The British Virgin Islands: A Caribbean Gem of Beauty and Opportunity

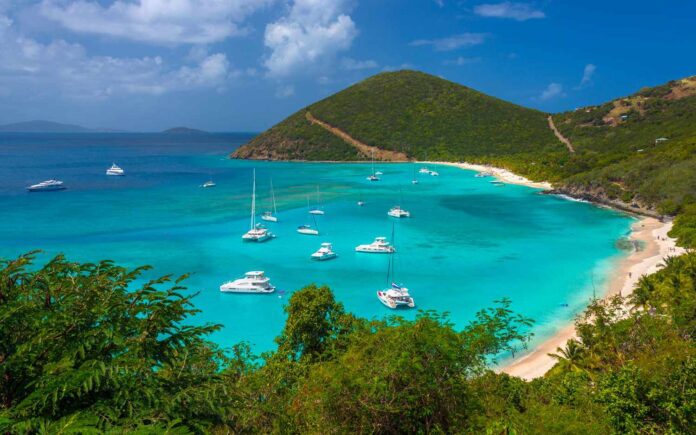

A suitable business location, nestled in the heart of the Caribbean, the British Virgin Islands (BVI) is a British Overseas Territory renowned for its stunning natural beauty, thriving economy, and strategic position as a global financial hub. This idyllic territory comprises approximately 60 islands and cays, with Tortola standing as the largest and most populous island. Visitors to the BVI are often drawn by its turquoise waters, pristine beaches, and vibrant marine ecosystem, making it a paradise for sailing enthusiasts and water sports aficionados.

However, the BVI is more than just a tropical retreat; it is a significant player in international finance, offering businesses and investors a tax-friendly, confidential, and stable regulatory environment. The territory’s self-governance and close ties to the United Kingdom provide a solid political and legal framework. Its dual focus on tourism and finance fuels a thriving economy, setting the BVI apart as a destination that successfully balances natural beauty with economic opportunity.

Geographic Overview and Natural Beauty

Located east of Puerto Rico and the US Virgin Islands, the BVI covers an area of approximately 153 square kilometers. Its geography is characterized by rolling hills, coral reefs, and a scattering of unspoiled islands that are rich in biodiversity. The largest islands, including Tortola, Virgin Gorda, Anegada, and Jost Van Dyke, offer unique landscapes ranging from sandy beaches to rugged terrains.

The climate in the BVI is tropical, with warm temperatures averaging between 22°C and 30°C throughout the year. A dry season from December to April attracts peak tourist activity, while the rainy season from May to November sees occasional tropical storms and hurricanes. Despite the risks associated with hurricane season, the government’s investment in infrastructure and preparedness has enhanced resilience, ensuring the safety of both residents and visitors.

Standard of Living in the British Virgin Islands

Life in the BVI is characterized by a harmonious blend of a relaxed tropical lifestyle and access to modern amenities. The islands offer a high standard of living, attracting expatriates and locals employed in key industries such as finance and tourism. Residents enjoy access to quality healthcare, private and public education, and an abundance of recreational opportunities. The territory’s low crime rates and close-knit community further contribute to its appeal as a safe and welcoming place to live.

Healthcare and Education

The healthcare system in the BVI includes both public and private facilities, with the main hospital, the Dr. D. Orlando Smith Hospital, located in Tortola. While basic medical services are readily available, residents often travel to nearby countries like Puerto Rico or the United States for specialized care. Many expatriates and locals supplement public healthcare with private insurance for added security.

Education in the BVI is another highlight, with options ranging from public schools to private institutions offering British and American curricula. For expatriate families, international schools provide tailored education that aligns with global standards. While higher education opportunities are limited within the BVI, students frequently pursue studies abroad in the US, UK, or other Caribbean nations.

Cost of Living and Housing

The cost of living in the BVI is notably high, primarily due to the reliance on imported goods. Essentials such as groceries, household items, and fuel often come with inflated prices. Housing, particularly on popular islands like Tortola and Virgin Gorda, commands premium rates, with rental costs comparable to those in major cities. Utilities, including electricity and internet, are also expensive, adding to the financial burden for residents.

