India’s real estate prices, particularly in metropolitan areas, are among the highest globally, often surpassing international norms. A recent post by management consultant Gurjot Ahluwalia went viral as he contrasted the buying power of $3 million (approximately Rs 25 crore) in Indian and U.S. property markets. By comparing two listings—one from Gurgaon, India, and another from New York City—the post ignited discussions on the disparity in value and what factors drive real estate prices in India. Here’s a closer look at what $3 million can buy in India and the U.S., why Indian property values are soaring, and what we can expect in the future.

What $3 Million Buys in India vs. the U.S.: A Real Estate Comparison

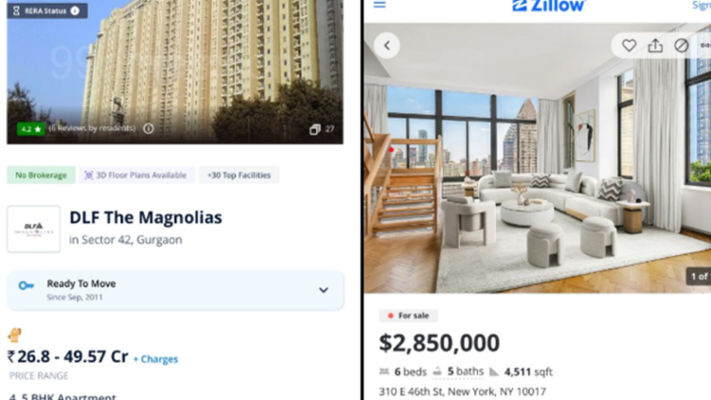

In his viral social media post, Ahluwalia showcased two property listings. One option, priced at $3 million, is located in DLF The Magnolias, a premium complex in Gurgaon’s Sector 42. For this amount, buyers can secure a spacious 5,000 sq. ft. apartment with high-end amenities, including a gym, swimming pool, covered parking, spa, and lush green spaces. Known as one of India’s most exclusive addresses, The Magnolias has become a symbol of luxury living, attracting top-tier clients, celebrities, and corporate elites.

In stark contrast, a property in New York City priced slightly lower at $2.85 million offers a 4,511 sq. ft. 6-room penthouse with breathtaking views of the iconic Empire State Building. In addition to a large living space, the property includes a planted south-facing terrace, a double rooftop terrace, a private guest house, and central air conditioning. Hardwood flooring and five bathrooms (four full and one half) complete the penthouse. While smaller than the Gurgaon apartment, the NYC property’s central location and iconic views are considerable perks, showcasing how buyers in the U.S. can access desirable features within the same price range.

Why is Indian Real Estate So Expensive? Factors Driving Up Prices

High Demand and Limited Supply

India’s rapidly growing population and urban migration patterns have intensified demand for urban housing. With an urban population of approximately 483 million as of 2023, the demand for housing continues to outstrip supply, particularly in major metros like Mumbai, Delhi, and Bangalore. According to a 2023 Knight Frank survey, property prices in Mumbai alone rose by 8.1% in the last year, placing it among the top 20 global cities for price growth.

A primary factor behind this price surge is land scarcity, especially in desirable locations within large cities. The cost of land acquisition often accounts for nearly 20% of a property’s final price, significantly inflating the overall market rate. Construction costs have also surged due to rising material and labor expenses, further elevating property values. Industry estimates indicate that India’s housing supply has grown by only about 4% annually in recent years, creating a persistent gap between supply and demand.

Investment and the Perception of Real Estate as a ‘Safe Haven’

Another factor fueling high prices is the perception of real estate as a safe investment asset. For many wealthy individuals, real estate represents a tangible, inflation-resistant investment, providing consistent returns over time. This trend has led to a real estate “bubble,” where property values in high-demand neighborhoods are pushed up by investment purchases rather than by end-user demand.

Additionally, international buyers, primarily Non-Resident Indians (NRIs), contribute to the high demand for luxury properties in metropolitan areas. A 2023 report by Anarock Property Consultants noted a 15% increase in NRI investments in Indian real estate, focusing on luxury and semi-luxury segments in cities like Delhi, Mumbai, and Bangalore. This influx of high-value investors has contributed to an unbalanced market, where middle-income buyers often struggle to access desirable housing options.

High Transaction Costs and Government Policies

High transaction costs, taxes, and complex regulations also contribute to inflated real estate prices in India. Stamp duty rates, registration fees, and Goods and Services Tax (GST) can together increase transaction costs by up to 10% of a property’s value. By comparison, transaction costs in the U.S. are generally lower, with the U.S. average hovering around 2%-3%, according to a 2024 report by the National Association of Realtors.

While government initiatives like the Real Estate (Regulation and Development) Act (RERA) have increased transparency and improved regulatory oversight, property buyers still face barriers, particularly with high-end real estate transactions. These factors, combined with cumbersome approval processes, further inflate costs, making Indian real estate an expensive proposition for investors and buyers alike.

Netizens React: Does Indian Real Estate Offer Value for Money?

Ahluwalia’s post attracted significant attention online, with social media users debating whether Indian real estate offers genuine value. Some respondents argued that the pricing in Gurgaon is “madly illogical” when compared to the U.S., where properties of equal or better quality can be purchased at a fraction of the cost. One user recounted that during a recent visit to Washington, D.C., they found a three-bedroom house in a well-connected suburb for about Rs 4-5 crore, featuring a courtyard and lawn—a stark contrast to the high prices of Indian metro properties.

Others weighed in on the quality of life aspect, noting that while New York City has a high cost of living, it offers broader economic opportunities and infrastructure that many Indian cities lack. As one user commented, “I would choose Manhattan—I lived in NYC in the past, and I can’t compare it to Gurgaon. NYC has tremendous opportunities and high pay, while the quality of life is better.” This sentiment reflects the gap in amenities and urban planning, which many believe contribute to Gurgaon’s overly steep property valuations.

Public figures also joined the conversation. Congress MP Karti Chidambaram remarked on the disparity, calling India’s real estate market “overpriced with poor infrastructure.” Critics of Indian real estate argue that, despite high prices, properties in many cities lack the infrastructure, planning, and safety standards seen in global real estate hubs, raising questions about whether India’s premium properties justify their valuations.

Future Trends: Will India’s Real Estate Market Correct?

India’s real estate market remains buoyant despite economic uncertainties, and some analysts warn of a potential pricing correction if fundamental changes aren’t made. Urban development projects, including the government’s Smart Cities Mission, aim to alleviate some of these concerns by investing in infrastructure and affordable housing in emerging urban areas. If successful, these initiatives could help distribute demand more evenly across regions and stabilize prices in top-tier cities.

Nevertheless, the luxury real estate market may continue to see upward trends, especially as India’s economic growth attracts more high-net-worth individuals to its metropolitan hubs. According to a JLL report, India’s real estate market is expected to reach a valuation of $1 trillion by 2030, with growth fueled by increased foreign investments and a rising middle class. However, if pricing remains driven by high-income investors, the market could deepen its current polarization, leaving middle-income buyers priced out of India’s largest cities.

For now, as Ahluwalia’s post highlights, the $3 million difference in what Indian and U.S. buyers can access underscores the disparity between the two markets. In the U.S., buyers still enjoy a diverse landscape where properties in sought-after locations remain accessible. In India, real estate has become an aspirational but often elusive investment, and unless demand and supply become more balanced, these high prices may continue to spark debate and push property out of reach for many would-be homeowners.