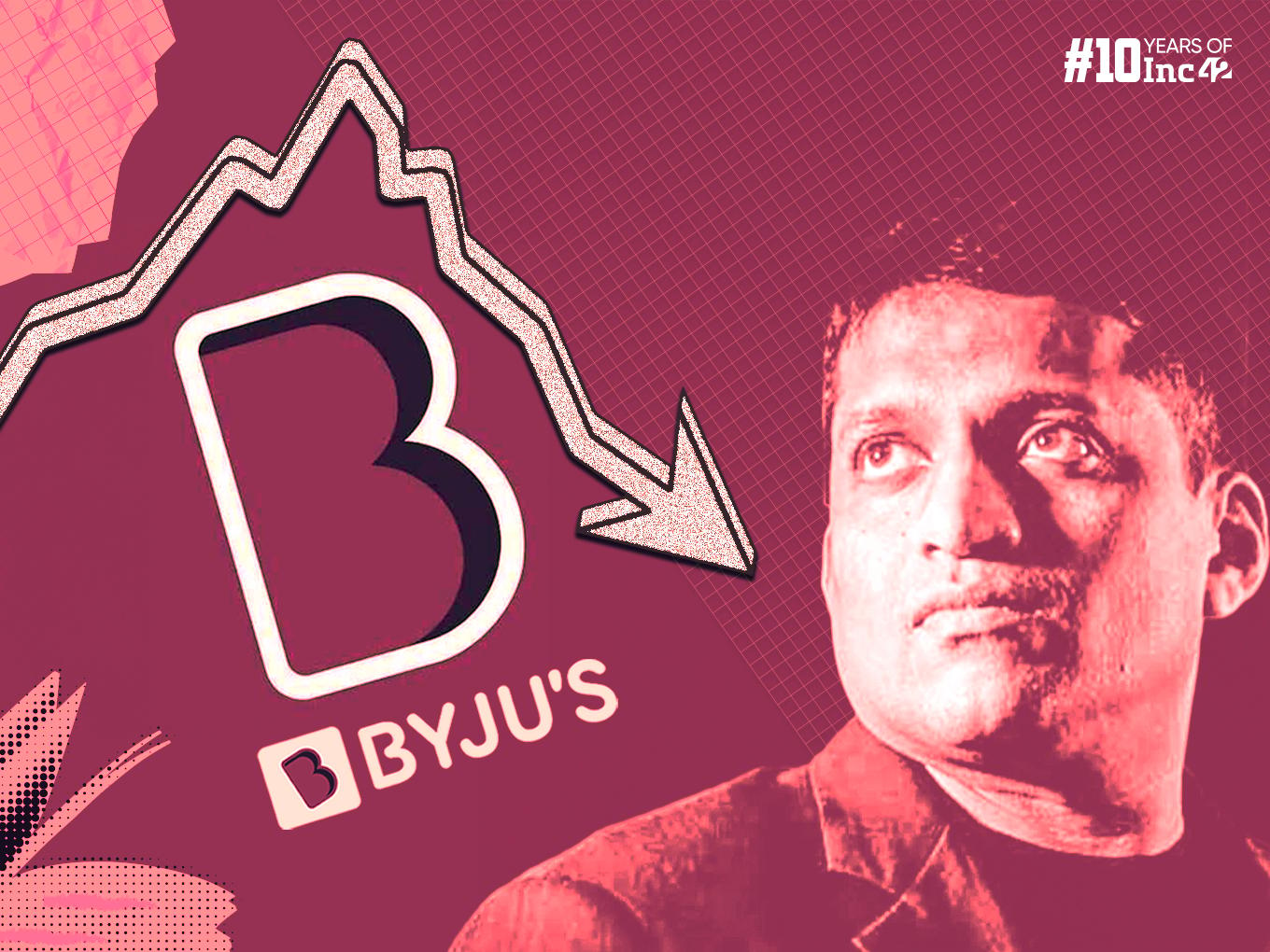

In a stunning turn of events, Byju’s, once hailed as India’s largest and most promising edtech startup, is now teetering on the brink of insolvency. With a valuation that once soared to $22 billion in 2022, Byju’s rapid ascent has now been overshadowed by financial mismanagement, unpaid dues, and a tumultuous relationship with lenders. Byju Raveendran, the company’s founder, recently conceded that his company is currently “worth zero,” while expressing hope for its eventual recovery. This article takes a closer look at the reasons behind Byju’s downfall and what the future holds for the once-mighty edtech giant.