Despite these challenges, the absence of personal income tax significantly offsets living expenses for many. The BVI’s unique combination of financial advantages and natural allure ensures its continued appeal for individuals seeking a high quality of life in an exclusive Caribbean setting.

Personal Taxes in the British Virgin Islands

One of the BVI’s most compelling attributes is its tax-free income environment. Residents and expatriates are not subject to personal income tax, capital gains tax, or inheritance tax. This policy makes the BVI an attractive destination for high-net-worth individuals and retirees who aim to maximize their wealth preservation and financial efficiency.

The absence of wealth or estate taxes further enhances the financial appeal of the territory. While residents are exempt from direct taxes on income, they contribute to social security, which funds essential services such as healthcare and pensions. This system ensures that the benefits of a tax-free environment are balanced with contributions to public welfare.

Corporate Taxes in the British Virgin Islands

The BVI’s reputation as a global offshore financial hub is rooted in its corporate-friendly tax policies. Businesses registered in the BVI enjoy a tax-neutral environment, with no corporate income tax, capital gains tax, or withholding tax. This advantageous framework has attracted multinational corporations, holding companies and investment funds seeking a stable and efficient base for their operations.

In addition to tax neutrality, the BVI offers confidentiality, minimal reporting requirements, and a streamlined incorporation process. These features make the territory an ideal jurisdiction for businesses aiming to manage international transactions, protect assets, and benefit from regulatory stability.

Major Industries in the British Virgin Islands

The BVI’s economy is primarily driven by two sectors: tourism and financial services. Together, these industries provide a solid foundation for the territory’s economic prosperity and international standing.

Tourism: A Gateway to Paradise

Tourism is a cornerstone of the BVI’s economy, attracting thousands of visitors annually. The island’s breathtaking natural beauty, coupled with a rich maritime history, makes it a sought-after destination for luxury travelers. Sailing is particularly popular, with the BVI often referred to as the “Sailing Capital of the World.” Yacht charters, diving excursions, and eco-tourism activities contribute significantly to the local economy.

The hospitality sector, encompassing hotels, restaurants, and tour operators, thrives due to this steady influx of visitors. Employment opportunities in tourism are abundant, supporting both locals and expatriates.

Financial Services: A Global Offshore Hub

The BVI’s financial services sector is a major economic driver, establishing the territory as a leading offshore jurisdiction. Favorable tax policies, confidentiality, and a robust legal framework attract businesses and investors worldwide. The sector includes offshore company registration, trust and estate planning, and investment fund management. These services cater to high-net-worth individuals and multinational corporations seeking efficient and secure financial solutions.

Inflation & Cost of Living in the British Virgin Islands

Inflation in the BVI remains stable but is influenced by global factors such as shipping costs, fuel prices, and currency exchange rates. The reliance on imported goods drives up the cost of living, making budgeting essential for residents and expatriates alike.

Despite the high costs, the absence of personal income tax offsets many expenses, particularly for those with higher incomes. This balance makes the BVI financially viable for professionals and retirees seeking a high standard of living in a tax-friendly environment.

Property Tax, Services, and Sales Tax in the British Virgin Islands

The BVI government collects property tax based on the annual rental value (ARV) of real estate. Rates vary depending on the type and location of the property, with commercial properties typically taxed at higher rates than residential homes.

Import duties ranging from 5% to 20% are levied on goods brought into the territory. These duties significantly impact the cost of living but serve as a primary revenue source for the government. Additionally, service fees are often added to bills in the hospitality sector, such as in restaurants and hotels. Essential services like utilities and telecommunications are not directly taxed but come with relatively high costs due to import-related expenses.

Types of Business Entities in the British Virgin Islands

The BVI offers a range of business structures tailored to the needs of international and offshore operators:

- Business Company (BC): The most common structure for international transactions and asset management. BCs cannot engage in local business but are ideal for global trade and investment.

- Limited Liability Company (LLC): Provides flexibility and limited liability, commonly used for joint ventures and asset protection.

- Partnerships: General and Limited Partnerships are available, with the latter often used for investment funds and private equity.

- Trusts: A leading jurisdiction for trusts, the BVI offers solutions for estate planning and wealth management.

- Branch of a Foreign Company: Foreign businesses can establish branches in the BVI, subject to regulatory requirements.

