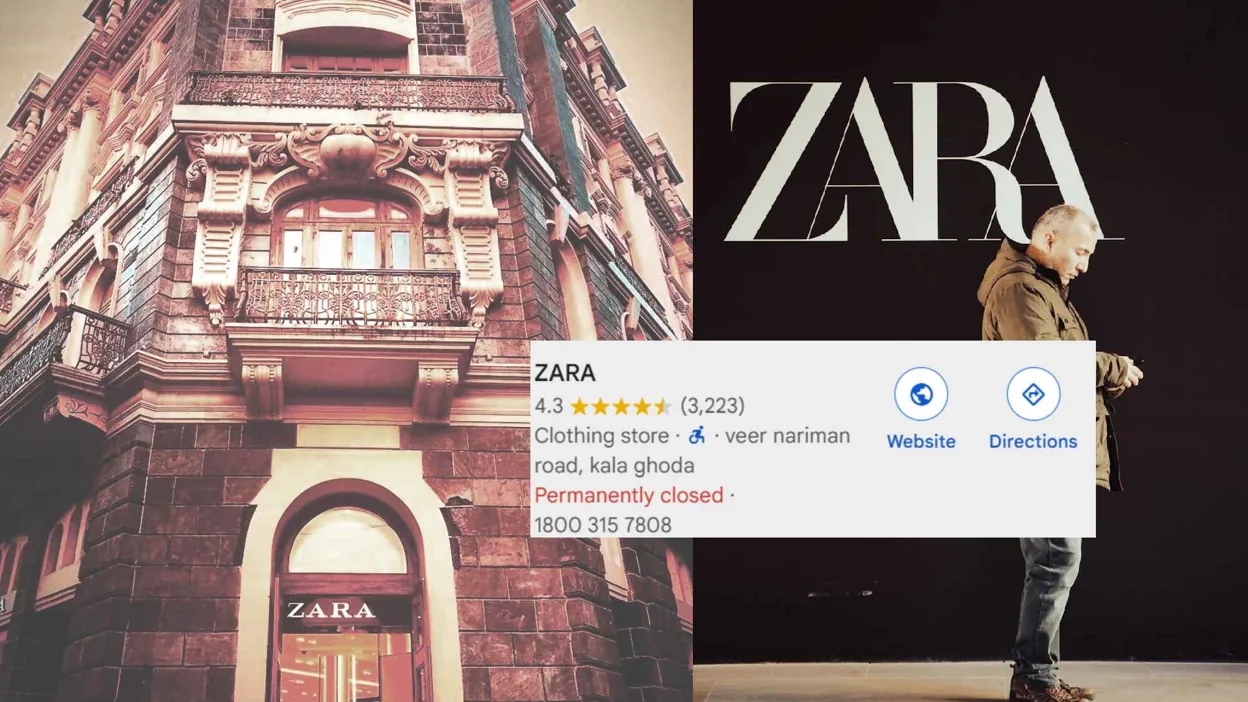

In the center of Mumbai, an unexpected twist has rocked the retail world. Zara, a brand known to millions, has closed its doors in one of the city’s most celebrated heritage buildings—the Ismail Building—due to extremely high rental costs.

The huge empty space of nearly 60,000 square feet that once buzzed with shoppers’ energy now finds a new tenant in Purple Style Labs. In a deal that is making headlines all over the country, Purple Style Labs has agreed to lease this premium space for a total of 2206 crore over five years. In the very first year, the annual rent is fixed at 836 crore and will keep rising with every passing year.

The Story at a Glance

Mumbai is a city that never sleeps. Its streets are filled with dreams, commerce, and heritage buildings that tell tales of a glorious past. One such building is the iconic Ismail Building—a 60,000 sq ft retail space that has seen many changes over the decades.

Zara, one of the world’s biggest fashion brands, once chose this building as a home for its store. But the cost of staying in such a prime location was too high. When the rent soared to astronomical numbers, Zara had no choice but to close its store.

Now, a new player, Purple Style Labs, has stepped in. They have signed a lease agreement that will see them taking over the space for five years at a total cost of 2206 crore. The deal is structured in such a way that the rent in the first year stands at 836 crore, with a clause for increases in the following years. This move is aggressive and signals that even in a market known for its challenges, there are players willing to invest heavily in Mumbai’s prestigious real estate.

Breaking Down the Deal: How It Happened

The High Stakes of Mumbai Real Estate

Mumbai is not just a city; it is a symbol of ambition, energy, and sometimes, extreme financial pressure. Real estate in Mumbai is among the priciest in the country. Over the past few years, rental costs for premium retail spaces have escalated sharply. This trend is driven by a mix of factors:

- Scarcity of prime locations: There are very few spots in Mumbai that offer both history and high foot traffic.

- Rising demand for luxury and branded retail: Big brands like Zara seek locations that add to their image.

- Economic growth and inflation: As the economy grows, the value of real estate rises, often pushing the rent beyond what many brands can afford.

For Zara, the escalating rent in the Ismail Building became a burden too heavy to bear. When faced with astronomical numbers like 836 crore for just the first year, it became clear that the cost of doing business in this prime spot was unsustainable.

