Top 10 Best Payment Gateways In India 2023

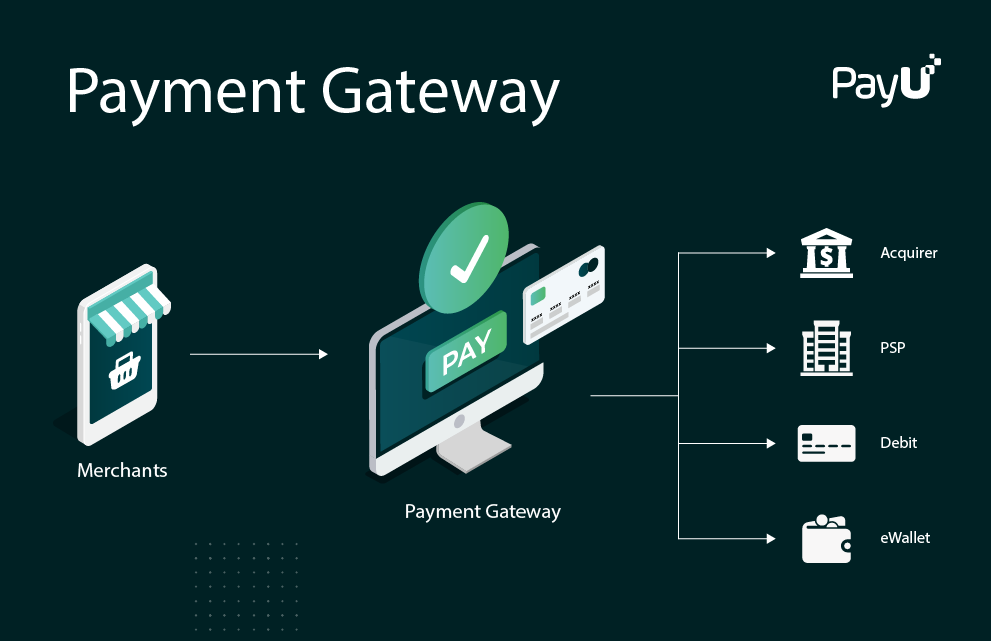

Payment gateways are online platforms or services that facilitate the secure processing and authorization of electronic transactions between buyers and sellers. They act as a bridge between the merchant’s website or application and the financial institutions that handle the payment processing.

When a customer makes a purchase online, the payment gateway securely collects and encrypts the customer’s payment information, such as credit card details or bank account information. It then transmits this information to the respective financial institution, such as a bank or payment processor, for authorization and processing.

Payment gateways play a crucial role in ensuring the security and integrity of online transactions. They employ various security measures, such as encryption and tokenization, to protect sensitive customer data and prevent unauthorized access.

Here are the key functions and features of payment gateways:

Payment Authorization: Payment gateways verify the customer’s payment information, including card details, CVV, and billing address, to authenticate and authorize the transaction with the associated financial institution.

Secure Data Transmission: Payment gateways encrypt the customer’s payment data during transmission to protect it from unauthorized access or interception.

Payment Processing: Once the transaction is authorized, the payment gateway initiates the process of transferring funds from the customer’s account to the merchant’s account.

Multiple Payment Options: Payment gateways support various payment methods, such as credit cards, debit cards, net banking, digital wallets, and alternative payment methods, allowing customers to choose their preferred payment option.

Integration with Merchant Websites/Applications: Payment gateways provide integration options for merchants to seamlessly incorporate the payment functionality into their websites or applications, enabling customers to make payments without leaving the merchant’s platform.

Security and Fraud Prevention: Payment gateways implement robust security measures, including fraud detection systems and tools, to identify and prevent fraudulent transactions and protect both buyers and sellers from potential risks.

Settlement and Reporting: Payment gateways handle the settlement process, ensuring that the funds are transferred from the customer’s account to the merchant’s account. They also provide reporting and analytics tools that allow merchants to track and analyze their transaction data.

Why Payment Gateways are important

Payment gateways are important for several reasons:

Secure Transactions: Payment gateways ensure the security and integrity of online transactions. They employ encryption and other security measures to protect sensitive customer data, such as credit card information, from unauthorized access or fraud. By handling the secure transmission of payment information, payment gateways instill trust and confidence in customers, encouraging them to make online purchases.

Convenience and Accessibility: Payment gateways enable customers to make online payments conveniently and easily. They support various payment methods, such as credit cards, debit cards, net banking, digital wallets, and alternative payment options. This flexibility allows customers to choose their preferred payment method, enhancing their shopping experience and reducing friction in the payment process.

