Shell’s Profit Brings Losses

The earnings of the British company, which was more than double from a year earlier, reported by U.S. rivals previously this week and are sure that the pressure will be intensified on governments to raise more taxes on the sector.

The energy giant “Shell” on Thursday Delivered a record $40 billion profit in 2022, capping an uproarious year after Russia invaded Ukraine which led surge in energy prices and allowed the giant to hand shareholders unparalleled returns.

“While delivering compelling shareholder returns, we intend to remain disciplined,” chief executive Wael Sawan claimed in a statement since he took the helm on January 1st on the first set of earnings.

Earnings in 2022 by Shell

Shell also hit analyst forecasts for an $8 billion profit, posting a record fourth quarter profit amounting to $9.8 billion on the road of strong recuperation and earnings from liquefied natural gas (LNG) trading.

Far more than double from a year earlier and from the previous record in 2008 of $31 billion, the annual profit now has reached $39.9 billion.

When the trade was opened Shell shares in London were up 1.3%.

A strong performance from shells trading business led to the gains which were based on robust refining margins, by higher oil and gas prices.

A strong performance from shells trading business led to the gains which were based on robust refining margins, by higher oil and gas prices.

Reaching a record high of $6 billion earnings from its LNG division, astride the gas price volatility being enhanced by strong gross trading earnings, although they experienced a loss in the third quarter and a steep decline in dissolving volumes because of outages at LNG provision.

Huge volatility in gas, oil and power markets has been seen around the world because of Russia’s war on Ukraine, because of which rivals of shell and shell itself profited with their leading trading operations and large global footprint.

Windfall taxes were imposed on the energy sector after governments started struggling with soaring energy bills. Shell claimed that it will incur approximately $2.4 billion related to the levies in 2022 in terms of accounting costs.

CONTINUOUS BUYBACKS

Shell previously announced that they raised the dividend by 15% in the fourth quarter, which was the 5th raise as it provided more than 60% cut up in 2020 during the COVID-19 pandemic.

Over the next three months, the company announced a brand-new share buyback program of $4 billion, which was unchanged from the previous three. buying back $19 billion in shares in the year till February 2023, which is approximately double the total in pre-pandemic 2019.

After the Russia Ukraine conflict broke out, shell and many other western energy companies what helped by the profits to mask enormous write downs which they took on Russian assets that abruptly exited.

Aiming to build low-carbon energy business and large renewables as part of its aspiration to swiftly reduce greenhouse gas emissions in the coming few decades.

An investment of $3.5 billion in the renewables and energy solutions business was made by the company in 2022, which is approximately 14% of its capital spending of $24.8 billion. In 2023 the capital expenditure will reach from $23 billion to $27 billion.

Mark Van Baal, who is a founder of activist shareholder group Follow This said: “as long as investments in fossil fuels lesson investments in renewables shell cannot claim to be in transition”

Shell was helped by the sudden surge in revenue to swiftly lessen text Dept at the end of 2022 from $52.6 billion a year earlier to $44.8 billion. Known as gearing, it’s debt-to-capital ratio, reduced from 21.1% a year earlier to 19%.

These worldwide massive profits for energy majors have sparked public fury because the consumers see the cost of lighting and heating their businesses and homes rocket.

Arguing that the group is “destructing climate and profiteering from it”- on Thursday environmental campaigner Greenpeace protested outside London headquarters of shell.

“Ministers should enforce big gas and oil companies to pay their fair share, instead of holding down the remuneration of teachers, paramedics, firefighters and millions of other hardworking public servants,” stated TUC general secretary Paul Nowak.

Energy firms are facing increased pressure to put in efforts to Transform away from fossil fuels as the world aims to become an economy of net zero emissions by 2050.

But BP, Shell’s rival claimed on Monday that the transformation could be quickened by Russia’s war in Ukraine, “oil will continue to play a huge role in the global energy system for the coming 15 to 20 years”.