Zara’s Exit: When and Why?

Zara, known for its fast fashion and trend-setting collections, had built a reputation for choosing prime retail spaces. Their store in the Ismail Building was no exception. However, when the rental costs reached an unmanageable level, Zara had to make a tough decision. The closure of its Mumbai store was not a sign of declining popularity but a direct result of the harsh economic realities of prime real estate in the city.

When?

The closure happened recently as the building owners and leasing companies revised the rent agreements. The timing coincided with a broader trend in Mumbai, where many high-end retail spaces are experiencing rental hikes due to limited supply and high demand.

Why?

Zara’s decision was driven by a need to control costs. In a competitive market, even well-known brands must ensure that their operational expenses do not outweigh the potential profit. The soaring rent was unsustainable, and closing the store was a strategic move to avoid deeper financial losses.

Who Are the Key Players?

Zara:

A flagship brand in global fashion, Zara represents the fast-paced world of retail. Its decision to exit the Ismail Building speaks volumes about the pressures faced by international brands in India’s booming but expensive markets.

Purple Style Labs:

The new tenant, Purple Style Labs, is emerging as a significant player in the retail and lifestyle sectors. Their willingness to take on a deal worth 2206 crore signals a bold commitment to tapping into Mumbai’s vibrant market despite the high costs. Their decision is rooted in the belief that the brand value and potential customer reach in a heritage location like the Ismail Building far outweigh the heavy financial burden.

Building Owners and Leasing Companies:

The owners of the Ismail Building and the leasing companies involved are key stakeholders. They are banking on the escalating rental rates and the prestige of their location to attract high-profile tenants. Their aggressive pricing strategy is a clear signal that they are focused on maximizing returns from one of Mumbai’s most iconic retail spaces.

The Historic Ismail Building: Where It All Unfolded

The Ismail Building is not just any building—it is a symbol of Mumbai’s rich heritage and commercial evolution. Located in a prime area of the city, it has stood the test of time and witnessed the transformation of Mumbai from a colonial trade hub to a modern metropolis.

Architectural and Historical Significance

The building boasts a unique blend of architectural styles that mirror Mumbai’s diverse history. Over the years, it has hosted various retail stores, each contributing to the narrative of the city’s growth. Its walls have seen the hustle of vendors, the march of shoppers, and the footsteps of generations.

Why the Ismail Building?

For international brands like Zara, the building offered more than just space—it was an opportunity to associate with a piece of Mumbai’s cultural legacy. However, such heritage locations come at a premium. The rent reflects not only the location’s value but also the aura of history and prestige that it carries. For Purple Style Labs, this was an attractive proposition. The company saw the potential of leveraging the building’s legacy to build its own brand image.

Impact of Heritage Status on Rent

Heritage buildings often command higher rent because they offer an intrinsic value that modern structures do not. The grandeur, the historical narratives, and the prime location all contribute to making these properties highly sought after. In this case, the escalating rent of 836 crore for the first year is a testament to the Ismail Building’s revered status in Mumbai.

The New Deal in Detail: What Purple Style Labs Has Agreed To

Purple Style Labs’ lease for the Ismail Building is a groundbreaking deal in several ways. Let’s break down the specifics in simple language:

Lease Duration and Total Rent

- Duration: The lease agreement spans five years.

- Total Rent: Over these five years, the total rent amounts to 2206 crore.

- First Year Rent: For the initial year alone, Purple Style Labs will pay 836 crore.

- Escalation Clause: The lease includes an annual increase, meaning that the rent will go up each year after the first.

What Does This Mean for the Retail Space?

The nearly 60,000 sq ft of retail space in the Ismail Building will now be under the management of Purple Style Labs. This space is not just a commercial asset—it is a canvas for creativity, a platform for retail innovation, and a symbol of Mumbai’s high-stakes real estate market. With such a significant financial commitment, Purple Style Labs is expected to bring new energy and possibly reimagine the retail experience in this iconic space.

Simple Words on the Financials

Imagine paying a huge sum every year for a building that has a story to tell. That is what Purple Style Labs is doing. With an annual rent starting at 836 crore, and rising each year, the company has bet big on the future of retail in Mumbai. This aggressive move signals that they are ready to invest heavily to capture the attention of customers who come to experience the legacy of the Ismail Building.

Market Trends: Why High Rent Is the New Normal in Mumbai

Mumbai’s real estate market is known for its high prices. The situation at the Ismail Building is a clear reflection of broader market trends.

The Demand for Prime Retail Spaces

Mumbai is the financial capital of India, and its real estate market is fueled by a constant demand for prime retail spaces. Here are a few reasons why the demand remains high:

- Economic Growth: Mumbai’s economy is growing, attracting both national and international brands.

- Consumer Spending: As consumer spending increases, brands are willing to invest more in premium locations.

- Limited Supply: There is a limited number of heritage buildings and prime spots in Mumbai, which naturally drives up the cost.

The Impact of High Rent on Brands

For brands like Zara, high rent can mean the difference between profit and loss. When rental costs soar, companies are forced to rethink their strategy. In Zara’s case, the decision to shut down the store was a move to protect their bottom line. It is a reminder that even global giants must be cautious in markets where the cost of doing business can be prohibitive.

