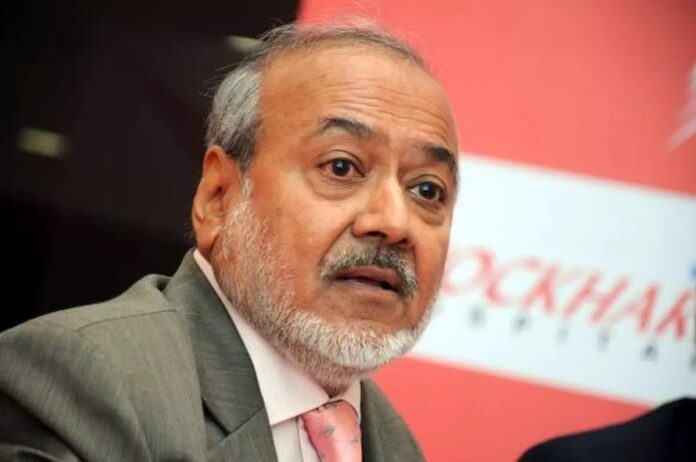

Habil Khorakiwala’s rise from managing his family’s business to becoming a global pharmaceutical leader is nothing short of remarkable. Born into a Dawoodi Bohra family, Habil was deeply influenced by his father, Fakhruddin Khorakiwala, who owned India’s first departmental store, “Akbarallys,” located near Gunbow Street in Bombay. Established in 1957, Akbarallys grew into a monopoly and became a household name for consumer goods. Habil, the eldest son, was expected to carry on the family’s legacy. However, his vision extended far beyond running a retail store—he wanted to make his mark in the pharmaceutical industry. This is the extraordinary story of how Habil Khorakiwala built Wockhardt, a ₹14,000 crore pharmaceutical giant, overcoming numerous setbacks and challenges along the way.

The Birth of Wockhardt: Vision and Strategy

Habil Khorakiwala’s journey into the pharmaceutical industry began with his pursuit of education. After completing his undergraduate studies, he had the opportunity to pursue a master’s degree in Pharmaceuticals from Purdue University in the United States. During this time, Akbarallys had expanded its product line to include medicines after acquiring Worli Chemical Works. Fakhruddin, Habil’s father, was now a prominent figure in Bombay’s business and political circles, even serving as the Sheriff of Mumbai. He needed someone to take the reins of the business. However, Habil had a different idea.

Rather than simply joining the family business, Habil returned to India with a vision to carve out a new path. He wanted to expand beyond selling medicines through Akbarallys and aimed to serve the broader Indian market with over-the-counter (OTC) drugs. In 1967, armed with this vision and a team of 20 employees, Habil founded Wockhardt, named after his father’s retail company but with a focus on pharmaceuticals. His goal was to supply medicines not only to Akbarallys but to consumers across India.

Expanding into Formulations: The Launch of Proxyvon

Habil’s initial strategy centered around selling OTC pharmacons, but he soon realized that there was significant potential in the formulations business. In 1972, he launched Wockhardt’s first formulation, Proxyvon, a pain management drug that would later become a well-known name in India. The success of Proxyvon propelled Wockhardt forward, helping the company clock annual sales of ₹4 lakh—a significant achievement for a young company in the early stages of growth.

As Wockhardt grew, Habil recognized the need for more sophisticated production facilities. In 1979, he commissioned the construction of a modern manufacturing plant in Chikalthana, Aurangabad. The new facility enabled Wockhardt to meet rising demand and expand its product portfolio. Around the same time, Habil forged a partnership with Mundi Pharma of Switzerland, becoming the first Indian company to bring Povidone Iodine (commonly known as Betadine) to India, a critical product for managing sepsis and infections. This move solidified Wockhardt’s reputation as an innovative pharmaceutical company.

