In a major financial move, OpenAI has secured a $4 billion revolving credit line, a day after completing a staggering $6.6 billion funding round, which further solidifies its position as one of the most valuable private companies globally. The funding and credit facilities come as OpenAI continues to build its arsenal to compete with tech giants such as Google (owned by Alphabet) and Microsoft, its largest corporate backer. The credit line will help OpenAI boost its liquidity to $10 billion, ensuring it has the resources to meet its immense computing capacity needs as it continues to push the boundaries of generative AI.

But how did we get here? What has led OpenAI to become a frontrunner in the race for artificial intelligence supremacy, and what does this credit line mean for its future?

The Past: OpenAI’s Journey to the Top of AI

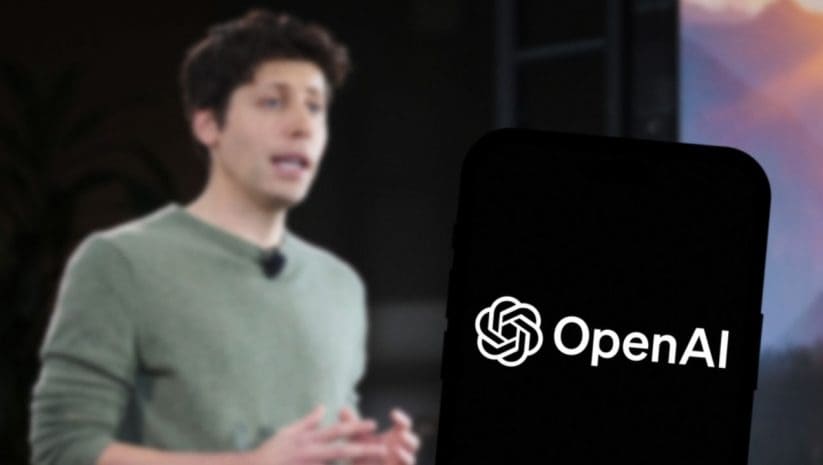

OpenAI, founded in 2015 by Sam Altman, Elon Musk, and other tech luminaries, was originally set up as a non-profit dedicated to advancing AI research in an ethical manner. The goal was to ensure that artificial general intelligence (AGI), when developed, would benefit all of humanity rather than be controlled by a few corporations.

Initially, OpenAI’s research efforts focused on improving machine learning techniques, and the company rapidly became known for its natural language processing capabilities. However, it was in 2020, with the release of GPT-3, that OpenAI became a household name in tech circles. GPT-3, a massive AI language model with 175 billion parameters, brought unprecedented abilities to generate human-like text, setting a new standard in generative AI.

Despite its research-focused, non-profit roots, OpenAI soon realized that commercial applications were critical to scaling its AI technologies. In 2019, the company made the pivotal decision to create a for-profit arm, OpenAI LP, which allowed it to raise external funding and monetize its innovations. Around the same time, Microsoft became a key partner, investing $1 billion into OpenAI and providing access to its Azure cloud computing infrastructure, which was crucial for training large AI models.

Key Moments in OpenAI’s Growth

- 2015: OpenAI is founded as a non-profit organization focused on AI safety and democratization.

- 2019: The company transitions to a for-profit entity and receives its first $1 billion investment from Microsoft.

- 2020: OpenAI releases GPT-3, revolutionizing natural language processing and generative AI.

- 2023: OpenAI integrates GPT-4, bringing enhanced capabilities and making ChatGPT one of the most used AI applications globally.

With ChatGPT, OpenAI launched its first successful product aimed at consumers, allowing businesses and individuals to harness the power of its conversational AI model. ChatGPT quickly gained traction across industries, being used for everything from customer service to creative writing, and became a symbol of the AI boom.

The Present: Financial Powerhouses Line Up

The latest $6.6 billion funding round, which values OpenAI at nearly $157 billion, was led by venture capital giants such as Thrive Capital and Khosla Ventures, with Nvidia and Microsoft continuing to provide strong backing. Microsoft, in particular, has continued to deepen its partnership with OpenAI, embedding its AI technologies across Azure, Microsoft 365, and Bing.

What makes the $4 billion credit line particularly significant is that it will allow OpenAI to continue purchasing the highly sought-after Nvidia GPUs. These chips are the backbone of modern AI models, providing the computational power required to train and deploy large language models (LLMs) like GPT-4. OpenAI is clearly gearing up for larger projects and even more significant AI breakthroughs, ensuring that it stays competitive in the ever-accelerating race against Google DeepMind, Meta, and Anthropic.

The credit line was secured with the help of financial giants such as JPMorgan Chase, Citi, Goldman Sachs, and Morgan Stanley, which shows the enormous confidence the financial world has in the potential of OpenAI to deliver immense returns.

But why such a massive credit facility, and why now?

Why the $4 Billion Credit Line?

The $4 billion credit line will give OpenAI the flexibility to respond quickly to new opportunities in the AI space, especially as the competition with Google, Meta, and Amazon intensifies. In AI, time is money. Training state-of-the-art models can cost millions, if not billions, of dollars in computational resources. Moreover, scaling these models for enterprise applications requires substantial investment in infrastructure.

Here’s how the credit line will likely be used:

- Nvidia GPUs: OpenAI will be able to buy high-end computing power to train new models.

- Infrastructure: The credit will support expansion of the infrastructure needed to deploy its models on a global scale.

- Flexibility: It provides OpenAI the flexibility to seize new growth opportunities, such as entering new markets or launching new AI services and products.

According to OpenAI’s CFO, Sarah Friar, “This credit facility further strengthens our balance sheet and provides flexibility to seize future growth opportunities.” It’s clear that OpenAI is planning for long-term growth and expansion, especially as demand for generative AI applications is skyrocketing across industries.

The Future: Where is OpenAI Headed?

Looking ahead, OpenAI is expected to play an even bigger role in shaping the future of artificial intelligence. With an expected $11.6 billion in revenue for 2025, it is set to outgrow many of its competitors. However, there are still challenges ahead. OpenAI is currently running at a $5 billion loss, but investors remain bullish, expecting those losses to turn into massive profits as the technology matures and scales.

One of the company’s most ambitious future plans is its work on artificial general intelligence (AGI), a type of AI that can perform any intellectual task that a human can do. While AGI remains theoretical, OpenAI’s CEO Sam Altman has repeatedly emphasized that AGI is the ultimate goal. With the massive financial backing now at its disposal, OpenAI is better positioned than ever to make breakthroughs in this area.

There’s also the matter of executive shakeups. Recently, Mira Murati, OpenAI’s Chief Technology Officer, left the company in a sudden move that has raised eyebrows. It remains unclear what impact this might have on the company’s leadership, but it hasn’t dented investor confidence thus far.

Challenges on the Horizon

- Profitability: While the company is generating billions in revenue, $5 billion in losses are still a major concern.

- Competition: Google DeepMind, Meta, and Anthropic are ramping up their AI research efforts. The battle for AI supremacy is far from over.

- Regulation: As AI becomes more pervasive, governments are likely to impose more regulations on the ethical use of these technologies, which could affect the pace of innovation.

A Powerful Future Beckons

OpenAI’s ability to secure a $4 billion credit line after an already impressive $6.6 billion funding round demonstrates the enormous faith that the financial and tech worlds have in its future potential. With ambitions ranging from dominating generative AI to one day developing AGI, OpenAI has both the funding and the technical capabilities to remain at the forefront of the AI revolution.

However, the next few years will be crucial in determining whether OpenAI can turn its massive funding and revolving credit line into a profitable and world-changing venture.