In the fast-paced world of startups, financial management can be both a lifeline and a stumbling block. Managing expenses, keeping track of cash flow, and complying with financial regulations is challenging for many entrepreneurs, especially with limited resources. Probooks, a rising player in fintech, aims to change that narrative. By combining innovative business solutions with a deep understanding of the challenges startups face, Probooks is redefining how financial management works in India. With a clear mission, a solid vision, and systematic yet cost-effective products, Probooks is making waves across the startup landscape.

Mission and Vision: Simplifying Business, Accelerating Growth

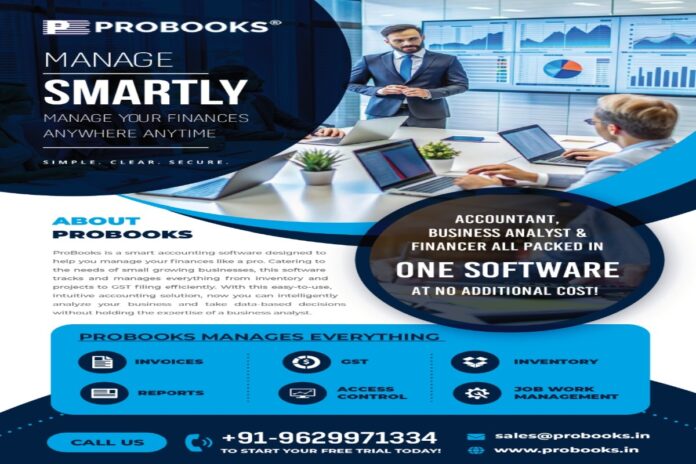

Mission: Probooks’ mission is simple yet powerful: to implement innovative business solutions that make financial management easier and more efficient. Startups, in particular, need solutions that can grow with them, and Probooks strives to provide exactly that.

Vision: At Probooks, the vision is to leverage emerging technologies to supplement fintech and provide innovative business solutions that redefine operations, identify business pain points, and accelerate growth through calculated action and smart technology. The goal is to empower businesses with cost-effective tools that adapt seamlessly as they grow.

Probooks’ products are systematically designed to provide startups scalability, ease of use, and cost-efficiency. Here’s how they accomplish this:

- Modular and Scalable Architecture: Easily scalable as businesses grow.

- Automation: Reducing manual work to minimize errors and boost productivity.

- Cloud Deployment: Enhancing accessibility and reducing operational costs.

- User-Friendly Interface: Minimal training requirements for new users.

- Subscription-Based Pricing: Budget-friendly for startups, with pay-as-you-go options.

- Compliance Built-In: Simplifies navigating regulatory obligations.

Tracking Expenses Made Easy: The Probooks Way

For any business, tracking expenses effectively is crucial for financial health. Probooks offers intuitive features that make expense tracking easier, enabling companies to focus more on growth and less on paperwork. Here’s how Probooks helps companies track their expenses effectively:

- Expense Categorization and Tagging: Ensures better visibility of spending patterns.

- Real-Time Expense Reporting: Get timely insights to make informed decisions.

- Budgeting and Expense Limits: Set thresholds to prevent overspending.

- Mobile App for Expense Tracking: Manage expenses on the go.

- Integration with Accounting Software: Seamlessly syncs data to reduce manual effort.

Why Probooks is Ideal for Indian Startups?

Indian startups face unique challenges—cost sensitivity, compliance requirements, and operational efficiency. Probooks caters specifically to these needs:

- Affordable Pricing with Scalable Plans: Making financial management accessible for startups at different growth stages.

- Localized Expense and Income Tracking: Tailored to Indian businesses’ needs.

- GST Compliance and Tax Management: Automated compliance for hassle-free tax filing.

- Real-Time Financial Reporting: Improved cash flow management through up-to-date financial insights.

- Mobile Accessibility: Allowing busy entrepreneurs to manage finances anywhere, anytime.

- Strong Security and Data Privacy Standards: Keeping sensitive data secure and compliant.

Continuous Improvement: Staying Ahead of User Expectations

Probooks is committed to ongoing enhancement and upgrading of its core features through a structured, forward-thinking approach:

- Agile Development Cycles: Embracing continuous iteration to accelerate updates and improvements.

- User-Centered Feedback: Proactively identifying and addressing user challenges to enhance overall satisfaction.

- Quality Assurance and UAT: Conducting rigorous testing to maintain a smooth, reliable experience.

- Tech Trends and Compliance- Staying attuned to regulatory developments and technological advances to remain competitive and compliant.