What the Deal Means for Future Leases

The lease deal between Purple Style Labs and the Ismail Building is a benchmark. It sets a high standard for what can be expected from premium retail spaces in Mumbai. Other brands and investors will closely watch this development. If Purple Style Labs succeeds in transforming the retail experience in the building, it might pave the way for more aggressive leasing deals in the future.

The Why: Economic and Cultural Factors at Play

Understanding why this deal came to pass requires looking at both economic and cultural factors that influence Mumbai’s real estate market.

Economic Drivers

- Inflation and Cost Increases: As the economy grows, inflation pushes up the cost of properties. In Mumbai, where space is at a premium, this effect is even more pronounced.

- Investment Confidence: Investors are confident in Mumbai’s long-term growth prospects. Even if the numbers seem astronomical, the belief in a profitable future drives these high-stakes deals.

- Competitive Market: With multiple international brands vying for a spot in Mumbai, the competition naturally pushes rent higher.

Cultural Significance

Mumbai’s heritage buildings are not just properties—they are part of the city’s soul. The Ismail Building, with its long history and unique architecture, holds a special place in the hearts of Mumbaikars. Brands that secure space in such buildings are seen as inheritors of that legacy. For Purple Style Labs, this cultural connection is a powerful asset. It allows them to market themselves as not only a modern brand but also one that respects and embodies Mumbai’s rich history.

Aggressive Business Moves

In simple terms, sometimes you have to be bold to win. The new lease deal is an example of aggressive business strategy. Purple Style Labs is making a statement that they are not afraid to invest big in one of the country’s most competitive markets. This approach might seem risky, but it also has the potential to pay off by boosting the brand’s visibility and reputation.

Who Are the People Behind the Move?

It is important to recognize the individuals and organizations that shape such bold decisions.

The Decision Makers at Purple Style Labs

At the heart of the new lease deal are the leaders at Purple Style Labs. They are entrepreneurs and business leaders who have taken a calculated risk. Their decision to invest 2206 crore over five years is not made lightly. They have weighed the risks against the potential rewards and believe that the heritage and location of the Ismail Building will give their brand an unbeatable edge. In a city like Mumbai, where every square foot counts, this aggressive move can set them apart from competitors.

Real Estate Experts and Investors

Real estate experts see this deal as a sign of confidence in Mumbai’s retail market. Investors are always on the lookout for properties that not only promise financial returns but also carry historical and cultural significance. The Ismail Building, with its legacy, fits the bill perfectly. Experts believe that such high-stakes deals will become more common as brands compete for prime locations in major cities.

Government and Regulatory Influences

While the decision to sign such a deal is made by private players, government policies also play a role. The local government’s support for preserving heritage buildings, coupled with policies that encourage foreign and large-scale investments, has created an environment where aggressive leasing deals can thrive. This balance between commercial interests and cultural preservation is delicate, and both government and business leaders must work together to maintain it.

When Did It All Begin? The Timeline of Events

To understand the full picture, it is useful to look at the timeline of events that led to the current situation.

Zara’s Entry and Growth

Early Days: Zara had established itself as a leading global brand with a reputation for fast fashion. Their entry into Mumbai was part of a broader strategy to capture the growing Indian market.

Establishing the Store: Zara chose the Ismail Building because of its prime location and heritage value. The store became a favorite among shoppers looking for trendy and affordable fashion.

The Rise in Rent

Market Changes: Over the past few years, the cost of commercial real estate in Mumbai has skyrocketed. Factors such as inflation, limited supply, and increased demand pushed the rent to new heights.

Decision Time: Faced with rental rates that soared to 836 crore in the first year alone, Zara had to decide whether to continue operating in an unprofitable environment. The decision was made to shut down the store rather than risk financial losses.

The New Lease Agreement

Negotiations: After Zara’s exit, the space was open for new opportunities. Negotiations for a new tenant began, and Purple Style Labs emerged as the frontrunner.

Final Agreement: The deal was finalized for a period of five years at a total cost of 2206 crore. The aggressive nature of the deal, with annual escalations starting at 836 crore, reflects both the value of the space and the high expectations of the tenant.

The Ripple Effect on Local Economy

The aggressive deal is likely to have a ripple effect on the local economy. As rental costs in prime locations soar, there may be increased investment in infrastructure and services to support these high-value areas. At the same time, local businesses will need to evolve, finding ways to compete in an environment where only the bold survive.

In the coming years, we can expect to see more such moves that challenge the norms and push the boundaries of what is possible in the world of retail and real estate. The aggressive lease deal at the Ismail Building is just one chapter in a larger story—a story of a city that refuses to be defined by limits and is always ready to reinvent itself.

Mumbai’s retail market is a battlefield, and only the bold will survive. With each aggressive move, whether it is a major brand pulling out or a new player stepping in with a daring investment, the dynamics of the city are being rewritten. In this landscape, every decision is a gamble, and every square foot is a prize. As we continue to watch this unfolding drama, one thing is clear: in Mumbai, the stakes are high, and the future belongs to those who dare to take the risk.