In a notable turn from its previous year’s profit, IndiGo, India’s largest low-cost carrier, reported a significant net loss of Rs 987 crore for the second quarter ending in September 2024. The setback underscores ongoing challenges faced by IndiGo’s operator, InterGlobe Aviation Ltd., in a traditionally lean quarter for the airline industry, which was further impacted by rising operational costs and grounded aircraft.

IndiGo’s Q2 Financial Snapshot: Key Metrics and Revenue Growth

During the quarter, IndiGo reported a 14% rise in revenue, reaching Rs 16,970 crore compared to Rs 14,944 crore in the same quarter the previous year. While this revenue increase indicates a positive trend, it still fell short of analysts’ expectations, which Bloomberg had pegged at Rs 17,254 crore. This shortfall, combined with rising expenses, culminated in a Rs 987 crore loss, starkly contrasting with the Rs 189 crore profit it recorded a year earlier.

The airline’s EBITDA remained stable at Rs 2,396 crore; however, the EBITDA margin experienced a decline, contracting from 16% to 14.1%. This drop highlights the challenges IndiGo is navigating in maintaining profitability amidst industry-wide hurdles.

Impact of Rising Costs and Operational Challenges on IndiGo’s Performance

IndiGo’s loss in Q2 largely reflects the impact of increased costs and operational disruptions. Grounded aircraft, which limited IndiGo’s capacity and led to a drop in efficiency, played a significant role in the financial dip. The airline’s CEO, Pieter Elbers, noted that the effects of these grounded planes are gradually diminishing as IndiGo optimizes its fleet management. However, fuel costs remain a major strain, intensifying financial pressures in an already weak quarter for the airline sector.

Despite the setbacks, IndiGo increased its capacity by 8.2%, reaching 38.2 billion available seat kilometers. Additionally, the airline carried 27.8 million passengers, marking a 5.8% increase. This indicates continued demand and growth potential, yet the slight dip in load factor to 82.6% suggests that maximizing passenger occupancy remains a goal.

Passenger and Ancillary Revenues: Key Contributors to IndiGo’s Growth

IndiGo’s passenger ticket revenues rose by 9.9%, amounting to Rs 14,359 crore, driven by steady demand in the Indian aviation market. Ancillary revenues saw even more robust growth, jumping by 20.9% to Rs 1,875 crore. This increase underscores IndiGo’s strategy to diversify its income sources and reduce dependency on ticket sales alone. Revenue from add-on services, such as baggage fees, seat selection, and onboard services, plays an increasingly important role in stabilizing overall financials amidst fluctuating ticket prices and operational challenges.

IndiGo’s Strategic Response to Losses: Expanding Services and Enhancing Loyalty Programs

To counteract its financial losses and build a resilient foundation for future growth, IndiGo has announced the launch of a business class service, which will roll out within the next two weeks. This strategic move into a premium segment is a response to demand from corporate travelers and frequent flyers who prioritize comfort, convenience, and added services, and marks IndiGo’s ambition to broaden its market appeal.

