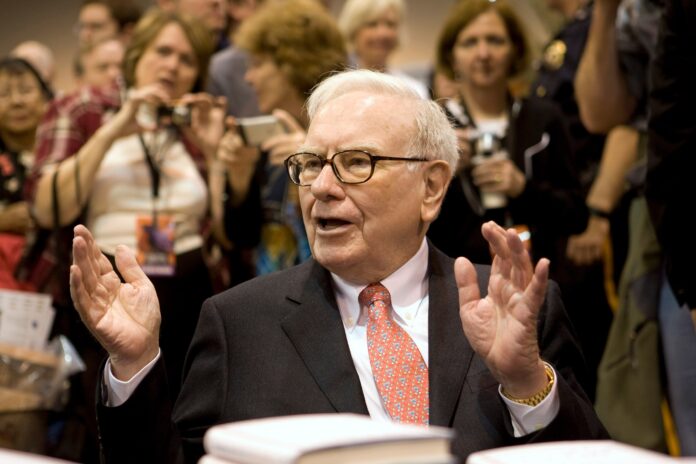

Berkshire Hathaway’s Record $325.2 Billion Cash Reserve: Buffett’s Strategic Patience Amid Market Uncertainties

Berkshire Hathaway Inc., under the leadership of Warren Buffett, has amassed a record-breaking cash reserve of $325.2 billion by the third quarter of this year. This substantial accumulation marks a high point for the conglomerate, reflecting a cautious approach from Buffett as he navigates a challenging investment environment. Rather than pursuing major acquisitions or high-stakes investments, Berkshire has been reducing its holdings in prominent equities, including a substantial trimming of its stake in Apple Inc. This strategic buildup of cash signals Buffett’s decision to prioritize flexibility over immediate growth, while grappling with limited opportunities for meaningful investments at attractive prices.

Reducing Apple Holdings: A Calculated Move

Berkshire’s relationship with Apple has been pivotal over the years, and the company’s recent reduction of its Apple holdings is noteworthy. In a recent statement, Berkshire reported that its stake in Apple, one of its most valuable holdings, stood at $69.9 billion by the end of the third quarter. This represents a decrease from the previous quarter’s $84.2 billion valuation, signifying a 25% cut. Berkshire first invested in Apple in 2016, ultimately spending $31.1 billion for 908 million shares through 2021. Despite this recent reduction, Buffett’s long-term confidence in Apple remains strong.

In May, Buffett emphasized Apple’s standing within Berkshire’s portfolio, even describing it as a business superior to two other key holdings: American Express Co. and Coca-Cola Co. He reiterated that Apple would likely remain Berkshire’s top holding, implying that tax considerations were the primary motivator for this recent sale. “I don’t mind at all, under current conditions, building the cash position,” Buffett noted, reflecting his willingness to hold substantial cash reserves in an uncertain market.

Emphasis on Conservative Investment Strategy

Throughout the third quarter, Berkshire maintained its status as a net seller of stocks, reporting a total of $34.6 billion in net share sales from July to September. Buffett’s recent activity in the stock market reflects a conservative stance, driven by his belief that current market valuations are too high to justify significant investments. His cautious approach is underscored by comments made during Berkshire’s annual shareholder meeting in May, where he explained that the company would only invest in opportunities with minimal risk and high potential returns. This prudent investment philosophy has become even more pronounced amid an uncertain economic climate, as Buffett refrains from acquisitions that may compromise Berkshire’s risk tolerance.

Despite his legendary reputation as a value investor, Buffett has resisted the temptation to make high-stakes purchases, citing the importance of protecting Berkshire’s capital. His preference for safety over speculative growth indicates a strategic pivot, focusing on long-term stability rather than short-term gains. While market watchers have questioned this conservative stance, Buffett’s decision to prioritize cash accumulation aligns with his belief that opportunities worth pursuing are currently limited, making it prudent to wait for more favorable conditions.

