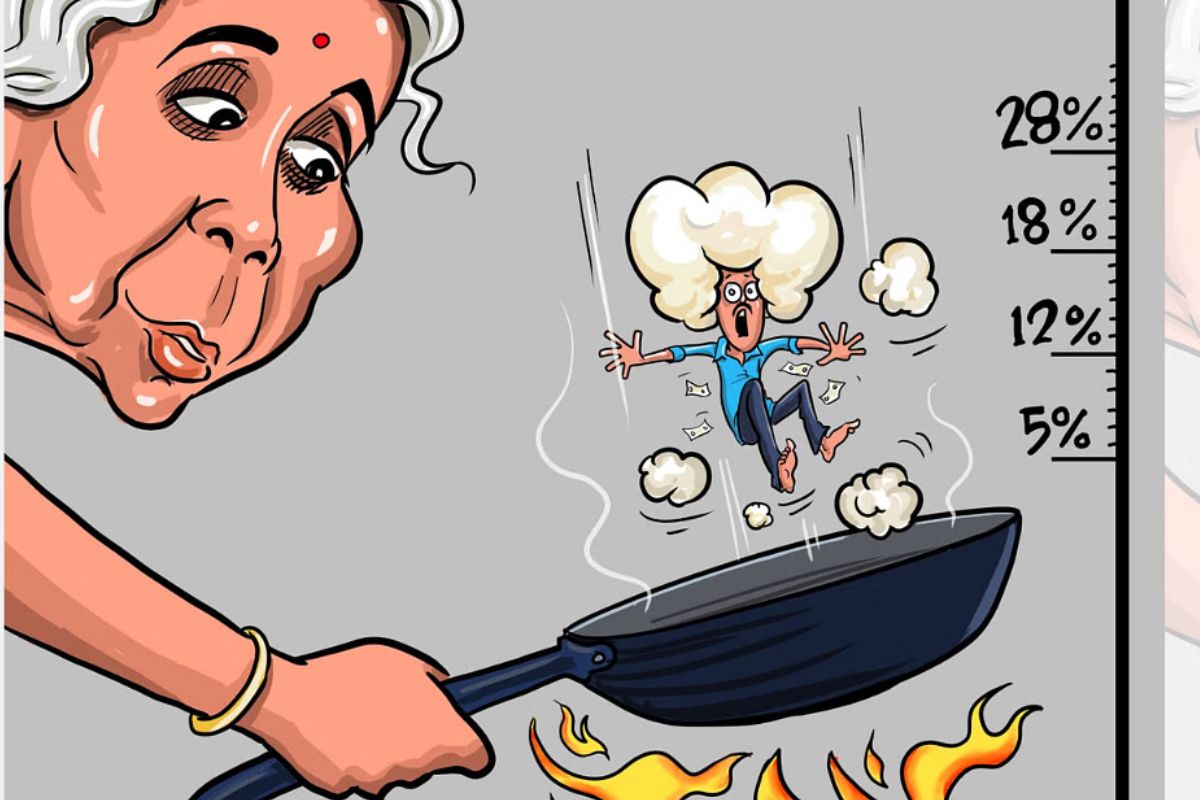

Amid growing debates over the complexities of India’s Goods and Services Tax (GST), a recent clarification by Finance Minister Nirmala Sitharaman on three different tax slabs for popcorn has sparked widespread criticism from political parties, business leaders, and citizens. Critics argue that the GST system, initially marketed as a “Good and Simple Tax,” has devolved into a convoluted framework that fosters inefficiency and inequity.

The Popcorn GST Controversy

The recent outrage was triggered after the GST Council’s 55th meeting clarified tax rates on popcorn. Sitharaman explained that salted popcorn supplied loose attracts a 5% GST, while pre-packaged and labelled popcorn falls under a 12% slab. However, caramel popcorn, classified as sugar confectionery, attracts an 18% tax.

“When you talk outside, it looks silly… but during discussions with states in the Fitment Committee, it is clearly mentioned that things with added sugar are treated differently… This is why salted popcorn attracts 5% GST, but caramel popcorn, being sugar confectionery, falls under a higher rate,” Sitharaman stated.

Her explanation, though detailed, failed to appease critics. Social media erupted with memes mocking the complexities, and opposition parties questioned the rationale behind such granular distinctions.