Global Reach: Payment gateways facilitate international transactions by supporting multiple currencies and payment options. They enable businesses to expand their customer base beyond geographical boundaries, tapping into global markets and catering to international customers. This global reach opens up new growth opportunities and revenue streams for businesses.

Seamless Integration: Payment gateways provide integration options for merchants, allowing them to seamlessly incorporate the payment functionality into their websites or applications. This integration simplifies the payment process for customers, as they can complete their transactions without being redirected to external payment platforms. It also enables businesses to maintain a consistent and branded user experience throughout the purchase journey.

Faster Transaction Processing: Payment gateways facilitate quick and efficient transaction processing. By automating the payment authorization and processing steps, they enable businesses to receive payments in real-time or with minimal delay. This speed improves cash flow for merchants and ensures a smooth customer experience without unnecessary waiting periods.

Fraud Prevention and Risk Management: Payment gateways employ sophisticated fraud detection and prevention systems to identify and mitigate fraudulent transactions. They use advanced algorithms and machine learning techniques to analyze transaction patterns and identify potential risks. By safeguarding against fraudulent activities, payment gateways protect both buyers and sellers from financial losses and reputational damage.

Transaction Tracking and Reporting: Payment gateways provide merchants with comprehensive transaction tracking and reporting capabilities. Merchants can access detailed transaction records, settlement reports, and analytics data, which helps them analyze sales patterns, identify opportunities for growth, and make informed business decisions.

History of Payment Gateways in India

The history of payment gateways in India can be traced back to the early 2000s when e-commerce started gaining traction in the country. Here’s a brief overview of the history of payment gateways in India:

Early Years (2000s):

In the early 2000s, online payments in India were primarily facilitated through traditional methods such as cash-on-delivery, bank transfers, and checks. However, as e-commerce started to grow, the need for secure and convenient online payment solutions became evident.

One of the pioneering payment gateways in India was CCAvenue, which was launched in 2001. CCAvenue provided a platform for merchants to accept online payments through credit cards, debit cards, and net banking.

Emergence and Growth (2010s):

The growth of e-commerce and the increasing adoption of online payments led to the emergence of new payment gateways in India.

In 2010, PayU India (formerly known as PayU) was launched as an online payment gateway. PayU India quickly gained popularity by offering a range of payment options and providing integration services for merchants.

Another significant player that entered the Indian market during this period was BillDesk, founded in 2000. BillDesk initially focused on providing bill payment solutions but later expanded into offering payment gateway services.

With the rise of mobile commerce, mobile wallets gained prominence as payment gateways in India. Companies like Paytm (launched in 2010) and MobiKwik (founded in 2009) introduced mobile wallet services that allowed users to make payments using their smartphones.

Advancements and Digital Payments Push:

In recent years, the Indian government’s initiatives, such as demonetization in 2016 and the promotion of digital payments, have further accelerated the growth of payment gateways in India.

The introduction of the Unified Payments Interface (UPI) in 2016 revolutionized the payment landscape in India. UPI enabled instant bank-to-bank transfers and facilitated the growth of UPI-based payment gateways such as PhonePe (acquired by Flipkart in 2016) and Google Pay (formerly Tez).

International players like PayPal and Stripe also entered the Indian market, offering their payment gateway services to businesses and individuals.

The Indian government’s push for digital payments, along with increasing smartphone penetration and the growth of e-commerce, has resulted in the rapid expansion of payment gateways in the country. Today, several payment gateway providers operate in India, offering a wide range of payment options and facilitating secure online transactions for businesses and consumers.

The history of payment gateways in India reflects the evolution of digital payments in the country, showcasing the growth of online commerce and the importance of secure and convenient payment solutions in facilitating e-commerce transactions.

Benefits of Payment Gateways

Payment gateways play a vital role in the online transaction process, which is the real essence of e-commerce. They provide several benefits, including:

Security: Payment gateways offer a secure environment for transactions. They use encryption to protect sensitive information like credit/debit card numbers, ensuring that information passes securely between the customer and the merchant, and also between the merchant and the payment processor.

Ease of Integration: Most payment gateways are designed to integrate seamlessly with other popular platforms and shopping carts. This makes it easy for businesses to set them up and start accepting payments.

Expanded Customer Base: With the help of payment gateways, businesses can sell their products or services worldwide, accepting payments in different currencies. This helps to increase their customer base.

Fraud Prevention: Payment gateways have systems in place to prevent fraudulent transactions. They use tools like CVV verification and use advanced algorithms to detect fraudulent patterns.

Convenience: For customers, payment gateways offer the convenience of making payments anytime, anywhere, and from any device. They do not need to go to a physical store or location to make a payment.