Limited Share Buybacks Reflect Changing Priorities

In previous quarters, Berkshire has used its substantial cash reserves to repurchase its own shares, a strategy aimed at boosting shareholder value. However, this past quarter marked the first time since 2018 that Berkshire declined to buy back its own stock. This decision reflects rising costs associated with repurchasing shares, driven in part by Berkshire’s strong market performance. The company’s shares have gained 25% in value this year, pushing Berkshire’s market capitalization to $974.3 billion. On August 28, the company’s market value briefly exceeded $1 trillion, a significant milestone for the Omaha-based conglomerate.

The decision to hold off on share buybacks may indicate a shift in Berkshire’s priorities, as the rising costs of repurchases potentially diminish their attractiveness. By refraining from additional buybacks, Berkshire can retain more cash on hand, enabling the company to act quickly should promising investment opportunities arise. This approach reflects Buffett’s preference for maintaining a substantial cash buffer, which offers both flexibility and resilience in a volatile market environment.

Challenges in the Insurance Sector

Berkshire’s cautious stance extends beyond its stock portfolio to its collection of insurance businesses, a sector that has traditionally been one of the conglomerate’s core revenue sources. This past quarter, earnings from underwriting in Berkshire’s insurance segment fell sharply by 69%, dropping to $750 million from $2.4 billion the previous year. This decline was largely attributed to higher losses incurred by Berkshire Hathaway Primary Group, one of the company’s key insurance units. The downturn in insurance earnings underscores the challenges facing the industry as a whole, as rising costs and heightened risk profiles weigh on profitability.

For Berkshire, the insurance sector has been a critical component of its diversified portfolio, providing steady cash flow and investment income. However, the recent slump in underwriting profits highlights the volatility inherent in this industry, prompting Buffett to exercise even greater caution in deploying Berkshire’s cash reserves. With insurance earnings under pressure, Berkshire’s ability to rely on this segment as a stable income source may be somewhat diminished, further reinforcing the importance of its cash pile as a financial buffer.

The Strategic Significance of Berkshire’s Cash Buildup

The record cash reserves held by Berkshire Hathaway represent more than just a financial milestone; they reflect a carefully considered strategy by Buffett and his team to navigate a complex and uncertain market landscape. By amassing $325.2 billion in cash, Berkshire has positioned itself to capitalize on opportunities that may emerge in the event of an economic downturn or market correction. This substantial cash cushion offers Berkshire a competitive advantage, enabling it to act swiftly should favorable investment opportunities arise.

Buffett’s decision to prioritize cash accumulation over acquisitions or share buybacks may appear conservative, but it underscores his commitment to protecting Berkshire’s financial health. By building a sizable cash reserve, Buffett ensures that Berkshire remains flexible and resilient, capable of weathering economic challenges and seizing opportunities as they emerge. This strategy reflects his belief in the importance of patience, especially in an investment climate where valuations are high, and the risk of overpaying for assets is significant.

A Long-Term Vision for Berkshire Hathaway

As Berkshire Hathaway’s cash reserves reach unprecedented levels, Warren Buffett’s approach reveals a disciplined commitment to long-term stability and financial flexibility. By reducing holdings in key equities like Apple, refraining from major acquisitions, and limiting share buybacks, Berkshire is positioning itself to navigate an uncertain economic landscape. The company’s record-breaking cash pile serves as both a buffer against potential downturns and a war chest for future opportunities that meet Buffett’s stringent investment criteria.

Buffett’s strategy underscores the value of patience and foresight in a rapidly changing market. His decision to wait for the right opportunities—rather than pursuing growth at any cost—reflects a belief that meaningful investments should offer both low risk and high reward. As Berkshire continues to accumulate cash, the conglomerate stands ready to deploy its resources strategically, ensuring its long-term success while upholding the principles that have guided Buffett’s career. In a market driven by short-term gains, Berkshire Hathaway’s cash pile symbolizes a commitment to enduring value and prudent financial management.