdraw the ₹2,000 banknotes from circulation has sparked various responses and observations across the country. In Guwahati, for instance, the banks did not experience a significant rush as customers were calmly depositing their ₹2,000 notes. Biltu Rai, the manager of the Bhangagarh branch of Punjab National Bank, stated that their branch had not witnessed a surge of customers seeking to deposit ₹2,000 notes, and no special measures had been implemented to handle such transactions as of yet. However, Rai assured that if the need arose, they would establish separate counters to efficiently accommodate customers.

In Ranchi, Prasidh Singh, a pensioner, visited a State Bank of India (SBI) branch to exchange his ₹2,000 notes. Singh had received these notes from his tenant a while back and now wished to deposit them. He mentioned that only three people, including himself, had arrived at the bank for exchanging notes in the morning. This demonstrates that while there is a gradual uptake in the depositing of ₹2,000 banknotes, there is no immediate rush among the public.

RBI Governor Shaktikanta Das addressed concerns and emphasized that there was no reason for people to panic or rush to banks for exchanging the ₹2,000 banknotes. He assured the public that there was an adequate supply of smaller denomination notes available and a generous exchange window of over four months, which provided ample time for individuals to manage their currency holdings. Das further stated that the withdrawal of the ₹2,000 banknotes would not have a significant impact on the overall economy. He revealed that these notes constituted less than 11% of the total currency in circulation, indicating that they were not commonly used for day-to-day transactions.

To facilitate the exchange process, the RBI advised banks to maintain a record of daily data on the deposit and exchange of ₹2,000 banknotes in a specific format. Furthermore, they were instructed to create waiting spaces with shade and drinking water facilities for the convenience of customers. These measures aimed to ensure a smooth transition and provide a positive experience for individuals engaging in currency exchange activities.

To facilitate the exchange process, the RBI advised banks to maintain a record of daily data on the deposit and exchange of ₹2,000 banknotes in a specific format. Furthermore, they were instructed to create waiting spaces with shade and drinking water facilities for the convenience of customers. These measures aimed to ensure a smooth transition and provide a positive experience for individuals engaging in currency exchange activities.

Reserve Bank of India withdraw the ₹2,000 banknotes

While the withdrawal of the ₹2,000 banknotes from circulation indicates a change in the country’s currency landscape, it is important to note that these notes will retain their legal tender status. This means that individuals can still utilize them for purchasing goods and services. However, the RBI governor did not comment on the legal tender status beyond September 30. He emphasized that the RBI would be sensitive to the requirements and needs of people, including those residing outside India, who might require additional time to exchange their ₹2,000 notes. The RBI will carefully evaluate these matters and work towards resolving any associated concerns.

Regarding the withdrawal of legal tender status, a government official familiar with the matter mentioned that the deadline of September 30 and the legal tender status could be subject to review in due course. Any decision to revoke the legal tender status would require the approval of the government. It is worth noting that the RBI had halted the printing of ₹2,000 banknotes in 2018-19 and had gradually reduced their circulation since then. As of March 31, 2023, the total value of ₹2,000 banknotes in circulation stood at ₹3.62 lakh crore, accounting for 10.8% of all notes, compared to ₹6.73 lakh crore or 37.3% on March 31, 2018.

Governor Das reiterated that the withdrawal of the ₹2,000 banknotes was part of currency management and that these high denomination notes had successfully served their purpose in facilitating the rapid re-monetization process after the demonetization exercise in November 2016.

He expressed confidence that the majority of the ₹3.62 lakh crore in circulation as ₹2,000 notes would be returned to the banking system by the stipulated deadline of September 30.

He expressed confidence that the majority of the ₹3.62 lakh crore in circulation as ₹2,000 notes would be returned to the banking system by the stipulated deadline of September 30.

To ensure transparency and compliance with existing regulations, Das clarified that there were no additional procedures specified for depositing the ₹2,000 banknotes. Individuals would need to adhere to the existing rules, which included producing their PAN cards if they deposited cash exceeding ₹50,000. He further dispelled speculations about the return of the ₹1,000 note, terming them as purely speculative.

The RBI’s decision to withdraw the ₹2,000 banknotes from circulation seeks to bring about a well-managed currency system, encourage the usage of smaller denomination notes, and align with the evolving needs of the Indian economy. The central bank remains committed to addressing any concerns that may arise during this transition period, ensuring the smooth functioning of the currency exchange process and providing suitable assistance to individuals both within and outside the country.