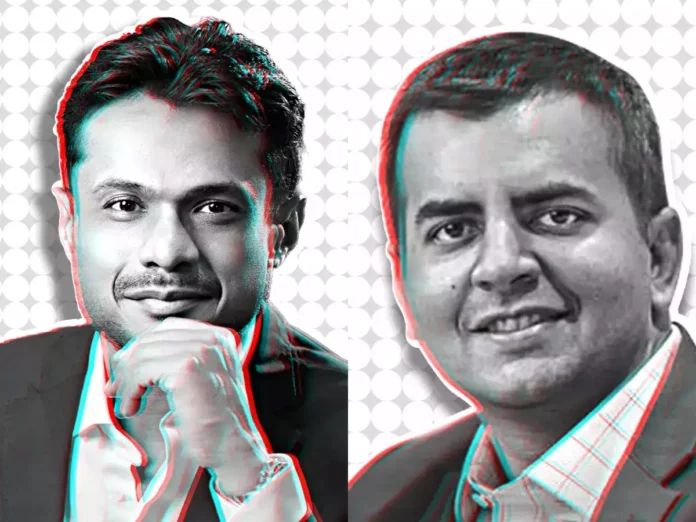

Sachin Bansal, a renowned entrepreneur and investor, plans to sell his $100 million stake in Ola, the popular ride-hailing startup. This move comes as Bansal seeks to offload his stake at a premium valuation, pegging the company’s worth at approximately $4 billion. Reports indicate that discussions are underway with private investors and family offices to facilitate the sale.

Bansal’s Investment Journey With Ola

Sachin Bansal had initially invested in Ola back in 2019 when the company was valued at around $3 billion. His decision to invest at the time was considered a strategic move, as Ola was expanding its market presence and competing aggressively with other ride-hailing giants. Over the years, Bansal’s stake has grown in value as Ola has diversified its offerings, including electric mobility and food delivery services.

For Bansal, this investment was part of a larger strategy to back promising startups in India. At the time, Ola was already a leading player in the Indian market, with substantial growth potential. His association with the company not only brought financial support but also lent credibility to the brand, given his reputation as the co-founder of Flipkart, India’s e-commerce pioneer.

Why Is Sachin Bansal Selling His Stake?

The decision to sell his stake aligns with Bansal’s broader investment strategy. Known for his calculated investments in startups, he may now be looking to reallocate his capital towards other ventures or opportunities. The premium valuation of $4 billion highlights Ola’s continued growth and market resilience despite challenges in the ride-hailing sector.

It is common for investors like Bansal to exit their investments once they reach a certain level of growth or valuation. By selling his stake, Bansal can not only realize significant returns but also redirect funds into newer startups or industries, such as fintech or green energy, areas he has shown interest in previously.

Ola’s Market Position And Growth

Ola has consistently been one of India’s leading ride-hailing platforms, with a significant market share across the country. The company has also expanded internationally, operating in markets like Australia, New Zealand, and the UK. These expansions have solidified Ola’s position as a global player, helping it compete with rivals such as Uber.

In recent years, Ola has also ventured into electric mobility with its subsidiary, Ola Electric. The launch of the Ola S1 electric scooter was a major milestone, showcasing the company’s ambition to dominate the EV market. This diversification has been a key factor in enhancing its valuation, attracting investors, and maintaining its competitive edge.

Ola’s ability to innovate and adapt to market trends has been a driving force behind its sustained growth. From introducing affordable ride-sharing services to exploring autonomous vehicle technologies, the company has demonstrated a commitment to staying ahead of the curve.

The Implications Of The Stake Sale

If successful, Bansal’s sale could attract more private investors to Ola, reinforcing confidence in its business model. It also signals the maturity of India’s startup ecosystem, where early-stage investors can exit at lucrative valuations. This development could inspire other entrepreneurs and investors to explore similar opportunities in high-growth sectors.

For Ola, the stake sale is unlikely to impact its day-to-day operations. However, it could pave the way for new strategic investors who can contribute fresh perspectives and resources. With increased capital infusion, Ola could further expand its services, invest in technology, and strengthen its position in both domestic and international markets.

Looking Back At Sachin Bansal’s Contributions

Sachin Bansal is widely known for co-founding Flipkart, which was later sold to Walmart in a landmark deal worth $16 billion. This sale not only marked one of the largest exits in Indian startup history but also positioned Bansal as one of the country’s most successful entrepreneurs. Post-Flipkart, Bansal has focused on investments in technology and startups, becoming a significant player in the Indian entrepreneurial ecosystem.

His involvement with Ola has been instrumental in solidifying its position as a market leader. By investing at a critical stage, Bansal helped Ola expand its operations, diversify its revenue streams, and build a robust brand. His expertise and financial backing have been invaluable in navigating the challenges of a competitive industry.

India’s Booming Startup Ecosystem

Sachin Bansal’s stake sale also reflects the evolution of India’s startup ecosystem. Over the past decade, the country has emerged as a global hub for innovation and entrepreneurship, with startups across various sectors attracting significant investments. From e-commerce and fintech to health tech and electric mobility, Indian startups have demonstrated their ability to scale and compete on a global stage.

The ability of early investors like Bansal to exit at high valuations underscores the maturity of this ecosystem. It highlights the growing confidence of global and domestic investors in Indian startups, paving the way for more funding and innovation.

What Lies Ahead For Ola And Bansal?

As Ola continues its journey, it faces both opportunities and challenges. The company is likely to focus on expanding its EV segment, improving service quality, and exploring new markets. With the backing of new investors, Ola is well-positioned to achieve its ambitious goals and maintain its leadership in the mobility sector.

For Sachin Bansal, the sale of his Ola stake is likely to be a stepping stone to new ventures. Known for his visionary approach, Bansal may explore investments in emerging sectors such as artificial intelligence, blockchain, or climate tech. His track record suggests that whatever path he chooses, it will likely have a transformative impact on India’s business landscape.

Sachin Bansal’s $100 million stake sale in Ola marks a critical milestone for the startup and reflects the evolving dynamics of India’s startup ecosystem. As Ola continues to innovate and expand, this move could open doors for new investors, fueling its growth and strengthening its market position.