Mohandas Pai’s Warning: “Tax Terrorism” Looms

Renowned businessman Mohandas Pai voiced concerns over the GST system, calling it “silly and complex.” In a pointed critique, he stated, “This is silly and complex. Will lead to tax terrorism. Citizens are becoming victims of bad policy which will make them hostages to rent-seeking officials and create disputes. GST needs to be simplified, not this.” Pai’s comments encapsulate the growing discontent among businesses and individuals who feel burdened by the multi-layered tax structure.

Congress: “Absurd and Unfair”

The Congress party joined the chorus of disapproval, with General Secretary Jairam Ramesh highlighting systemic flaws in GST implementation. “The absurdity of three different tax slabs for popcorn has unleashed a tsunami of memes on social media. But it brings to light a deeper issue: the growing complexity of a system that was supposed to be a Good and Simple Tax,” he posted on X.

Ramesh underscored the flaws in GST enforcement, citing significant tax evasion, input tax credit fraud, and loopholes exploited by bogus companies. “Tracking of supply chains is weak, the registration process is flawed, and compliance requirements are still cumbersome. Misclassification of goods is frequent,” he added. He also pointed out data from the Directorate General of GST Intelligence (DGGI), revealing GST evasion of ₹2.01 lakh crore in FY24.

Ramesh urged the government to consider a complete overhaul of the GST framework, suggesting the need for a simplified GST 2.0 ahead of the Union Budget. “Will the PM and FM summon the courage to launch a complete overhaul and institute a GST 2.0?” he asked.

Tax Terrorism and the Middle-Class Burden

The growing complexity of GST has fueled accusations of “tax terrorism,” where ambiguous rules lead to harassment by tax officials. This phenomenon disproportionately affects small businesses and the middle class, who lack the resources to navigate the intricate tax system.

Critics argue that the multi-tiered GST structure unfairly targets essential and everyday items. For instance, pre-packaged snacks like popcorn, an affordable treat for many, are taxed at higher rates when they undergo minor processing or packaging. Such policies, they claim, disproportionately burden the poor and middle-class segments of society while benefiting large corporations that can exploit loopholes or afford legal expertise.

“While the GST Council deliberates on popcorn tax slabs, the real victims are ordinary citizens struggling to keep up with rising costs and a system that prioritizes revenue collection over fairness,” said an economic analyst.

GST and Revenue Generation: A Double-Edged Sword

The GST, introduced in 2017, was touted as a unifying tax regime aimed at simplifying India’s complex tax structure. However, in practice, it has led to frequent disputes, misclassification of goods, and arbitrary distinctions that confuse taxpayers.

Proponents argue that GST has streamlined tax collection, widened the tax base, and increased revenue. However, critics highlight that the drive for revenue has come at the cost of equity and simplicity. The rising number of fraud cases and evasion scandals—amounting to over ₹2 lakh crore in FY24—point to systemic inefficiencies.

Social Media Erupts

The GST popcorn controversy has sparked a wave of humor and criticism online. Memes mocking the classification of popcorn as “sugar confectionery” have gone viral, with many users questioning why everyday items attract such scrutiny. “The government can now tax the air you breathe depending on whether it’s humid or dry,” quipped one user.

While social media outrage provides comic relief, it also underscores deeper frustrations with India’s tax system.

The Call for GST 2.0

With the Union Budget around the corner, there are growing calls for the government to revamp the GST framework. Simplifying tax slabs, reducing compliance burdens, and strengthening enforcement mechanisms are seen as essential steps to restore public confidence in the system.

“GST was envisioned as a transformative reform, but it has become a nightmare for taxpayers. We need GST 2.0—streamlined, transparent, and fair,” said a tax consultant.

A System in Need of Reform

The GST system, once celebrated as a milestone in India’s economic journey, now finds itself at the center of controversy. The caramel popcorn debate may seem trivial, but it reflects the larger issues plaguing the system. As Mohandas Pai aptly put it, the growing complexity risks turning citizens into “hostages to rent-seeking officials.”

For many Indians, the question remains: will the government address these concerns and make GST truly simple and equitable, or will the system continue to burden the poor and middle class while allowing tax terrorism to thrive?