An Introduction to New Zealand

New Zealand a suitable business location in the southwestern Pacific Ocean, is celebrated for its extraordinary landscapes, rich cultural heritage, and dynamic economy. Consisting of the North Island, the South Island, and several smaller islands, New Zealand is a haven for nature lovers, offering pristine beaches, majestic mountains, and verdant plains.

Its cultural tapestry weaves together the traditions of the indigenous Māori people with European influences, creating a unique and harmonious society. With a population of approximately 5 million, New Zealand combines modern conveniences with deep-rooted traditions, making it an attractive destination for tourists and expatriates alike.

Living Standards in New Zealand

New Zealand ranks consistently among the world’s top nations for quality of life, thanks to its clean environment, excellent healthcare, and exceptional education system. The country’s robust infrastructure and well-maintained public services provide a foundation for a high standard of living.

Major urban centers like Auckland, Wellington, and Christchurch offer diverse employment opportunities, cultural activities, and vibrant lifestyles. Although living costs in these cities can be high, competitive wages and equitable income distribution help offset expenses. New Zealand’s strong social welfare programs ensure that residents have access to essential services such as healthcare and housing, further enhancing the overall standard of living.

Taxation for Individuals in New Zealand

New Zealand employs a progressive taxation system for individuals, where tax rates increase with income.

- Income Tax: Personal income tax rates start at 10.5% for annual earnings up to NZD 14,000 and rise to 39% for incomes exceeding NZD 180,000.

- Tax Benefits: The absence of capital gains tax (except in specific scenarios) and inheritance tax simplifies tax compliance for individuals.

- Healthcare Funding: Unlike many nations, New Zealand does not require healthcare premiums, as the public healthcare system is funded through general taxation.

- Goods and Services Tax (GST): Set at 15%, GST is applied to most goods and services, excluding financial transactions and residential rent.

This transparent and straightforward taxation system ensures that residents benefit from world-class public services while maintaining manageable financial obligations.

Corporate Taxation in New Zealand

New Zealand’s corporate tax system is renowned for its simplicity and fairness, fostering a business-friendly environment.

- Corporate Tax Rate: The corporate income tax is set at 28%, a competitive rate among OECD nations.

- GST for Businesses: Businesses charge a 15% GST on most goods and services but can claim back GST on operational expenses.

- International Collaboration: Double-taxation agreements with numerous countries minimize tax barriers for foreign investors and multinational corporations.

- Ease of Compliance: The straightforward regulatory framework and efficient systems reduce bureaucratic hurdles, encouraging both startups and established enterprises to thrive.

These factors position New Zealand as an appealing destination for local and international business ventures.

Key Industries Driving New Zealand’s Economy

New Zealand’s economy thrives on a mix of traditional and emerging industries, ensuring both stability and growth:

- Agriculture and Dairy:

Agriculture forms the backbone of the economy, with New Zealand being the world’s largest exporter of dairy products. Meat, wine, and kiwifruit are also in high demand globally, contributing significantly to the nation’s GDP. - Tourism:

The nation’s pristine natural beauty, adventure activities, and rich Māori cultural experiences attract millions of tourists annually, making tourism a vital sector. - Technology and Innovation:

New Zealand’s tech industry is growing rapidly, with strengths in software development, film production (notably The Lord of the Rings), and biotechnology gaining international recognition. - Renewable Energy:

With its commitment to sustainability, New Zealand invests heavily in renewable energy projects, ensuring a greener future. - Education and Forestry:

The export of education services and forestry products also contributes to economic diversification and resilience.

Inflation and Cost of Living in New Zealand

New Zealand’s stable economic environment typically keeps inflation in check, averaging between 2-3%. However, global economic pressures can occasionally lead to higher inflation, affecting essential goods and services.

- Housing: Housing costs have surged in recent years, particularly in cities like Auckland and Wellington, due to high demand and limited supply.

- Essentials: Groceries, utilities, and transportation contribute to the cost of living, which is higher in urban areas than in rural regions.

- Wages and Welfare: Competitive wages and robust social welfare systems help residents manage these costs, ensuring a reasonable standard of living despite economic fluctuations.

Taxes on Property, Services, and Sales in New Zealand

New Zealand maintains a simplified tax system, ensuring clarity and fairness for residents and businesses:

- Property Rates: Instead of direct property taxes, local councils levy rates based on property values to fund essential public services such as waste management and infrastructure maintenance.

- Goods and Services Tax (GST): A 15% GST applies to most goods and services, excluding financial transactions and residential rent. Businesses with annual turnover exceeding NZD 60,000 must register for GST.

- Capital Gains Tax: While New Zealand does not generally impose a capital gains tax, certain property transactions, such as short-term trading, are exceptions, making the property market attractive for investors.

This straightforward approach ensures ease of compliance while supporting public services and infrastructure development.

