The majority of Adani Group shares fell sharply again on Monday as investors remained unconvinced by the Indian conglomerate’s response to criticism from a U.S. short seller, bringing the companies’ combined stock market losses to $66 billion in three days.

Adani Enterprises, which will be put to the test this week with a follow-on share offering, rose 4%, but this was well below the offer price and off initial gains of up to 10%.

Gautam company has been at odds with Hindenburg Research and responded on Sunday to a report from the short-sellers that raised concerns about the company’s debt levels and use of tax havens.

The company has been at odds with Hindenburg Research for some time. Adani stated that it complied with all local laws and made all necessary regulatory disclosures.

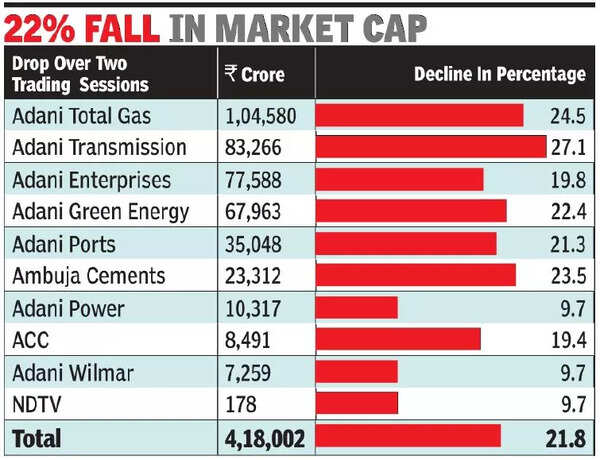

Adani Transmission, Adani Total Gas, and Adani Green Energy all experienced 20% declines on Monday.

Adani Ports and the Special Economic Zone decreased by 0.5%, while Adani Power and Adani Wilmar both saw declines of 5%.

Weak investor sentiment entered the second day of Adani Enterprises’ $2.5 billion secondary share sale.

The share price, which ranged from 3,112 to 3,276 rupees, was significantly lower than the stock’s current trading price of 2,892 rupees.

The issue received 1% more subscriptions on Friday, the first day of the offer, despite a larger decline in stock prices.

According to preliminary information from stock exchanges on Monday, Adani has now received bids for 687,840, or 1.5%, of the 45.5 million shares that are up for sale. On Tuesday, the deal will be finalized.

According to the data, neither domestic nor international institutional investors, nor mutual funds, have placed any bids so far.

“Retail participation is likely to have a shortfall,” said Hemang Jani, the equity strategist at Motilal Oswal Financial Services, “with current market prices still trailing the offer price and sentiment taking a great hit due to the Hindenburg controversy that happened.”

Even though there is a chance the share sale won’t go through, it will be important to watch to see how institutional investors participate right now.

Despite reports that bankers for the country’s largest secondary share sale were considering extending the deadline beyond January 31 or adjusting the price due to the drop in its share price, the Group told Reuters in a statement on Saturday that the sale remains on track at the planned issue price.

According to Indian regulations, the share offering must receive a minimum of 90% subscription; otherwise, the issuer is required to refund the full amount.

Among the investors who submitted bids for the anchor portion of the issue were Maybank Securities and the Abu Dhabi Investment Authority.

There is no financial impact, according to Maybank, as the subscription to the companies offer was fully funded by client funds.

Life Insurance Corporation (LIC), a state-run insurance goliath, contributed as well, taking 5% of the anchor portion, or roughly $734 million.

It already owns 4.23% of the main company, and it also has a 9.14% stake in Adani Ports and a 5.96% stake in Adani Total Gas.

DEBT, DE-LEVERAGING

Debt refers to the amount of money borrowed by an individual, company, or government. De-leveraging refers to the process of reducing debt levels or reducing the amount of debt relative to income or assets.

It is a strategy used to improve financial stability and reduce the risk of default.

De-leveraging can be achieved through various methods, including paying off debt, selling assets, or reducing spending.

The goal of deleveraging is to improve a company’s or individual’s financial health and stability.

On Saturday, the company that creates MSCI indexes said it was keeping an eye on the variables that “may impact the eligibility of those relevant securities” in its indexes and was looking for market participants’ opinions on Adani.

The MSCI India Index contains at least six Adani Group companies, with a total weight of 4.31%.

This threat has emerged because funds that bought stocks based on the MSCI will be asked by their investors to sell the holding, even though it may not happen right away, according to Dev Choksey, the company’s founder and managing director.

Seven of the listed companies in the Adani Group have experienced a massive wipeout as a result of the Hindenburg report since last week.

Since the report’s publication on Friday, the market value of the seven listed group entities had dropped by a combined $66 billion as of Monday. Adani Total Gas won the race with a $21 billion loss.

In response to Adani’s rebuttal on Monday, Hindenburg stated that the answer “largely confirmed our findings and ignored our key questions.”

In its response on Sunday, the company emphasized its connections to domestic and foreign banks and boasted about its access to a variety of funding sources and structures, naming European lenders like BNP Paribas, Credit Suisse, and Deutsche Bank as well as American banks Citigroup and JPMorgan Chase & Co.

But for Adani, 60, the ongoing stock market crash is a major setback. The school dropout’s incredible rise included gains of more than 1,500% in some of his group stocks over three years, making him the third richest man in the world before he dropped to eighth place on the Forbes list on Monday.

Five of the seven major listed companies, according to Hindenburg’s report, reported current ratios of less than 1, which the report said indicated “a heightened short-term liquidity risk.”

Current ratios are a measure of liquid assets minus near-term liabilities.

Due to what it referred to as “sky-high valuations,” it was claimed that shares of seven Adani-listed companies have an 85% downside potential.

It was also asserted that several significant Adani-listed companies have “substantial debt,” placing the entire group on “precarious financial footing.”

In its response on Sunday, he claimed that its group companies had “consistently delivered” over the previous ten years.

Also, read these articles.