Bed Bath and Beyond raises $225 million

On Tuesday, Bed Bath and Beyond Inc said about $225 million was raised in an equity offering and are bound to get another $800 million in top coming next months, as the scuffling retailer is trying to keep away from bankruptcy.

The lead investor, Hudson Bay Capital Management in the share sale, Reuters, was told by two people who were familiar with the situation before the offering closing.

The prospect of bankruptcy was first highlighted by Bed Bath and Beyond early last month and stated on Monday that it prepared to raise about $1 billion in a complicated deal where it offered favored warrants and stock.

Analysts stated that fresh cash might afford Bed Bath and Beyond just a few quarters to save its business, and a diminishing economy would weaken any chance of a triumphant turnaround.

The offering “might be a Band-Aid but I’m not sure of all the formation of their balance sheet,” stated Robert Gilliland, Concenture Wealth Management’s, managing director. “The issue is that they’re likely not going to be a big turnabout story.”

Bed Bath and Beyond on its way to Bankruptcy

Bed Bath decided, to not comment on Hudson Bay Capital’s position in the share sale. Hudson Bay did not acknowledge the request for comment. Hudson Bay Capital development was first reported by Bloomberg News.

The Canadian department store chain Hudson’s Bay Co., Is not related to Hudson Bay Capital.

In a letter to distributors viewed by Reuters, the Chief Executive of Bed Bath and Beyond, Sue Gove, attempted to relieve concerns, stating she anticipated the stock sale to “Induce our efforts to turnabout the establishment.” she requested vendor support and pledged “open discussion.”

“In fiscal 2023, we anticipate that it will enable strategic initiatives by providing the needed runway and resources” to continue, to implement its transformation, she said.

Vendors of Bed Bath and Beyond are concerned and have elucidated little to the company, which is a reason for the delay or halts in payments. Reuters was told by two vendors.

“Everything is on hold,” a children’s apparel maker stated last week, adding that the product shipping had stopped since early January to Bed Bath. A maker of personal care products stated that the payments were “astronomically delayed.”

No immediate response was seen by Bed Bath to a request for comment on what the vendor said or the memo.

At the end of last month, Reuters reported that Over-seers were lined up, by Bed Bath and Beyond to close any extra stores until and unless a buyer emerged at the last minute.

Prices on Bed Bath and Beyond bond which are due in 2024 Escalated on Tuesday to $0.24 on the dollar from around $0.05 a day, but still displays financial distress.

In the aftermath of closing down 49% on Tuesday, the shares of Bed Bath and Beyond jumped up 3% in extended trading.

“It seems like a way of increasing time hoping someone saves them but that seems a bit unlikely,” a chief market analyst at IG, Chris Beauchamp said.

“It is not new that this news has poked the residue of that particular mania, having been on the edge of the meme stock frenzy” he added.

“Having been on the edge of the meme stock frenzy, it’s not surprising that this news has poked the embers of that particular mania,” he added.

Bed Bath and Beyond looked at its shares surging as high as $30 the previous year, which was a part of the meme stock phenomenon when investor and activist Ryan Cohen pushed the company for changes and took a stake in the company.

In the past few years, there have been more meme stocks that have been increased by retail investors. Which comprise video game retailers, GameStop Corp, and AMC Entertainment, which closed down at 11% and 9% respectively on Tuesday.

“The meme stock’s popularity could vary depending on the market’s features (but investors) have to be careful about it, mainly in a pricey environment” U.S. investment analyst at eToro, Callie Cox said.

In a supervisory filing, Bed Bath and Beyond said “we do not know for how long these dynamics will last or if they will last, but the recent imponderable and present prices mirror market and trading kinetics which is not related to our fundamental business, or industry fundamentals or market”

Bed Bath & Beyond will survive for another day – for now at least.

The company raised a $100 million loan from one of its lenders, Sixth Street Partners. The sole book-runner for the offering was B. Riley Securities, said Bed Bath.

Bed Bath and Beyond’s current market value is approximately $353 million.

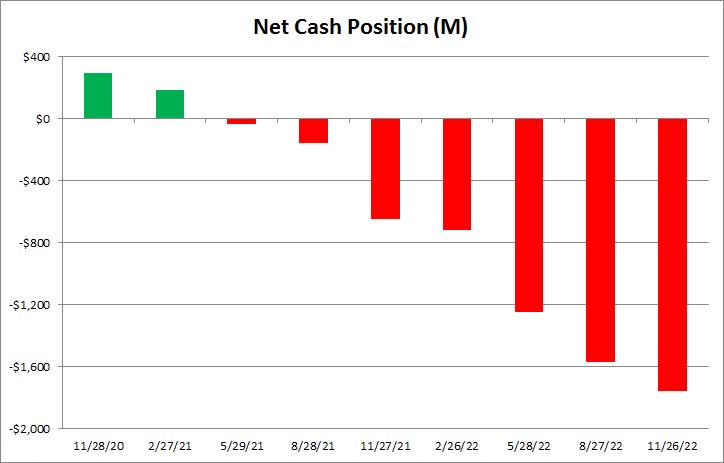

The cash ingrain will be utilized to settle some of the retailer’s debts after Bed Bath backed out on a loan with JP Morgan in January and skipped a $25 million interest repayment on February 1st, the company stated in security filings.

To maintain the costs and concentrate on spending less, Bed Bath wants to massively decrease its traditional footprint to total stores (480)- 120 Buy Baby stores and another 360 with the Bed Bath and Beyond banner, the company issued in a News release.

In a filing, on Monday the company said it would close 150 more Bed Bath stores. After already closing down 200 of its byname stores and Harmon Face Values locations 50. Earlier in the year Bed Bath and Beyond had many stores 955 open as of now it faces many problems.