Business Structures Available in New Zealand

Entrepreneurs in New Zealand can select from several business structures, each tailored to different needs and goals:

- Sole Trader

This is the simplest and most cost-effective structure, ideal for individuals operating independently. It is easy to establish and manage, though the owner assumes full personal liability for debts. - Partnership

Designed for businesses with two or more partners, this structure allows profits and responsibilities to be shared according to an agreement. Partnerships offer flexibility but come with shared liabilities. - Limited Liability Company

The most popular choice for medium to large enterprises, this structure provides a separate legal identity, shielding owners from personal liability. It’s well-suited for businesses aiming for scalability. - Trusts and Cooperatives

These specialized entities cater to particular purposes, such as charitable activities or collective farming, offering unique legal and operational benefits. - Branch of a Foreign Company

This option enables international businesses to establish a local presence while adhering to New Zealand’s regulations. It is a preferred structure for global companies expanding into the country.

Choosing the right structure ensures compliance with tax and legal obligations while supporting long-term growth.

Licensing Requirements to Establish a Business in New Zealand

Starting a business in New Zealand is a streamlined process, though specific industries may require additional permits and certifications:

- General Business Registration

All businesses must register with the New Zealand Companies Office and secure a New Zealand Business Number (NZBN) for identification. - Sector-Specific Permits

Industries such as food services, construction, liquor retail, and childcare require special licenses or certifications to ensure compliance with industry standards. - Environmental Approvals

Businesses impacting the environment, such as those in agriculture or mining, must obtain resource consent under the Resource Management Act. - Health and Safety Compliance

Adherence to the Health and Safety at Work Act is mandatory, ensuring workplace safety across all industries. - Tax and GST Registration

Businesses expecting an annual turnover exceeding NZD 60,000 must register for Goods and Services Tax (GST) with the Inland Revenue Department (IRD).

With efficient online portals and proactive government support, the licensing process is both quick and user-friendly.

Opportunities for Foreign Entrepreneurs in New Zealand

New Zealand actively encourages foreign investment and offers numerous opportunities for expatriates to establish and grow businesses:

- Tourism and Hospitality

The country’s thriving tourism industry creates demand for innovative accommodations, restaurants, and adventure activities, making it a lucrative sector for expats. - Technology and Innovation

With a growing focus on renewable energy, artificial intelligence, and software development, expats with expertise in these areas can contribute significantly to the tech ecosystem. - Agribusiness

New Zealand’s strong agricultural sector offers opportunities for sustainable farming practices, food processing, and agritech innovations. - Education and Training

English language schools, vocational training centers, and e-learning platforms are in high demand, presenting growth opportunities for expat entrepreneurs.

Government initiatives such as the Investor Visa and Entrepreneur Work Visa simplify the process of starting a business, offering financial and operational support.

Pathways to Citizenship for Expats in New Zealand

Gaining citizenship in New Zealand is a structured process that begins with residency:

- Temporary Visas

Expats typically start with work visas or entrepreneur visas, which allow them to establish a presence and contribute to the economy. - Permanent Residency

After meeting specific requirements, such as working or investing for a designated period, expats can apply for permanent residency, which provides nearly all the rights of citizenship. - Citizenship by Grant

Permanent residents who have lived in New Zealand for at least five years can apply for citizenship. Applicants must demonstrate good character, basic English proficiency, and knowledge of New Zealand’s culture. - Dual Citizenship

New Zealand permits dual citizenship, enabling expats to retain their original nationality.

Becoming a citizen offers full access to voting rights, social welfare benefits, and the ability to participate fully in the country’s civic and economic life.

Benefits of Registering a Business in New Zealand

New Zealand’s reputation as one of the world’s most business-friendly nations makes it an ideal destination for entrepreneurs. Key advantages include:

- Ease of Doing Business

Consistently ranked among the top countries for ease of doing business, New Zealand offers streamlined processes with minimal bureaucracy, making it efficient for startups and established enterprises. - Robust Legal Framework

The country’s stable and transparent legal system ensures strong intellectual property protection, straightforward dispute resolution, and fair regulatory practices. - Access to Global Markets

Strategically located in the Asia-Pacific region, New Zealand provides a gateway to major markets such as Australia, China, and Southeast Asia. Free trade agreements enhance export opportunities. - Tax Simplicity

New Zealand’s competitive corporate tax rate of 28% and the absence of a general capital gains tax make it attractive for businesses. The country’s tax system is clear and easy to navigate. - Strong Global Reputation

Businesses in New Zealand benefit from the country’s image of quality, sustainability, and innovation, enhancing brand credibility in global markets.