Faster Transaction Processing: Compared to traditional methods, payment gateways process payments much faster. This speed can help improve the cash flow of a business.

Multiple Payment Options: Payment gateways usually support a wide range of payment methods, including credit cards, debit cards, mobile payments, and sometimes even cryptocurrency. This provides customers with flexibility and choice when making payments.

Automation and Efficiency: Payment gateways automate the payment process, reducing the administrative time required to manage transactions. It reduces manual errors and improves efficiency.

Transaction Management: Many payment gateways provide user-friendly interfaces that allow businesses to manage transactions, refunds, and withdrawals in a simplified manner.

Reporting: Payment gateways also offer robust reporting tools. These tools can help businesses track transactions, identify trends, and generate financial reports.

Best Payment Gateways in India

![Top 10 Best Payment Gateways in India [Updated]](https://www.mconnectmedia.com/blog/wp-content/uploads/2020/11/Top-10-Best-Payment-Gateways-in-India-800x500.jpg)

PayU

Razorpay

CCAvenue

Instamojo

Paytm Payment Gateway

PayPal

Cashfree

EBS (E-Billing Solutions)

BillDesk

Atom Paynetz

PayU

PayU is a leading financial services provider in global growth markets. It was founded in 2002 and is headquartered in the Netherlands. The company’s operations focus on providing a range of payment technology to online merchants.

The primary services offered by PayU include:

Payment Processing: PayU enables businesses to accept online payments from customers. They support a variety of payment methods including credit and debit cards, bank transfers, and a large number of local payment methods in various countries.

Fraud Prevention: PayU also provides features to help businesses mitigate the risk of fraudulent transactions.

Merchant Services: The company offers various services to assist merchants in managing their online businesses. These can include things like customer analytics, financial reporting, and marketing services.

PayU operates in multiple markets around the world and is particularly strong in emerging markets like India, Latin America, Africa, and Eastern Europe. They are part of Prosus, a global internet group and one of the largest technology investors in the world.

If you are seeking more recent updates or specific information about their services, it would be best to visit their official website or get in touch with them directly.

Razorpay

Razorpay is a leading full-stack financial solutions company in India. Founded in 2014 by Harshil Mathur and Shashank Kumar, Razorpay provides a suite of products and services designed to simplify and manage digital transactions.

Here are some key offerings from Razorpay:

Payment Gateway: Razorpay’s payment gateway supports multiple payment methods including credit/debit cards, net banking, UPI, and popular wallets. This allows businesses to accept payments online smoothly and securely.

Subscriptions: Razorpay Subscriptions allow businesses to set up and manage recurring payments for their products or services.

Invoices: Razorpay offers a feature to generate and send GST compliant invoices, which customers can pay online.

RazorpayX: This is Razorpay’s neobanking platform that helps businesses manage their finances, including payouts, card payments, and account management.

Capital: Razorpay Capital is a lending platform offering working capital loans and corporate credit cards to help businesses manage their cash flow.

Thirdwatch: This is an AI-driven tool for real-time fraud detection to reduce return-to-origin (RTO) costs for e-commerce businesses.

Route: Razorpay Route is a smart automation and payouts solution that helps businesses automate their vendor and distributor payments.

IFSC: Razorpay maintains an Indian Financial Systems Code (IFSC) repository that developers can use for Indian banking related operations.

CCAvenue

CCAvenue is a popular payment gateway solution in India, designed to simplify online transactions for businesses. The company was founded in 2001 and is based in Mumbai, India.

Here are some of the key offerings and features of CCAvenue

Payment Gateway: CCAvenue’s primary service is its payment gateway, which allows online businesses to accept and process a variety of payment methods, including credit and debit cards, net banking, wallets, EMI (Equated Monthly Installments), and UPI (Unified Payments Interface).

Multiple Currency Processing: CCAvenue supports transactions in multiple currencies, which is particularly useful for businesses that have an international customer base.

Multilingual Checkout Page: Their payment gateway provides a multilingual checkout interface, supporting 18 Indian and international languages. This feature helps businesses cater to a diverse customer base.

Easy Integration: CCAvenue offers seamless integration with major e-commerce platforms and shopping carts, making it easy for merchants to incorporate the payment gateway into their existing online platforms.

Security: CCAvenue uses advanced encryption technology to ensure the secure transmission of transaction data.

Analytical Reports: They provide comprehensive reports to help merchants monitor and analyze their transactions.

Marketing Tools: CCAvenue also offers a variety of marketing tools, such as promotional campaigns and coupon code generation, to help businesses attract and retain customers.