Byju’s Rapid Rise: How the Pandemic Fueled Growth

At its peak, Byju’s was a global success story, offering online educational courses to millions of students across 21 countries. The COVID-19 pandemic, which forced education systems worldwide to pivot to online platforms, proved to be a golden opportunity for Byju’s to expand rapidly. With increased demand for digital learning, the company experienced an unprecedented surge in users, resulting in its valuation skyrocketing to $22 billion in 2022. However, Byju’s explosive growth came at a cost, with Raveendran now admitting that the company “overestimated potential growth” and expanded into “too many markets too quickly.”

Byju’s Overexpansion: Too Much, Too Soon

The aggressive expansion strategy adopted by Byju’s ultimately proved to be one of its biggest mistakes. In a bid to capture a global market, the company entered into multiple countries simultaneously, which stretched its resources thin. Byju Raveendran, in his first media briefing in 18 months, acknowledged that this expansion was a major contributing factor to the company’s current struggles. The company was simply not prepared to handle such rapid growth, leading to operational inefficiencies and a growing number of liabilities.

This overestimation of growth potential is now a lesson in how even the most promising companies can falter when their ambitions exceed their capabilities.

Byju’s Financial Mismanagement: The Beginning of the Fall

One of the key issues plaguing Byju’s today is its mounting financial woes. The company has faced severe allegations of mismanagement and unpaid dues, which have only worsened its standing with both investors and lenders. U.S. lenders filed complaints with the Indian Supreme Court in August 2023, accusing Byju’s of misusing $1 billion in borrowed funds. While Raveendran has denied any wrongdoing, the company has been plunged into a legal battle that threatens its very survival.

The implications of these financial missteps go beyond mere insolvency; they have eroded trust in Byju’s and raised concerns about the governance practices within the company.

Byju’s Battle with Foreign Lenders: A Legal Conundrum

The legal battle with U.S. lenders, represented by Glas Trust, is a significant part of Byju’s current struggles. Glas Trust has accused the company of misusing funds, leading to insolvency proceedings. While the Indian Supreme Court has yet to rule on the grievances, the ongoing dispute has cast a long shadow over Byju’s future.

This dispute is emblematic of the broader tensions between Indian startups and foreign investors, where disagreements over financial management and accountability have often led to public spats. In Byju’s case, the once-strong relationships with foreign investors like General Atlantic have been severely damaged, contributing to the company’s downward spiral.

Byju’s Boardroom Turmoil: Internal Chaos Adding to Woes

Adding to Byju’s troubles are the numerous boardroom exits and leadership challenges it has faced in recent months. Key executives have resigned amid the growing crisis, leaving a vacuum in leadership during a critical time for the company. The lack of stability at the top has made it even more difficult for Byju’s to navigate the ongoing legal and financial challenges it faces.

Delayed financial disclosures and public criticism have further damaged the company’s reputation. These internal issues have made it harder for Byju’s to present a united front to both investors and the public, exacerbating its problems.

Byju’s Public Image: From Darling to Downfall

Once considered a darling of global investors, Byju’s now faces a tarnished public image. The company, which was once synonymous with innovation and educational progress, is now more associated with financial mismanagement and legal battles. The downfall of Byju’s is a stark reminder of how quickly fortunes can change in the tech world, particularly when trust with stakeholders is eroded.

The global edtech landscape has evolved, and Byju’s inability to adapt to these changes has been one of its biggest downfalls. Investors, who once lined up to support the company, are now hesitant to be associated with a brand that is mired in controversy.

Byju’s Founder: From Billionaire to Struggling Leader

Byju Raveendran’s story is one of both triumph and tragedy. The Indian mathematics whiz, who rose from being a teacher to a billionaire entrepreneur, is now grappling with the collapse of his empire. His candid admission that Byju’s is “worth zero” is a reflection of the harsh reality the company faces today.

Despite the setbacks, Raveendran remains hopeful about rescuing Byju’s from the brink. “Whatever is coming, I will find a way out,” he said during his media interaction. However, the path to recovery will not be easy, and it remains to be seen whether Byju’s can regain its former glory.

Conclusion: Byju’s Struggle to Survive Amid Mounting Challenges

Byju’s meteoric rise and subsequent fall is a cautionary tale for startups worldwide. The company’s overexpansion, financial mismanagement, and internal chaos have all contributed to its current state of insolvency. As Byju’s battles legal disputes and works to repair relationships with investors, its future hangs in the balance.

The fate of Byju’s will depend on its ability to address its financial issues, stabilize its leadership, and rebuild trust with stakeholders. Whether the company can recover from this crisis remains to be seen, but one thing is clear: Byju’s is no longer the dominant force it once was in the edtech industry.