Licenses to Start a Business in the British Virgin Islands

Starting a business in the BVI requires obtaining appropriate licenses and adhering to regulatory standards. Key licenses include:

Trade Licenses: Required for local businesses such as retail shops or restaurants.

– Financial Services Licenses: Essential for banking, insurance, and asset management firms, regulated by the BVI Financial Services Commission (FSC).

– Tourism and Hospitality Licenses: Necessary for businesses like hotels and yacht charters.

The licensing process involves submitting documentation, undergoing background checks, and paying the required fees. The BVI government ensures a streamlined process, particularly for international businesses.

Opportunities for Expats for Business Growth in the British Virgin Islands

Expatriates in the BVI find opportunities in tourism, financial services, and real estate. Tourism offers potential in luxury hospitality, eco-tourism, and wellness retreats. In financial services, expatriates with expertise in law, accounting, or asset management can establish firms to cater to offshore business needs. Real estate development, especially in luxury accommodations, presents lucrative opportunities.

Citizenship for Expats in the British Virgin Islands

Acquiring citizenship in the BVI is challenging for expatriates, as there is no automatic pathway. Permanent residency is possible after 20 years of residence but does not guarantee citizenship. British citizenship is an option under specific conditions, though it is a complex process. Despite these hurdles, long-term visas and work permits provide stability for expatriates.

Why Register a Company in the British Virgin Islands

The BVI’s tax neutrality, regulatory stability, and confidentiality make it a leading offshore jurisdiction. Businesses benefit from a simplified incorporation process, robust legal framework, and limited disclosure requirements. These advantages position the BVI as a top choice for global investors and multinational corporations.

How to Register a Company in the British Virgin Islands

The registration process involves:

- Choosing a business structure (e.g., BC or LLC).

- Engaging a licensed registered agent.

- Reserving a unique company name.

- Preparing and submitting incorporation documents.

- Paying applicable fees.

Once approved, the Financial Services Commission (FSC) issues a Certificate of Incorporation.

Cost to Register a Business in the British Virgin Islands

Registration costs for a Business Company (BC) range from $1,000 to $2,000, with annual maintenance fees around $450. Companies in regulated sectors face additional licensing fees. While not the cheapest offshore jurisdiction, the BVI offers unmatched advantages in regulatory stability and confidentiality.

Relation with Other Countries of the British Virgin Islands

As a British Overseas Territory, the BVI benefits from strong ties with the UK and compliance with global tax transparency standards. Tax Information Exchange Agreements (TIEAs) enhance its reputation, making it a trusted partner in global finance.

Other Taxes in the British Virgin Islands

The BVI levies payroll tax on employers at rates between 10% and 14%, with some costs passed to employees. Stamp duty applies to real estate transactions, particularly for non-residents. License fees are required for businesses in regulated sectors.

Social Security, Weather, Climate & Regional Safety in the British Virgin Islands

Social security benefits include pensions and healthcare, funded by employer and employee contributions. The BVI’s tropical climate and investment in hurricane preparedness ensure safety and resilience. Low crime rates and a close-knit community further enhance the territory’s appeal.

Passport Power of the British Virgin Islands

British Overseas Territories passports (BOTC) grant visa-free access to over 100 countries, enhancing travel freedom. Full British citizenship is an option under certain conditions, providing expanded residency rights.

Scope of Education, Growth, and Quality of Life in the British Virgin Islands

Education in the BVI includes public and private options, with many students pursuing higher studies abroad. The territory’s high quality of life, driven by economic opportunities and natural beauty, continues to attract residents and expatriates seeking a balanced and fulfilling lifestyle.

The British Virgin Islands (BVI) stand as a shining example of natural beauty and financial sophistication, attracting visitors and investors alike. Renowned for their pristine beaches, turquoise waters, and vibrant marine life, the islands offer an unmatched tropical escape. Beyond tourism, the BVI serves as a global financial hub, thanks to its stable political environment and investor-friendly regulations. Whether exploring its natural wonders or leveraging its robust offshore financial services, the BVI encapsulates a perfect blend of leisure and opportunity. As a premier destination, the British Virgin Islands continue to thrive, preserving their charm while embracing global progress.