Instamojo

Instamojo is an Indian-based online selling and payments platform, established in 2012 by Sampad Swain, Akash Gehani, and Aditya Sengupta. The company’s mission is to empower small and medium enterprises (SMEs) and enable them to build, manage, and grow their businesses online.

Here are the primary offerings and features of Instamojo:

Payments: Instamojo provides an easy-to-use payment gateway allowing businesses to collect payments online. They support various payment methods including credit/debit cards, net banking, UPI, and wallets.

Online Store: Instamojo allows businesses to create their own online store without any coding skills. They can list products or services, and Instamojo provides the tools for order management, payment collection, and delivery.

Digital Products & Services: Instamojo also supports the sale of digital products and services, such as e-books, music, software, or online courses. They handle secure delivery of digital goods after payment.

Instamojo App Store: This feature offers various apps and services that businesses can use to enhance their online store, such as tools for marketing, sales, support, finance, social media, and more.

SmartLinks: These are custom payment links that businesses can share with their customers via SMS, email, WhatsApp, or social media. Customers can pay by simply clicking the link.

Instamojo Credit: This service offers short-term loans to help businesses manage their cash flow.

NEFT/RTGS/Bank Transfer: This feature allows businesses to collect payments directly in their bank accounts via NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), or bank transfers.

Paytm Payment Gateway

Paytm Payment Gateway is a service provided by Paytm, a leading digital financial services platform in India. Paytm itself was founded in 2010 by Vijay Shekhar Sharma and is known for its mobile wallet, e-commerce shopping, and various financial services.

Here are the key features and offerings of Paytm Payment Gateway

Multiple Payment Methods: The Paytm Payment Gateway supports various payment methods, including debit cards, credit cards, net banking, Paytm Wallet, UPI, and Paytm Postpaid, thus offering customers a wide variety of options.

International Payments: Paytm Payment Gateway also supports international payments, allowing businesses to accept payments from customers worldwide.

Seamless Integration: Paytm provides easy integration of its payment gateway into various platforms, including popular e-commerce platforms and custom-built websites.

Security: Paytm uses robust security measures to ensure the safety of transactions. This includes PCI-DSS compliant systems and secure encryption technology.

Dashboard and Analytics: Paytm provides a comprehensive dashboard for merchants to view and analyze their transactions, refunds, and settlements. This helps businesses better understand their revenue streams and customer behavior.

Customer Support: Paytm offers dedicated customer support to address issues and queries related to the payment gateway.

Smart Payment Routing: This feature automatically routes payments through multiple acquiring banks to increase success rates.

Custom Checkout Experience: Businesses can customize the checkout experience to maintain their branding and offer a consistent user experience.

PayPal

PayPal is an American company operating a worldwide online payments system that supports online money transfers and serves as an electronic alternative to traditional paper methods like checks and money orders. The company was established in December 1998 as Confinity by Max Levchin, Peter Thiel, and Luke Nosek, primarily to provide software security for handheld devices. It developed the money transfer service, PayPal, launched in 1999.

Here are the key offerings and features of PayPal

Online Payments: PayPal is most widely known for its payment processing services for online vendors, auction sites, and many other commercial users. It allows customers to send, receive, and hold funds in multiple currencies worldwide.

Personal Transactions: Users can also use PayPal to send money to friends or family, either from their PayPal balance or linked bank account, debit card, or credit card.

eBay Integration: In the early 2000s, PayPal was acquired by eBay, and it became heavily integrated into the eBay purchasing process. Though eBay later spun off PayPal into a separate company, their connection remains strong.

PayPal Credit: PayPal offers a line of credit that users can apply for. This operates like a credit card, with online credit approval and statement balances.

Security: PayPal provides a secure way to shop online. The recipient of a payment does not receive any sensitive financial information like the sender’s credit card or bank account number.

Mobile Payment Processing: PayPal has mobile payment processing services, allowing businesses to accept payments from customers on mobile devices.

PayPal Business Account: This provides additional features, such as the ability to make payments to multiple people and other advanced tools useful for businesses.

International Payment: PayPal operates in numerous countries and supports various currencies, making it suitable for international transactions.

Cashfree

Cashfree is a fintech company based in India that offers a range of digital payment solutions. It was founded by Akash Sinha and Reeju Datta in 2015. Cashfree enables businesses in India to collect and send money via a simple integration.

Here are some key offerings from Cashfree:

Payment Gateway: Cashfree provides a payment gateway that supports a wide range of payment methods, including credit/debit cards, net banking, UPI, wallets, and EMI.

Payouts and Bulk Disbursements: Their Payouts product enables businesses to send money to any bank account, UPI address, or PayTM wallet in India. This is useful for businesses that need to distribute payments at scale, such as e-commerce companies, insurance companies, and lending platforms.

