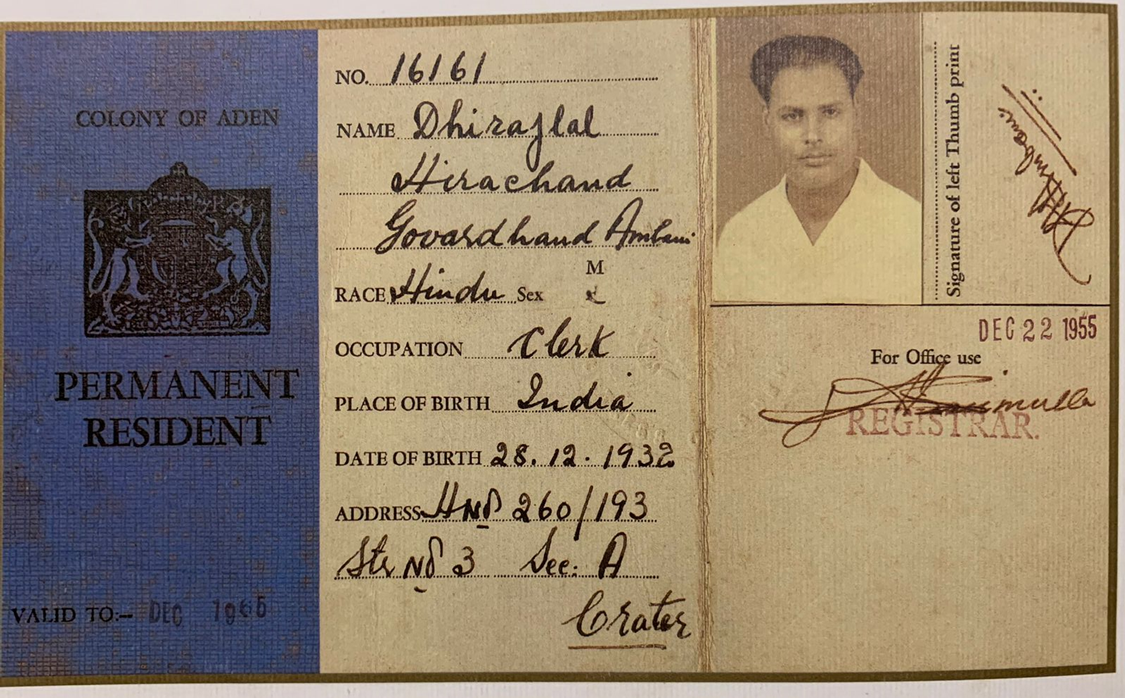

When it comes to building an empire, most people envision billions in start-up capital, state-of-the-art facilities, and an elite Rolodex. Dhirubhai Ambani, however, turned that fantasy on its head, crafting a corporate juggernaut out of sheer market perception and clever maneuvering. Born on December 28, 1932, into modest circumstances as the son of a schoolteacher in a small town in Gujarat, Ambani’s early life did not predict his future dominance. But ambition found him early, and with a bold spirit, he took his first leap at just sixteen, leaving for Aden, Yemen, in search of opportunity.

A Young Man with a Silver Dream.

In Yemen, the young Dhirubhai started his journey as a dispatch clerk, a far cry from his eventual success, but he didn’t stay there long. Seizing a lucky break, he became a distributor for Shell Products, climbing the ranks to manager at a bustling oil station. But it wasn’t ambition alone that set him apart; it was his uncanny ability to sniff out profit in unexpected places. At the time, the Yemeni rial held a secret treasure: a high silver content. Dhirubhai realized he could buy rials in bulk, melt them down, and sell the silver for a profit in London’s bullion market. Within three months, he had turned a tidy profit—a small fortune for his age. Though the venture was quickly shut down, Dhirubhai had tasted his first big win, and there would be no going back.

Dhirubhai’s Humble Start in Mumbai.

Returning to India in 1958 with little more than his wits and Rs.15,000, Dhirubhai set up the modest Reliance Commercial Corporation in a cramped, 350-square-foot office in Mumbai’s Masjid Bunder. Far from glitzy boardrooms and posh offices, he began his business with a single phone, a desk, and a vision: to import polyester yarn and export spices. By 1964, he established Reliance Textiles, introducing the brand “Vimal” into the Indian market. With its quality earning praise from no less than the World Bank, Vimal quickly became a household name and laid the foundation for Dhirubhai’s ascent.

The Birth of India’s Equity Culture.

Dhirubhai wasn’t content with just manufacturing; he wanted to change the way India thought about investment. In 1977, Reliance Industries Ltd. (RIL) went public, marking a pivotal moment in Indian corporate history. With remarkable persuasion, Dhirubhai convinced 58,000 investors, many from rural Gujarat, to trust his vision, popularizing the equity culture in a country where public skepticism toward stocks ran deep. Reliance’s IPO was a roaring success, and Dhirubhai’s dream was no longer just his own—it was India’s.

Power Play in the Stock Market.

By the 1980s, Dhirubhai had ascended to near-mythic status in the stock markets, and his shrewd tactics earned him both admiration and ire. The 1982 “Bear Cartel” incident at the Bombay Stock Exchange has since become legend. When a group of stock brokers began short-selling Reliance shares to drive down prices, He spotted an opportunity. With a coalition of bullish allies, he counteracted, maintaining Reliance’s stock price at Rs. 152. When settlement day arrived, the cartel was stunned—the bulls, funded by none other than him, demanded physical delivery of shares, leaving the bears scrambling to buy back shares at inflated prices. The price shot up to Rs.180, and Dhirubhai walked away not just with profits but as the undisputed king of India’s stock market. Critics called for investigations, but he remained unapologetic. The Reserve Bank of India (RBI) eventually confirmed that the funding had come from legal NRI investments, proving the maneuver was above board.

A Legacy Built on Grit and Vision.

Throughout the ‘80s and ‘90s, Dhirubhai broadened Reliance’s reach into petrochemicals, telecommunications, information technology, and more. While giants like Tata and Birla had taken a century to build empires, He was creating his in just a few decades, earning him accolades like “Man of the Century” from Chemtech and Chemical Engineering World in 2000, and Wharton School’s “Dean’s Medal” for outstanding leadership.

But his legacy isn’t just about wealth. In a country where business often seemed exclusive to an elite few, he demonstrated that the door was open to anyone with the right blend of acumen and audacity. His methods weren’t without controversy, but they were undeniably effective. By the time he passed away in 2002, Reliance had become India’s largest private sector company with a turnover of $19.976 billion, leaving a mark not just on the stock market but on the nation’s collective imagination.

Dhirubhai Ambani’s story is proof that wealth doesn’t come only from deep pockets. Sometimes, all you need is an eye for opportunity, a bit of audacity, and an unwavering belief that you can turn the system to your favor. And, of course, a touch of wit never hurts.