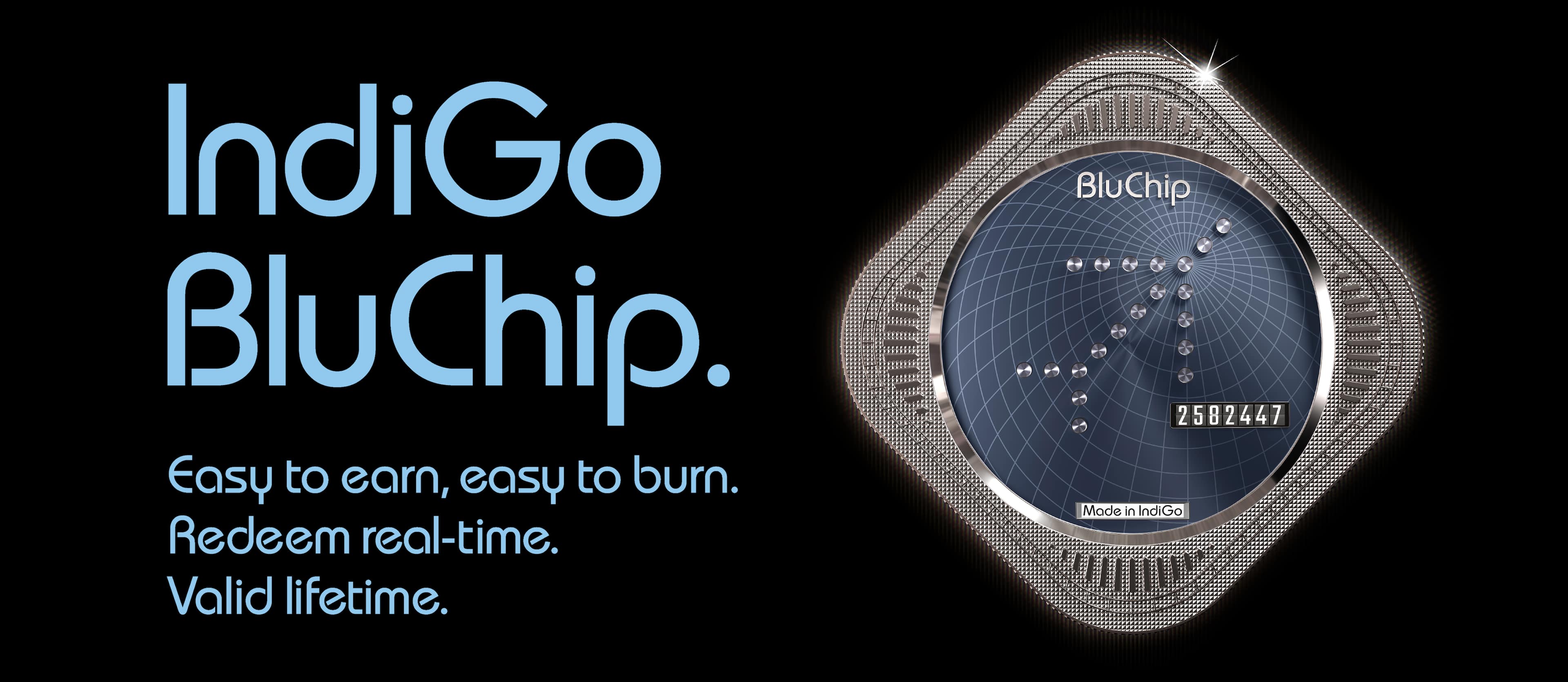

The airline is also capitalizing on the recent launch of its loyalty program, IndiGo BluChip. Initial feedback has been positive, and the program is expected to attract frequent travelers, boost customer retention, and provide a steady revenue stream from dedicated customers. According to CEO Pieter Elbers, the loyalty program aligns with IndiGo’s aim to capitalize on the growing Indian market and increase brand loyalty among an expanding customer base.

Challenges in the Indian Aviation Sector and IndiGo’s Positioning

The Indian aviation market, characterized by intense competition and cost pressures, has been both an opportunity and a challenge for IndiGo. As a market leader with a significant domestic share, IndiGo has positioned itself as a cost leader, maintaining efficiency through cost-cutting measures and streamlined operations. However, the ongoing challenges, particularly fluctuating fuel prices and periodic fleet issues, underscore the need for adaptive strategies and resilience in maintaining competitive pricing while managing rising costs.

IndiGo’s focus on expanding its market reach, launching new services, and maintaining cost efficiency places it in a favorable position within the competitive landscape. Yet, achieving profitability will require continuous adaptation to external factors, such as regulatory changes and fuel price volatility, that impact operational expenses.

Future Outlook for IndiGo: Navigating Growth and Stability

Looking forward, IndiGo’s strategy reflects a cautious optimism. The airline aims to navigate the challenges of the Indian market by enhancing its service offerings and improving customer experience. With capacity and passenger numbers rising, IndiGo is well-positioned to leverage India’s burgeoning air travel demand. However, achieving sustained profitability will require managing costs effectively and addressing ongoing operational disruptions.

IndiGo’s commitment to growth while remaining cost-effective is evident in its strategic initiatives, but the airline’s ability to overcome external pressures, like fuel price hikes, will be crucial. CEO Pieter Elbers remains optimistic, suggesting that IndiGo is poised for recovery as grounded aircraft return to service and operational efficiencies are enhanced.

Conclusion: A Pivotal Quarter for IndiGo’s Strategic Direction

IndiGo’s Q2 results reveal both the airline’s challenges and its resilience. Reporting a significant net loss after a profitable year highlights the financial pressures the aviation sector faces, but IndiGo’s strategies—expanding services, improving loyalty programs, and maintaining its cost leadership—signal a proactive approach to mitigating these issues. For IndiGo, the next quarters will be pivotal in determining whether these strategies can translate into consistent profitability amidst an evolving and competitive market.