In its latest annual report, Apple has issued a cautionary note to its investors, stating that future products, services, and technological offerings may never achieve the same profitability as its flagship iPhone business. The announcement, as reported by The Financial Times, highlights Apple’s concerns about sustaining its remarkable profit margins as the company continues to diversify its product line.

The iPhone: A Financial Powerhouse for Apple

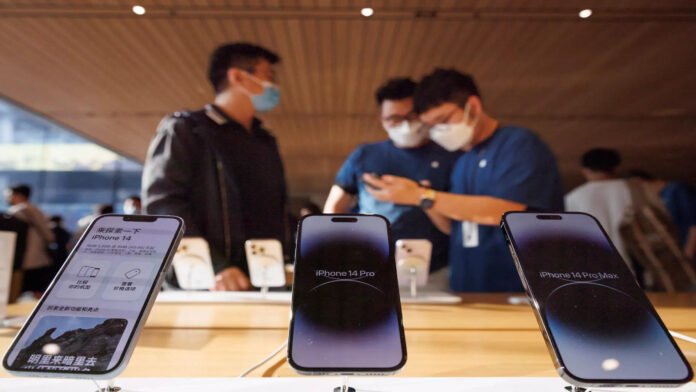

Since its launch in 2007, the iPhone has become a cultural phenomenon and a central revenue driver for Apple, consistently accounting for a large portion of the company’s income. The iPhone’s success has set a high standard, contributing significantly to Apple’s global dominance and placing the company in a strong financial position for over a decade. However, as the smartphone market matures, competition increases, and innovation slows, Apple faces the challenge of finding new product lines that can replicate the iPhone’s remarkable financial performance.

Why Future Products May Struggle to Match the iPhone’s Success?

In the report, Apple notes that “new products, services, and technologies may replace or supersede existing offerings.” This essentially means that as Apple continues to innovate and release new devices, they might replace existing products, leading to potential cannibalization within its own product lines. Furthermore, the company points out that these new offerings may bring in “lower revenues and lower profit margins” compared to the iPhone, indicating that these products may not yield the same high-profit levels that have historically driven Apple’s success.

Apple’s warning is grounded in the challenges associated with the competitive tech landscape. The company has been exploring other revenue streams, including wearables like the Apple Watch, services like Apple TV+ and Apple Music, and new technology investments in fields like augmented reality (AR) and virtual reality (VR). While these areas have shown growth potential, none have matched the iPhone’s profit-generating capacity.

Impact on Apple’s Financial Health and Investor Confidence

Apple’s disclosure could have implications for investor confidence, as it suggests potential volatility in future profitability. The company acknowledged that the anticipated lower profitability of new products “can adversely impact the company’s business and financial condition.” This admission underscores the risk Apple faces as it seeks to shift focus from being primarily a hardware company to one that balances hardware, software, and services.

This caution comes at a time when the tech giant is increasingly relying on services to offset potential declines in hardware sales. The services sector, which includes the App Store, AppleCare, and digital content subscriptions, has become a significant revenue contributor. However, while it has a high-profit margin, it has yet to match the financial scale achieved by iPhone sales.

Apple’s Strategic Diversification Efforts

Despite these challenges, Apple continues to push forward with innovations and has placed significant investments in areas like augmented reality, wearable technology, and health. The recent releases of new iPhone models, along with updates to the Apple Watch and AirPods, are part of Apple’s broader strategy to maintain its market share while attracting new customers. Additionally, the company’s push into health and fitness technology through devices like the Apple Watch has added a fresh revenue stream.

Moreover, Apple’s foray into the subscription services sector with products like Apple TV+, Apple Arcade, and Apple Fitness+ reflects its intent to build a steady flow of recurring income. Yet, these services operate in highly competitive spaces and might not yield the same profit margins as hardware sales.

The Future of Apple’s Profitability in a Changing Tech Landscape

Apple’s announcement is a candid acknowledgment of the difficulties in maintaining the high-profit levels it has enjoyed from the iPhone. It also raises questions about how sustainable its profitability will be in the face of intensifying competition and market saturation.

Investors might interpret Apple’s warning as a sign that the company is prepared for a future where traditional hardware sales might not dominate. Instead, the company seems focused on building an ecosystem of interconnected devices and services, with the hope that consumer loyalty to the Apple brand will drive steady growth across various categories, even if each individual product may not replicate the success of the iPhone.

This strategic shift, while likely to produce more consistent revenue, could indeed mean a lower overall profit margin. However, with an established loyal customer base and a strong reputation for quality and innovation, Apple is in a unique position to experiment with new products and services.

Conclusion: A New Era for Apple and Investor Expectations

As Apple transitions from its dependence on the iPhone towards a more diversified portfolio, the company faces the dual challenge of maintaining its growth and keeping investors satisfied. The warning about future profitability may signal a more realistic outlook for the tech giant, encouraging investors to adapt their expectations. While the iPhone’s legacy of profitability may be difficult to replicate, Apple’s strong ecosystem and continuous innovation offer a foundation for sustainable, albeit potentially less lucrative, future growth.