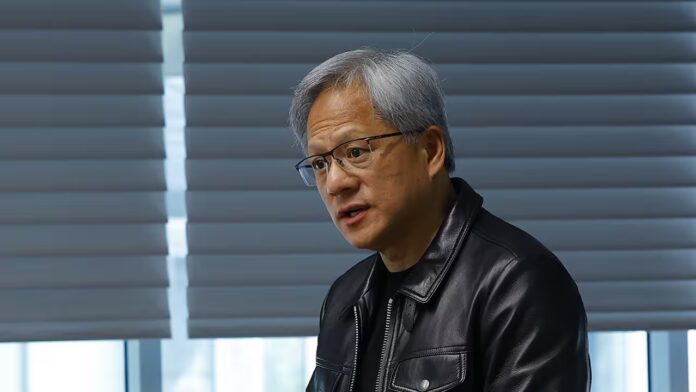

Quantum Computing Stocks Crash 50% in a dramatic market turn, raising questions about the industry’s readiness and investor confidence. Companies like Rigetti Computing, D-Wave, Quantum Computing, and IonQ saw their stock prices plummet on Wednesday, following remarks by Nvidia CEO Jensen Huang. He stated that “useful quantum computers are many years away,” casting doubt on the near-term viability of the technology.

Why Did Quantum Computing Stocks Plunge?

The sharp drop in stock prices can be traced to Huang’s statement at a recent industry event. He remarked, “If you said 15 years for very useful quantum computers, that’d be early…30 would be late. If you say 20, many would believe it.” These comments directly contradicted the optimistic projections of many quantum computing firms, which claim they are on the verge of revolutionary breakthroughs.

This stark reality check spooked investors, who began to question whether these companies can deliver on their promises within the projected timelines.

The Quantum Hype vs. Reality

Quantum computing has long been touted as the next big leap in technology, with promises of solving problems that classical computers cannot. From drug discovery to cryptography and logistics, the potential applications are immense.

However, the technology remains in its infancy, with significant hurdles to overcome, including:

- Error Correction: Quantum systems are prone to errors that require complex correction mechanisms.

- Scalability: Current quantum computers operate with only a few qubits, far below the scale needed for practical applications.

- Infrastructure Costs: Building and maintaining quantum systems is extraordinarily expensive.

These challenges have led to skepticism about whether the industry can achieve meaningful advancements in the near future.

Market Speculation and Overvaluation

The crash also highlights the speculative nature of investments in emerging technologies. Quantum computing companies have seen their valuations soar based on future potential rather than current achievements.

- IonQ’s Case: The company, which went public through a SPAC merger, saw its valuation skyrocket despite having limited revenue and commercially viable products.

- Rigetti Computing: Known for its bold claims, Rigetti has faced criticism for overpromising and underdelivering on technological milestones.

Investors are now reassessing whether these companies’ stock prices reflect realistic expectations or are merely fueled by hype.

Nvidia’s Role in the Quantum Landscape

Nvidia, a leading player in the broader tech ecosystem, has been cautious in its approach to quantum computing. While the company is actively investing in quantum simulations and hybrid computing models, Huang’s comments suggest that Nvidia views quantum computing as a long-term prospect rather than an imminent reality.

Huang’s remarks carry significant weight due to Nvidia’s dominant position in AI and computing, leading many to interpret his skepticism as a signal to reevaluate the timeline for quantum adoption.

Historical Patterns in Tech Bubbles

The quantum computing stock crash is reminiscent of other tech industry corrections:

- The Dot-Com Bubble (2000): Overhyped internet companies with little to no revenue collapsed when investors realized they were overvalued.

- The Blockchain Craze (2018): Many blockchain startups failed to deliver on promises, leading to widespread investor losses.

These examples show that technological innovation often takes longer than anticipated, and early-stage companies can struggle to meet inflated expectations.

What Does This Mean for Quantum Computing?

The stock crash does not necessarily signal the end of quantum computing’s promise. Instead, it highlights the need for a more measured approach:

- Realistic Timelines: Companies must set achievable milestones rather than overly ambitious goals.

- Transparency: Clear communication about progress and challenges can help rebuild investor trust.

- Focus on Hybrid Models: Integrating quantum and classical systems may provide practical solutions in the interim.

Impact on Other Tech Sectors

The quantum stock crash also sent ripples through adjacent industries, including AI and semiconductors, as investors began questioning the valuations of other speculative technologies. This could lead to a broader market correction, particularly for companies relying on unproven innovations.

Investor Takeaways

For investors, the quantum computing crash offers several lessons:

- Do Your Research: Avoid investing in companies without a clear path to commercialization.

- Diversify: Spread investments across multiple sectors to mitigate risk.

- Be Patient: Emerging technologies often take decades to mature.

A Reset for the Quantum Industry

While the crash is a setback, it could ultimately benefit the quantum computing industry by tempering expectations and refocusing efforts on achievable goals. As the dust settles, companies that can demonstrate real progress are likely to emerge stronger.