- Strategic Roadmap Planning: Conducting quarterly and annual reviews to ensure alignment with evolving business goals and industry needs.

By prioritizing these elements, Probooks strives to meet and surpass user expectations consistently.

The Driving Force Behind Probooks

The driving force behind Probooks is the desire to simplify financial management for startups and SMEs. Traditional financial tools are often complex, rigid, and expensive, deterring many small businesses. Probooks aims to solve these issues by:

- Supporting Startups and SMEs: Providing accessible financial tools.

- Simplifying Compliance and Taxation: Making regulatory requirements easier to handle.

- Empowering Businesses with Real-Time Insights: Allowing data-driven decision-making.

- Fostering Growth Through Scalable Solutions: As businesses grow, Probooks grows with them.

- Reducing Financial Friction: Streamlining financial management to reduce the burden on entrepreneurs.

Probooks’ Unique Selling Proposition (USP)

Probooks differentiates itself from other financial solutions by focusing on affordability, simplicity, and specialized features for startups and SMEs. Here’s what sets it apart:

- Localized Compliance and GST Automation: Tailored to Indian market requirements.

- Cost-Effective, Scalable Pricing: Designed to support businesses at every growth stage.

- User-Friendly Interface: Suitable even for users with no accounting background.

- Integrated Financial Ecosystem: Bringing various aspects of financial management under one roof.

- Real-Time Financial Insights: Promoting better cash flow management and business decision-making.

- Ongoing Support and Education: Helping businesses make the most of Probooks’ features.

Challenges and How Probooks Overcame Them?

Building Probooks came with its own set of challenges, which the team tackled with a user-focused and flexible approach:

- Meeting Complex Compliance Requirements: Leveraging automation to simplify GST and tax compliance.

- Balancing Simplicity with Comprehensive Functionality: Ensuring tools are powerful yet easy to use.

- Building Trust and Educating Users: Providing educational resources to help users understand financial management better.

- Ensuring Affordability: Finding ways to keep costs low without compromising on quality.

- Scaling Infrastructure for Growth: Using a cloud-based architecture that scales with demand.

- Developing Localized Solutions: Creating features specifically for Indian users, from compliance to localized financial insights.

Probooks’ Commitment to Sustainability

Probooks is committed to sustainability in both its internal operations and through encouraging eco-friendly practices among clients:

- Digital-First Approach: Minimizing paper usage by emphasizing digital documentation.

- Remote Work Environment: Reducing carbon footprint through remote work policies.

- Energy-Efficient Cloud Infrastructure: Opting for greener data centers.

- Employee Engagement: Promoting sustainability initiatives within the team.

- Encouraging Clients: Offering tools that support clients in tracking and optimizing their sustainability goals.

Probooks’ Reflection on the Company Culture

The core values of Probooks are reflected throughout the company—from the platform’s design to its approach to customer service. The focus on customer-centric solutions, continuous innovation, and accessibility is deeply ingrained in Probooks’ culture.

- Customer-Centric Approach: Putting users first in every decision.

- Innovation and Continuous Improvement: Always seeking ways to enhance products and services.

- Simplicity and Accessibility: Ensuring tools are easy to use and available to all businesses.

- Sustainability Commitment: Integrating sustainability into everyday operations.

- Team-Driven Culture: Fostering an environment of collaboration and shared growth.

Pan-India Influence and Vision

Probooks has a clear vision of expanding its influence pan-India, empowering startups and SMEs with accessible, efficient, and scalable financial tools that cater to the unique needs of Indian markets. Probooks aims to be the go-to financial tool for businesses across the country by focusing on regional needs, forging strong partnerships, and continuously innovating.

Skill Enhancement for Employees

Probooks places a strong emphasis on employee development as a means of fostering long-term success for the company. Here’s how Probooks helps its employees grow:

- Learning and Development Programs: Providing comprehensive training for both technical and soft skills.

- Access to External Learning Resources: Encouraging employees to take courses, attend conferences, and improve their skills.

- Cross-Functional Training: Encouraging collaboration across teams.

- Continuous Feedback: Providing employees with the feedback they need to grow.

- Work-Life Balance: Ensuring employees have a healthy work-life balance to foster creativity and well-being.

Probooks are redefining financial management for startups and SMEs in India by offering accessible, cost-effective, and cutting-edge solutions. Driven by its mission to streamline financial tasks and its vision to empower businesses through advanced technologies, Probooks is establishing a new benchmark for financial tools. With a user-centric design, a dedication to sustainable practices, and a steadfast focus on growth and inclusivity, Probooks is set to become the premier choice for financial management among India’s startups and SMEs.