Auto Collect and Virtual Account Services: Cashfree provides a way for businesses to automatically track customer payments with virtual bank accounts. When a customer makes a payment to a unique virtual account, the business can instantly verify the incoming payment.

Marketplace Settlement: This feature helps online marketplaces and aggregators to automatically split incoming payments with vendors.

Cashgram: Cashgram is a web link that businesses can send to customers via email or SMS. The customer clicks on the link to make a payment. This is useful for businesses that do not have a mobile app or a payment page.

Subscriptions: Cashfree allows businesses to set up and manage recurring payments from their customers.

Pay Later: In partnership with a variety of lending platforms, Cashfree’s Pay Later option gives customers the ability to buy now and pay later, potentially boosting conversion rates for businesses.

EBS (E-Billing Solutions)

EBS (E-Billing Solutions) is one of the leading payment service providers in India. The company was founded in 2005 and has since been absorbed into Ingenico Group, a France-based global leader in seamless payment solutions.

Payment Gateway: EBS’s primary offering is a payment gateway service, allowing businesses to accept and process online payments. The gateway supports a wide range of payment options, including credit cards, debit cards, net banking, and various digital wallets.

Security: EBS is fully compliant with the Payment Card Industry Data Security Standard (PCI DSS), and it employs robust security measures to ensure the safety of transactions.

Multi-Currency Support: The EBS payment gateway supports a wide range of international currencies, enabling businesses to cater to a global customer base.

Easy Integration: EBS provides easy integration options with most e-commerce and CMS platforms. They also offer a range of APIs and SDKs for custom integration.

Mobile Payment Support: EBS supports mobile payments, enabling businesses to cater to customers who prefer to make transactions via mobile devices.

Analytics and Reporting: EBS provides a comprehensive dashboard and reporting tools, helping businesses to monitor and analyze their transactions and revenues.

Customer Support: EBS offers round-the-clock technical and customer support to address any issues related to the payment gateway.

BillDesk

BillDesk is an Indian payment gateway company that provides online bill payment services. It was established in 2000 by three former Arthur Andersen executives, M.N. Srinivasu, Ajay Kaushal, and Karthik Ganapathy. The company is based in Ahmedabad, Gujarat, India, and operates across the country.

Here are some key services and features offered by BillDesk:

Online Bill Payment: The primary service of BillDesk is providing a platform for users to pay their bills online. This includes utility bills (like electricity and gas), telephone bills, mobile phone bills, internet bills, insurance premiums, and more.

Auto-Pay: BillDesk offers an “Auto-Pay” service, where users can set standing instructions for automatic payment of specified bills, ensuring they never miss a due date.

Payment Gateway: BillDesk also provides payment gateway solutions for merchants, allowing them to accept online payments from their customers. They support various payment methods including credit cards, debit cards, net banking, and wallets.

Reminders and Notifications: BillDesk provides a feature to set reminders for due dates of bills, and it notifies users about the status of their payments.

Security: BillDesk has put in place stringent security measures to ensure safe transactions. They follow the data security standards set by the Payment Card Industry Data Security Standard (PCI DSS).

Partner Banks: BillDesk has partnered with numerous banks across India, allowing their customers to make online payments easily.

Atom Paynetz

Atom Paynetz is a payment gateway solution provided by Atom Technologies, an Indian financial technology company that provides multi-channel payment solutions. Atom Technologies was established in 2006 and is based in Mumbai, India.

Here are the main services and features of Atom Paynetz

Payment Gateway: Atom Paynetz’s primary offering is its payment gateway. It supports various payment methods, including credit cards, debit cards, net banking, IMPS (Immediate Payment Service), UPI (Unified Payments Interface), and multiple mobile wallets.

Security: Atom Paynetz is PCI DSS (Payment Card Industry Data Security Standard) compliant, ensuring a secure environment for online transactions.

IVR Payment: Atom Paynetz offers Interactive Voice Response (IVR) payment solutions, allowing businesses to accept payments over the phone.

POS Solutions: Atom Technologies also provides POS (Point of Sale) solutions for businesses, enabling them to accept card payments at physical locations.

Easy Integration: Atom Paynetz offers easy integration with different e-commerce platforms and custom websites.

Mobile Payments: Atom Paynetz supports mobile payments, allowing businesses to accept payments through mobile devices.

Recurring Payments: They offer services to set up and manage recurring payments, which can be useful for subscription-based businesses.

Multi-Currency Support: The Atom Paynetz payment gateway supports multiple currencies, enabling businesses to cater to international customers.