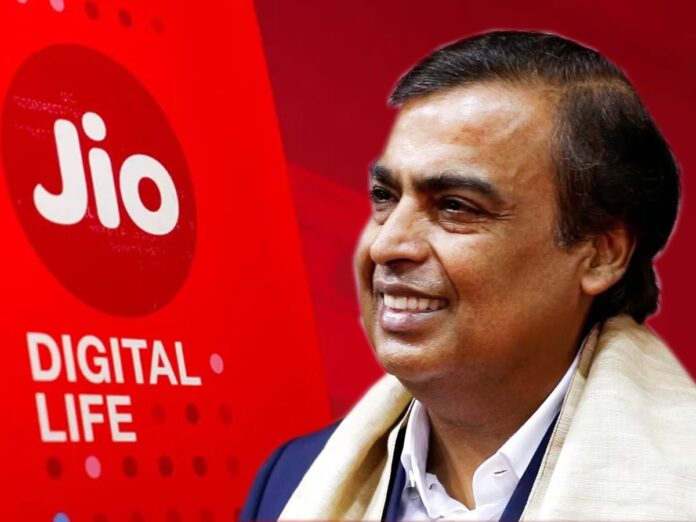

Mukesh Ambani, the Indian billionaire and chairman of Reliance Industries, is setting his sights on a 2025 Mumbai listing for his telecom arm, Jio, which is estimated by analysts to be valued at over $100 billion. This could mark India’s largest-ever initial public offering (IPO), surpassing the recent record set by Hyundai India’s $3.3 billion IPO. Analysts from Jefferies have pegged Jio’s valuation for the IPO at approximately $112 billion, making it a highly anticipated event in the Indian markets. However, Reliance’s retail arm, another significant player within the conglomerate, will likely go public only after 2025 due to certain operational and business issues that need to be resolved, according to sources close to the matter.

Reliance Jio, the telecom and digital powerhouse, has rapidly positioned itself as a key competitor not just in India, but also globally. The company has announced partnerships with tech giants like Google and Meta and is collaborating with Nvidia to develop artificial intelligence infrastructure. Jio is also set to face competition from Elon Musk’s Starlink, if the satellite internet service launches in India. Despite the global interest and its expansive growth, Reliance Industries has yet to finalize a valuation internally for the Jio IPO or appoint bankers to move forward with the process. According to sources familiar with the matter, Reliance aims for Jio’s IPO to be a landmark event for the Indian stock market, but timelines remain fluid.

Reliance Industries, an oil-to-retail conglomerate, had announced back in 2019 that its telecom arm, Jio, and its retail division would move towards a public listing within five years. Since then, no specific timeline updates have been provided by Mukesh Ambani. However, recent information from sources indicates that the retail business is unlikely to go public until it resolves some internal operational challenges. Reliance Industries did not respond to requests for comment on the latest updates.

The decision to delay the retail IPO appears strategic. Both sources highlighted that Reliance does not wish to list two large entities in the same year. The retail business, which has grown significantly and diversified into various segments, is currently addressing operational inefficiencies. The company runs India’s largest grocery store network with over 3,000 supermarkets, along with fashion and electronic outlets. It has also made strides in e-commerce to challenge Amazon’s presence in India and has entered the quick commerce space to meet the surging demand for rapid deliveries—a sector that has captured immense consumer interest recently.

However, this rapid expansion has led to a few issues. Sources indicate that some of Reliance Retail’s stores have reported losses, contributing to suboptimal earnings per square foot. The retail division, which also includes high-profile brands like Hamleys, and has partnered with Jimmy Choo, Marks & Spencer, and Pret A Manger in India, has been affected by rising competition, particularly from startups in the quick commerce space. This was evident in the July-September quarter, where Reliance Retail reported its first quarterly sales decline in over three years—a 1.1% year-on-year drop.

Analysts have observed that Reliance Retail has expanded “too fast” and now needs to focus on streamlining its diverse operations before attempting to go public. This includes addressing inefficiencies in various retail formats, managing losses in physical stores, and optimizing earnings per square foot. The retail division has been valued at $112 billion by Bernstein, indicating its strong potential, but operational improvements are necessary to enhance profitability and market readiness before an IPO.

Jio Platforms, which encompasses the telecom and digital businesses, has already attracted considerable foreign investment, with about 33% of the entity owned by international investors after raising $17.84 billion in recent years. Reliance Retail, too, has seen around a 12% stake sold to foreign investors, raising $7.44 billion in the same period. These investments underline the international confidence in both divisions’ growth prospects, but a clear separation in their listing timelines seems prudent to ensure focused investor attention and successful IPOs for both units.

The Indian market, meanwhile, has shown strong investor appetite, with IPOs hitting a record high in 2024. By October, approximately 270 companies had raised $12.58 billion through IPOs, eclipsing the $7.42 billion raised in all of 2023. With market conditions looking favorable, Reliance seems eager to capitalize on this momentum, especially with Jio’s listing poised to be a game-changing event for Indian capital markets.

While the Jio IPO is set to capture global attention, the retail unit’s IPO is more complex, largely due to the nature of the business and the challenges associated with rapid expansion. Reliance Retail’s sprawling empire includes grocery, fashion, electronics, and even toy stores, making it vital for the company to optimize operations across these diverse segments before pursuing an IPO. Moreover, launching two major IPOs within a short span could dilute market interest, another reason why the retail unit’s listing is being deferred.

In conclusion, Mukesh Ambani’s strategy of going public with Jio before the retail business is part of a calculated move to ensure the maximum impact and avoid overwhelming the market. With the Indian market riding on high investor confidence, Reliance Jio’s IPO, expected to be the country’s biggest, is slated for a 2025 debut. Meanwhile, Reliance Retail is taking a cautious approach, aiming to resolve internal challenges and improve operational efficiency before venturing into the public market. Investors are eagerly watching, as the success of these IPOs could redefine India’s corporate landscape and reinforce Reliance Industries’ dominance in both telecom and retail sectors.