International Expansion and Growth

By the mid-1990s, Wockhardt had established itself as a major player in the Indian pharmaceutical industry. The company received regulatory approvals from the UK Medicines Control Agency (MCA), the U.S. Food and Drug Administration (FDA), and the Australian Therapeutic Goods Administration (TGA), which opened the doors for international expansion. Wockhardt began producing a wide range of products, including blood pressure medications, diet foods, and intravenous fluids.

In 1998, Wockhardt took a major step towards global expansion by acquiring Wallis Laboratory in the UK and Merind, a pharmaceutical company in India, for ₹165 crore. These acquisitions allowed Wockhardt to enter the highly competitive European and Indian pharmaceutical markets, broadening its portfolio and increasing its revenue streams.

Going Public: Wockhardt’s IPO and Growth

On July 8, 1999, Wockhardt took a monumental step by becoming a publicly traded company. Its initial public offering (IPO) marked a major milestone, and the company’s growth skyrocketed. By 2005, Wockhardt was generating revenue from three key segments: formulations (46.8%), diet foods (17%), and intravenous fluids (24%). The company’s total revenue reached ₹1,412 crore, with a profit of ₹250 crore.

However, the global financial crisis of 2008 dealt a severe blow to Wockhardt. Like many other companies, Wockhardt was not immune to the economic downturn, and it defaulted on a bond payment of ₹480 crore in 2009. This financial setback led to a loss of ₹555 crore, putting the company in a precarious position. Habil Khorakiwala faced the toughest challenge of his career, as the company’s future hung in the balance.

The Turning Point: Corporate Debt Restructuring

Despite the immense pressure, Habil was determined to save Wockhardt. In 2012, he successfully navigated the company through a corporate debt restructuring (CDR) process, securing ₹1,300 crore to stabilize the business. This restructuring was a turning point for Wockhardt, allowing the company to regain its financial footing. However, the challenges didn’t end there. In 2015, Wockhardt faced two major import bans imposed by the U.S. FDA, tarnishing the company’s 48-year legacy. Habil knew that he had to act fast to restore Wockhardt’s reputation and position in the global market.

A Renewed Focus on Innovation: R&D and Comeback

Habil made a bold decision to increase Wockhardt’s research and development (R&D) budget to 11.5% of its revenue. He placed a renewed emphasis on in-house drug development, understanding that innovation would be key to the company’s revival. Wockhardt became the first Indian pharmaceutical company to receive Qualified Infectious Disease Product (QIDP) status for three of its drugs from the U.S. FDA. This recognition marked a major comeback for Wockhardt and signaled its return to the global stage.

By 2016, Wockhardt had bounced back, generating ₹4,519 crore in revenue and a profit of ₹387 crore. The company’s renewed focus on R&D, combined with its global operations, positioned it as a leader in the pharmaceutical industry once again.

Wockhardt Today: A Global Pharmaceutical Giant

Today, Wockhardt is a global pharmaceutical giant with operations in over 30 countries and 12 state-of-the-art manufacturing plants. The company has three dedicated research centers and continues to innovate in the fields of biotechnology, pharmaceuticals, and healthcare. Wockhardt is one of the top three Indian generic drug companies in the UK, and its total valuation has reached ₹14,000 crore.

Habil Khorakiwala’s Legacy: A Lasting Impact

Despite facing numerous challenges throughout his career, Habil Khorakiwala’s determination and resilience have made him one of India’s most successful entrepreneurs. In 2015, he was ranked the 59th richest man in India, but his legacy extends beyond financial success. Through the Wockhardt Foundation, Habil has made a lasting impact on society. The foundation’s initiatives in healthcare and education have touched the lives of over 12.8 crore people, providing free services to underserved communities across India.

Habil Khorakiwala’s journey from a family business to building a ₹14,000 crore pharmaceutical empire is a testament to the power of vision, perseverance, and innovation. His story is an inspiration to entrepreneurs everywhere, showing that with the right mindset, even the toughest challenges can be overcome.