The latest Telecom Regulatory Authority of India (TRAI) data paints a shifting picture in India’s telecom sector, highlighting significant subscriber losses for Reliance Jio, India’s largest telecom operator, alongside gains for BSNL, the state-run entity. The figures for October 2024 reveal a complex landscape influenced by tariff hikes, competitive pressures, and evolving consumer preferences.

Reliance Jio Leads Losses, BSNL Gains Ground

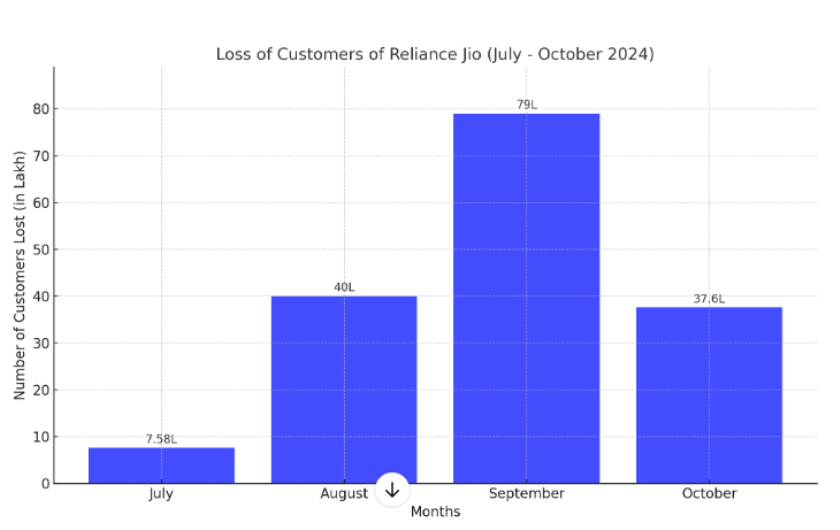

Reliance Jio experienced a sharp decline in its subscriber base over the past four months, losing a total of 1.65 crore users. This includes 37.6 lakh subscribers lost in October, 79 lakh in September, 40 lakh in August, and 7.58 lakh in July 2024. Despite holding the largest market share at 39.99%, Jio’s total subscriber count now stands at 47.48 crore.

Bharti Airtel, India’s second-largest telecom operator, gained 24 lakh mobile subscribers in October but reported losses in previous months: 14.3 lakh in September, 24 lakh in August, and 16 lakh in July. Its total subscriber count reached 28.7 crore by October, with a market share of 33.50%.

Vodafone Idea continued to struggle, losing 19 lakh subscribers in October after a decline of 15.5 lakh in September, reducing its subscriber base to 12.5 crore and holding a market share of 18.30%.

Meanwhile, BSNL bucked the trend by adding 5 lakh subscribers in October, totaling a remarkable gain of 68 lakh over the last four months. The state-run operator now boasts 3.6 crore subscribers, claiming an 8.05% market share.

Tariff Hikes Shape Subscriber Dynamics

The subscriber losses among private telecom operators have largely been attributed to the tariff hikes implemented in mid-2024. These increases have prompted a shift in consumer preferences, with many subscribers opting for cost-effective plans offered by BSNL. The impact of these price adjustments is evident in the declining wireless subscriber base, which stood at 1,150.42 million at the end of October, marking a marginal monthly drop of 0.29%.

Despite these challenges, Jio remains the top broadband service provider with 474.81 million subscribers, followed by Airtel (287.67 million), Vodafone Idea (125.43 million), BSNL (36.38 million), and Atria Convergence Technologies (2.27 million).

Broadband and Fixed Line Trends

India’s broadband market also reflects the competitive dynamics among telecom operators. The top wired broadband service providers as of October are:

- Jio: 14.79 million subscribers

- Airtel: 8.91 million subscribers

- BSNL: 36.38 million subscribers

- Atria Convergence Technologies: 2.27 million subscribers

- Kerala Vision Broadband: 1.24 million subscribers

In the wireless broadband category, Jio dominates with 460.02 million subscribers, followed by Airtel (278.76 million), Vodafone Idea (125.43 million), BSNL (32.15 million), and Intech Online (0.25 million).

The fixed-line sector also saw growth, with wireline subscribers increasing from 36.93 million in September to 37.79 million in October. Jio continues to lead the fixed-line market with a 41.51% share, followed by Airtel (25.25%) and BSNL (16.14%).

M2M Connections on the Rise

The number of Machine-to-Machine (M2M) cellular mobile connections rose from 54.64 million in September to 56.12 million in October. Airtel leads the M2M segment with 29.08 million connections, followed by Vodafone Idea (15.01 million), Reliance Jio (8.95 million), and BSNL (3.07 million).

Market Share Overview

As of October, the market share among major telecom operators is as follows:

- Reliance Jio: 39.99% (47.48 crore subscribers)

- Bharti Airtel: 33.50% (28.7 crore subscribers)

- Vodafone Idea: 18.30% (12.5 crore subscribers)

- BSNL: 8.05% (3.6 crore subscribers)

While Jio and Airtel maintain their dominant positions, BSNL’s steady growth underscores the potential for public-sector players to gain ground in a competitive market.

A Dynamic Telecom Landscape

TRAI’s latest data underscores the shifting dynamics in India’s telecom sector, driven by pricing strategies, consumer preferences, and competitive pressures. Reliance Jio and Bharti Airtel continue to lead the market but face challenges from subscriber losses and intensifying competition.

BSNL’s sustained growth amidst these challenges highlights the importance of affordable and accessible telecom services. As the sector navigates these changes, operators must balance profitability with customer retention to maintain their positions in this rapidly evolving landscape.