Steps to Register a Business in New Zealand

The process of registering a company in New Zealand is straightforward and can be completed online:

- Select a Business Name

Choose a unique company name and check its availability on the Companies Office website to ensure compliance with naming regulations. - Reserve the Name

Once approved, reserve the name through the online portal for a small fee (approximately NZD 10). - Prepare Documentation

Collect essential details, including the company’s registered address, director and shareholder information, and optionally, a company constitution. - Complete Registration

Register the company through the New Zealand Companies Office portal, submitting all necessary information and paying the registration fee (approximately NZD 115). - Obtain Tax Identification

Apply for an Inland Revenue Department (IRD) number for tax purposes, and register for GST if your turnover is expected to exceed NZD 60,000 annually. - Set Up a Business Bank Account

Open a local bank account to manage the company’s financial transactions efficiently.

Thanks to New Zealand’s efficient digital systems, the registration process is quick, often completed within a few days.

Cost of Business Registration in New Zealand

Setting up a business in New Zealand is affordable and accessible for entrepreneurs:

- Name Reservation: NZD 10

- Company Registration: NZD 115

- GST Registration: Free (if required)

- Optional Constitution Filing: NZD 25

Additional costs may include professional advisory fees, bank account setup charges, and industry-specific licenses. These reasonable expenses, combined with New Zealand’s favorable business environment, make it an excellent choice for entrepreneurs.

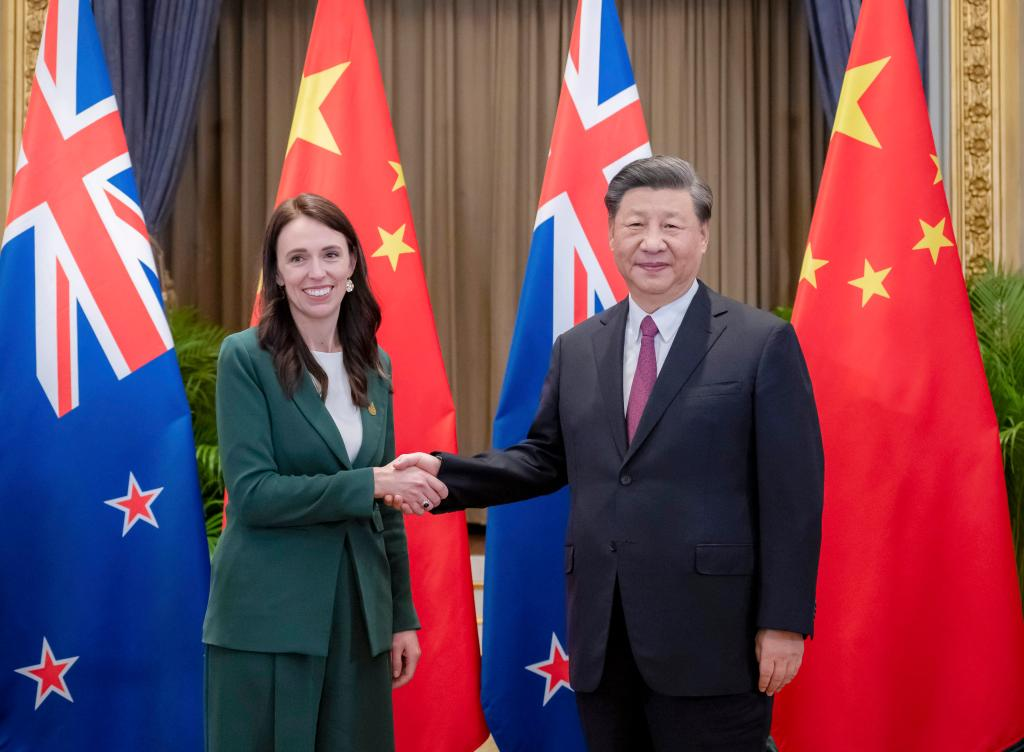

New Zealand’s Global Relations and Partnerships

New Zealand fosters strong diplomatic and economic ties worldwide, with a focus on free trade and collaborative international relations:

- Free Trade Agreements (FTAs)

The country benefits from numerous FTAs, including the Closer Economic Relations Agreement with Australia, its largest trading partner, and agreements with China and members of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These agreements reduce tariffs, enhance market access, and offer competitive advantages to New Zealand businesses. - Regional Collaborations

As a member of the Asia-Pacific Economic Cooperation (APEC) and the Pacific Islands Forum, New Zealand champions regional stability, economic integration, and sustainable development. Its active role in these organizations reflects its commitment to fostering growth and cooperation across the Asia-Pacific region. - Cultural and Diplomatic Connections

New Zealand shares deep-rooted cultural ties with the Pacific Islands, the United Kingdom, and Australia. Its engagement with Māori heritage strengthens its global connections with other indigenous communities, promoting cultural diplomacy. - Immigration and Work Exchange Initiatives

Programs such as the Working Holiday Visa scheme encourage people-to-people exchanges, attracting international talent and enhancing tourism. These initiatives strengthen New Zealand’s global presence and workforce diversity.

