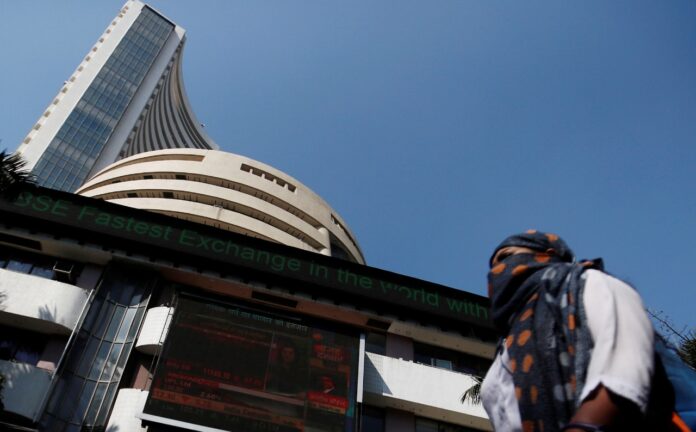

Markets log gains for 2nd day on buying in Reliance

Equity benchmarks ended higher on Friday helped by buying in index major Reliance Industries along with fresh foreign fund inflows.

Extending its previous day’s rally, the 30-share BSE benchmark climbed 203.01 points or 0.34 per cent to settle at 59,959.85. During the day, it jumped 376.33 points or 0.62 per cent to 60,133.17.

On similar lines, the broader NSE Nifty advanced 49.85 points or 0.28 per cent to end at 17,786.80 .

In the Sensex pack, Maruti, Reliance Industries, NTPC, Power Grid, Mahindra & Mahindra, Bajaj Finserv, Titan and Kotak Mahindra Bank were the major winners.

Shares of Maruti climbed nearly 5 per cent after the company announced its earnings.

Maruti Suzuki India on Friday reported an over four-fold increase in consolidated net profit to Rs 2,112.5 crore in the second quarter ended on September 30, 2022, riding on record sales.

Tech Mahindra, Tata Steel, Sun Pharma, ICICI Bank and State Bank of India were among the laggards.

“Gains in index heavyweights helped the domestic market to withstand its gains despite negative trends in its global peers. US tech stocks had a significant sell-off following disappointing quarterly results and a bleak forecast.

“However, the strengthening rupee along with a softening treasury yield and decent Q2 earnings results are supporting the domestic market in the near term,” said Vinod Nair, Head of Research at Geojit Financial Services.

The BSE smallcap gauge fell by 0.62 per cent and midcap index dipped 0.41 per cent.

Among BSE sectoral indices, auto jumped 1.66 per cent, energy climbed 1.20 per cent, oil & gas (0.76 per cent) and consumer discretionary (0.32 per cent).

However, metal fell by 1.44 per cent, commodities declined by 1.08 per cent, IT (0.76 per cent), bankex (0.72 per cent) and telecommunication (0.55 per cent).

Meanwhile, the rupee declined by 15 paise to close at 82.48 (provisional) against the US dollar on Friday.

Elsewhere in Asia, markets in Seoul, Tokyo, Shanghai and Hong Kong ended lower.

Stock exchanges in Europe were trading in the negative territory in mid-session deals. Wall Street had ended on a mixed note on Thursday.

International oil benchmark Brent crude was trading 0.84 per cent lower at USD 96.15 per barrel.

Foreign Institutional Investors (FIIs) turned buyers on Thursday as they bought shares worth Rs 2,818.40 crore, as per exchange data.