India’s Bold Move: The Implications of Eliminating the 2000-Rupee Note on Its Economy

In a significant step towards implications combating corruption and promoting a digital economy, India recently made the bold decision to eliminate the 2000-rupee note from circulation. This move, aimed at curbing illicit activities and promoting transparency, has far-reaching implications for the country’s economy.

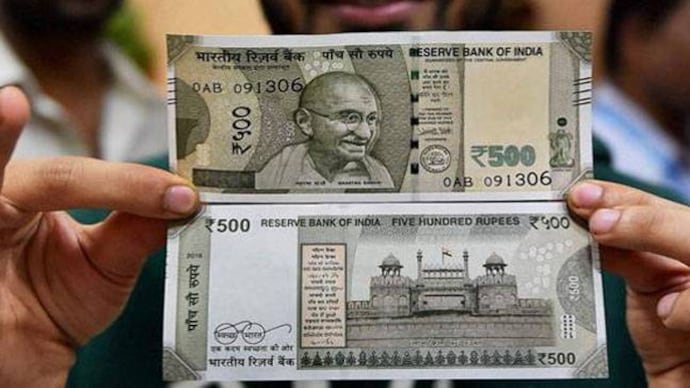

The decision to scrap the 2000-rupee note was part of the government’s larger efforts to tackle black money, counterfeit currency, and corruption. The high-denomination note had become a preferred choice for hoarding unaccounted wealth and facilitating illegal transactions.implication By phasing it out, the government aimed to disrupt these illicit practices and create a more accountable financial system.

One of the immediate implications of this move was the need for individuals and businesses to exchange their 2000-rupee notes for lower denominations or alternative modes of payment. The process implication of demonetization led to a temporary disruption in the economy as people adjusted to the new currency landscape. Long queues formed outside banks and ATMs as citizens rushed to exchange their high-value notes, causing some inconvenience and short-term economic slowdown.

However, the long-term benefits of this decision are expected to outweigh the initial challenges. By eliminating the 2000-rupee note, the government aimed to promote digital transactions, enhance tax compliance, and encourage financial inclusion. With a greater focus on digital payments, the economy can become more transparent, efficient, and less dependent on cash transactions.

Another significant implication of scrapping implications the 2000-rupee note is the impact on illicit activities. The high denomination note was often used by counterfeiters to produce fake currency, posing a threat to the integrity of the financial system. By removing this note from circulation, the government aimed to disrupt the operations of counterfeiters and make it harder for them to engage in fraudulent activities.

Furthermore, the move towards eliminating the 2000-rupee note aligns with the global trend towards a cashless society. Many countries implications around the world are adopting digital payment systems to reduce the reliance on physical currency. By embracing implication digital transactions, India can streamline its economy, reduce the costs associated with printing and managing physical currency, and enhance financial security.

However, it is essential to acknowledge the challenges that accompanied this decision. The sudden demonetization disrupted various sectors, especially those dependent on cash transactions, such as agriculture and small businesses. The informal sector, which largely operates on cash transactions, faced difficulties as liquidity temporarily decreased. Additionally, the rural population, with limited access to digital infrastructure, encountered challenges in adopting digital payment methods.

To mitigate these challenges, the government implemented several measures. It introduced new currency notes of lower denominations to ensure the smooth functioning of daily transactions. It also encouraged the use of digital payment platforms and provided incentives to promote their adoption. The government’s focus implication on financial literacy and digital infrastructure development aimed to ensure that all sections of society could participate in the digital economy.

The long-term implications of scrapping the 2000-rupee note on India’s economy are yet to be fully realized. While the initial disruption caused by demonetization led to some short-term economic slowdown,implication the move has the potential to bring about transformative changes in the country’s financial landscape. A shift towards digital transactions can enhance financial inclusion, promote transparency, and reduce corruption.

Moreover, the elimination of the 2000-rupee note sends a strong message that the government is committed to combating black money, counterfeiting, and corruption. It demonstrates the government’s determination to create a level playing field for businesses, encourage tax compliance, and foster a culture of accountability implication.

In conclusion, India’s decision to scrap the 2000-rupee note has significant implications for its economy. While it presented initial challenges.

The transition to a cashless implication economy requires concerted efforts and continuous adaptation. As India progresses on this path, it is crucial to address the concerns and challenges that arise. One such concern is the need for robust digital infrastructure and connectivity across the country, implication especially implication in rural areas where access to financial services and technology may be limited. The government has implication recognized this and has taken steps to expand digital infrastructure, improve internet connectivity, and promote financial literacy to ensure that all segments of society can participate in the digital economy implications.

Additionally, the government’s focus on promoting digital payments implication has spurred innovation in the fintech sector. Mobile payment apps, digital wallets, and online banking services have witnessed rapid growth and have become integral to the daily lives of millions of Indians. This not only provides convenience implication but also opens up opportunities for financial inclusion, as even those without traditional bank accounts can now access and utilize digital payment platforms.

Moreover, the elimination of the 2000-rupee note has had implications for the tax system. With a reduced dependence on cash transactions, there is greater scope for improving tax compliance and expanding the tax base. Digital transactions implication leave a digital footprint, making it easier for authorities to track and monitor financial activities. This can lead to a more effective tax collection system, which in turn can contribute to the government’s revenue generation and enable investments in infrastructure, healthcare, education, and other sectors that benefit the overall development of the country.

It is worth noting that the impact of the decision to scrap the 2000-rupee note extends beyond the domestic economy. India’s move towards a cashless economy has the potential to strengthen its position in the global digital payments landscape. As the world increasingly embraces digital transactions, India can position itself as a leader in financial technology and innovation. This can attract investments, foster entrepreneurship, and contribute to the country’s economic growth.

However, it is essential to address the concerns and challenges implication that emerged during the implementation of demonetization. The sudden withdrawal of high-value currency notes caused temporary disruptions in sectors reliant on cash, and individuals faced difficulties in accessing their funds during the transition period. Lessons can be learned from this experience to ensure that future policy interventions are implemented with greater precision and minimal disruption.

In conclusion, the decision to eliminate the 2000-rupee note in India represents a bold move towards a cashless economy. While it has posed short-term challenges, the long-term implications hold promise for a more transparent, inclusive, and digitally-driven economy. As India continues its journey towards a cashless future, it is crucial to address infrastructure gaps, enhance financial literacy, and promote digital inclusivity to ensure that the benefits of this transformation reach all sections of society. By embracing the opportunities presented by a digital economy, India can position itself as a global leader in financial technology, foster economic growth, and improve the overall well-being of its citizens.