These partnerships open doors for businesses, providing access to global markets, skilled talent, and international collaborations.

Additional Taxes in New Zealand

Beyond income tax and GST, New Zealand has other tax obligations that contribute to its fair and balanced system:

- Pay-As-You-Earn (PAYE)

Employers deduct PAYE taxes directly from employees’ wages based on income levels. This ensures timely tax collection and simplifies compliance for individuals. - Fringe Benefits Tax (FBT)

Employers offering non-cash benefits, such as company vehicles or subsidized housing, are required to pay FBT. - Resident Withholding Tax (RWT)

Interest and dividend earnings are subject to RWT, deducted at source by financial institutions to simplify tax obligations for individuals and businesses. - Accident Compensation Corporation (ACC) Levies

Contributions to the ACC fund New Zealand’s unique no-fault accident insurance system. Levies are calculated based on earnings and business activities. - Excise Duties

Specific goods, including alcohol, tobacco, and fuel, attract excise taxes to support public health and environmental goals.

New Zealand’s transparent and straightforward tax system supports its business-friendly reputation while ensuring fair revenue distribution.

New Zealand’s Social Security System

New Zealand offers a comprehensive social security framework to support residents throughout their lives. Administered by the Ministry of Social Development, key features include:

- Income Assistance

Financial aid is available for those in need, including unemployment benefits, disability allowances, and family tax credits. These programs provide a safety net during difficult times. - Healthcare Access

Public healthcare is primarily funded through taxation, ensuring free or subsidized medical services for residents. Services include hospital care, emergency treatment, and general practitioner consultations. - Retirement Support

The New Zealand Superannuation (NZ Super) offers financial stability to eligible residents aged 65 and older, ensuring dignity in retirement. - Family and Child Services

Programs such as the Best Start payment provide financial assistance to families with young children, fostering a supportive environment for the next generation.

This robust social system reflects New Zealand’s commitment to equity, health, and overall well-being.

Climate and Safety Across New Zealand

New Zealand’s environment is defined by its temperate maritime climate and high levels of regional safety:

- Weather and Seasonal Diversity

- North Island: Warm subtropical climates dominate regions like Auckland and Northland, with mild winters and warm summers.

- South Island: Cooler weather prevails, with snowy winters in alpine regions such as Queenstown and Wanaka, making it a winter sports haven. Coastal areas maintain temperate conditions throughout the year.

This seasonal variety offers residents and tourists opportunities to enjoy diverse outdoor activities, from hiking and surfing to skiing.

- Safety and Security

Ranked among the world’s safest nations, New Zealand boasts low crime rates and political stability.

- Disaster Preparedness: Comprehensive systems are in place to address risks like earthquakes and volcanic activity.

- Community Policing: Police services are approachable and efficient, fostering a sense of trust and safety.

These factors create a secure and welcoming environment for residents and visitors alike.

The Global Power of the New Zealand Passport

The New Zealand passport is among the most powerful globally, offering exceptional mobility and access:

- Visa-Free Travel

Holders of a New Zealand passport can travel visa-free or obtain visas on arrival in over 190 countries, including the United States, the United Kingdom, Canada, and the European Union. - Global Opportunities

This mobility facilitates international business, study, and tourism, making the passport a valuable asset for its holders.

The passport’s strength reflects New Zealand’s robust diplomatic relations and reputation as a trusted global player.

Education, Economic Growth, and Opportunities in New Zealand

- World-Class Education

New Zealand’s education system is renowned for its quality and inclusivity:

- Primary and Secondary Education: Residents benefit from free or low-cost education, with a focus on creativity and practical learning.

- Higher Education: Universities like the University of Auckland and the University of Otago rank highly globally, attracting both local and international students.

- International Appeal: Safe environments and work opportunities post-graduation make New Zealand a preferred destination for international learners.

- Economic Growth and Job Prospects

New Zealand’s thriving economy is driven by industries such as agriculture, tourism, technology, and renewable energy.

- Employment Opportunities: Diverse sectors offer competitive wages and stable careers.

- Entrepreneurial Support: Startups receive backing through government grants, incubators, and mentorship programs, fostering innovation.

- Exceptional Lifestyle

Residents enjoy a high quality of life, characterized by:

- Work-Life Balance: A focus on outdoor recreation and cultural engagement ensures a fulfilling lifestyle.

- Sustainability: New Zealand’s commitment to eco-friendly practices ensures a clean and green living environment.

- Cultural Integration

New Zealand’s inclusive society and widespread English proficiency make it easy for newcomers to adapt and thrive.

The country’s emphasis on education, innovation, and well-being positions it as a global leader in providing opportunities and fostering growth.