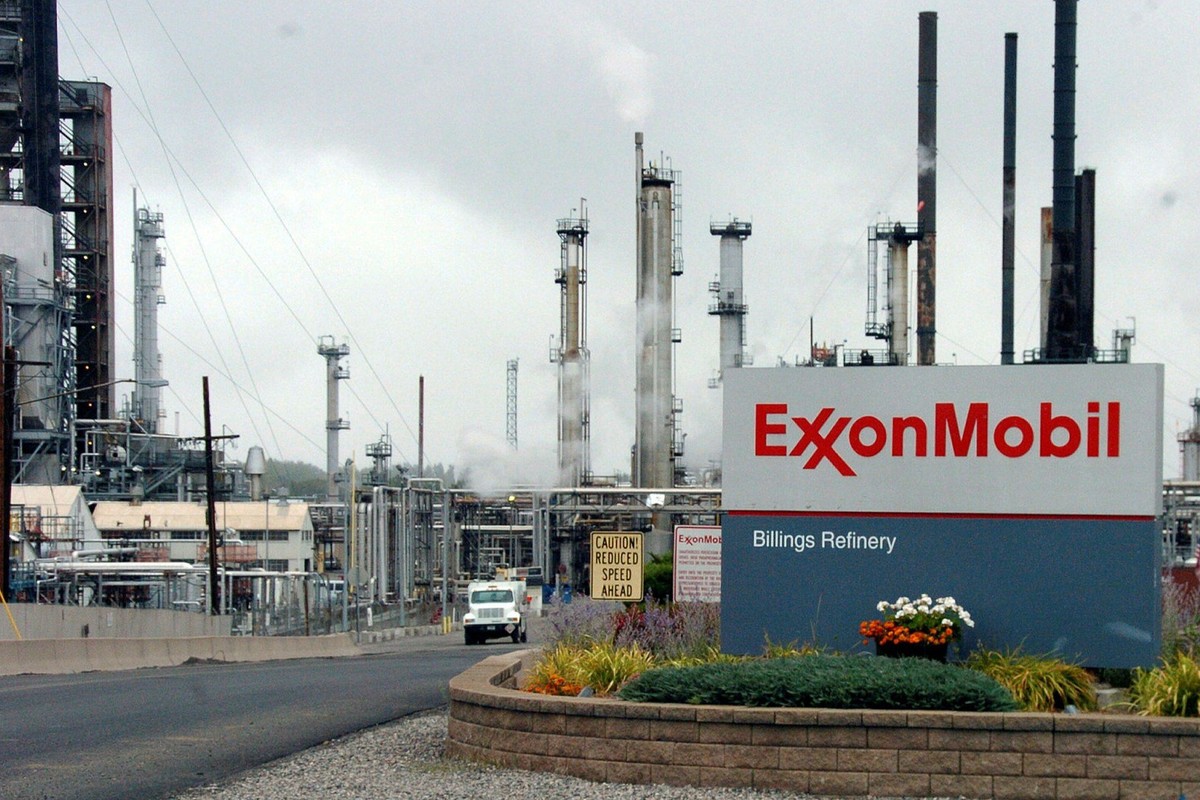

U.S. energy major ExxonMobil reported an even larger record profit of almost $56 billion, shareholders were handed massive windfalls. Shell’s update came two days after ExxonMobil’s report.

U.S. President Joe Biden was obligated to give a blow to American energy giants, which included Chevron, asserting that during a cost-of-living crisis they should be helping to reduce energy prices.

Earlier in the week Biden tweeted that the only thing, which “stops big oil from increasing production (and furthermore lessening prices) is their choice to the renumerate shareholders billions of dollars rather than reinvesting profits”.

After a White House spokesperson told BBC the record profits of Exxon were “outrageous”, the president was mandated to intervene, in the wake of Russian invasion of Ukraine especially after “the people of America are forced to pay towering prices at the pump”.

Governments have started windfall taxes on the gigantic profits, to ease the pain of consumers.

The windfall taxes which were imposed by the UK and the European Union after a surge in earnings was experienced by Shell, they revealed that it would cost them around $2 billion.

“Major rewards as well as challenges can be achieved while passing through an economic cycle, Shell is showing its financial muscles on a stupendous scale,” Richard Hunter stated, Interactive Investor’s head of markets.