JP Morgan Follows Suit

Amid the Global Layoffs by different establishments JP Morgan Chase & Co has allegedly laid off hundreds of employees within less than a few hours of the announcement, about their plans to sign on some bankers.

As per a news report by Reuters quoting sources from the company JP Morgan Chase & Co, the company has finalized to reduce positions and create new roles accordingly.

Globally Layoffs have Affected more than 90,000 employees from 321 companies who lost their jobs. Goldman Sachs in the banking sector in January started laying off their staff in a drive to cut costs, with reports stating that 3,200 or around 1/3rd of people were affected which is stated to be the highest among the Banks.

“We regularly analyze our business and customer demands and balance our people accordingly- hatching new roles where we realize the need or reducing positions when needed,” a spokesperson from Chase told Reuters.

JPM reported it would expand its staff dedicated to assisting small businesses by employing more than 500 bankers during 2024, with more than over 2,300 at present.

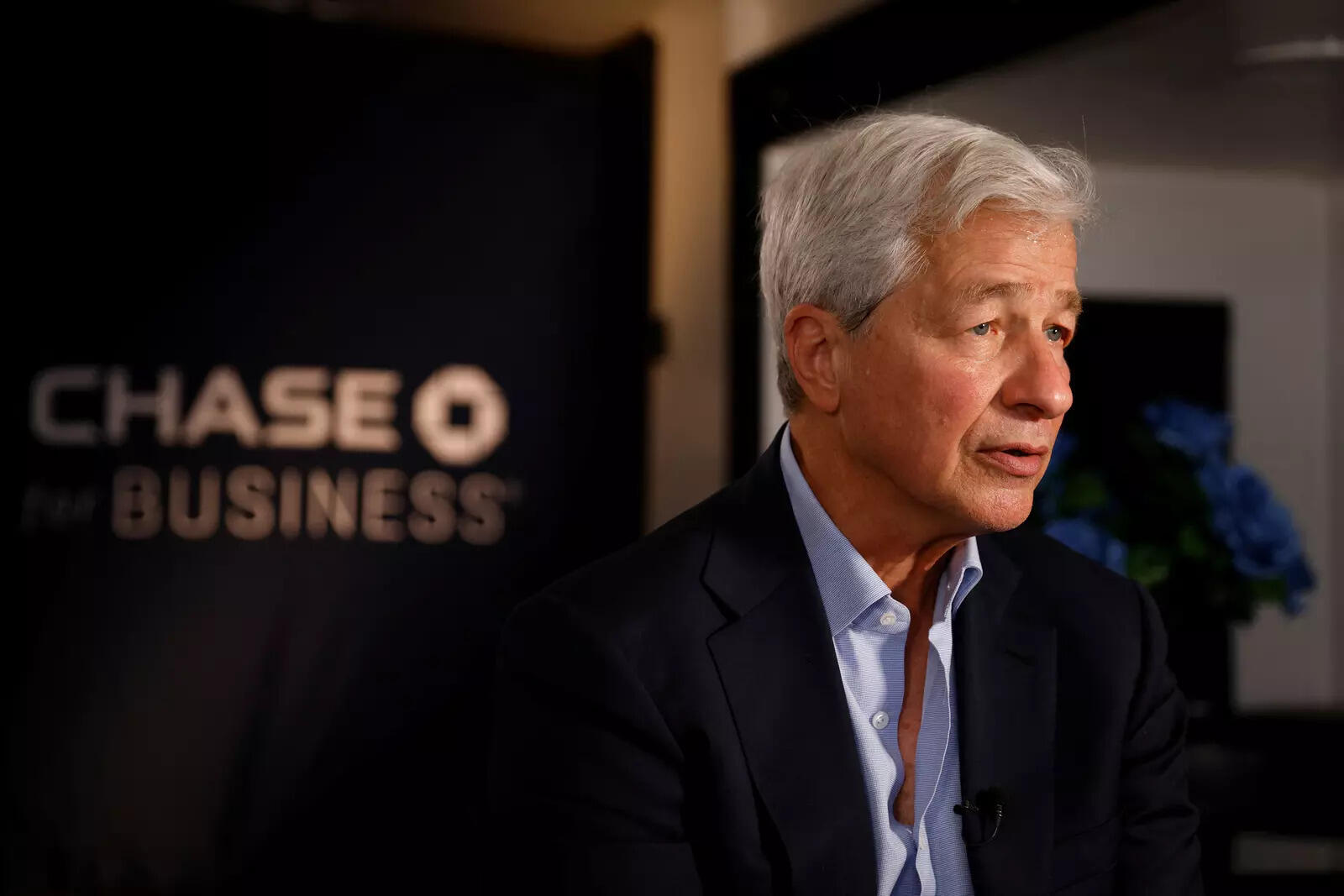

JP Morgan CEO Jamie Dimon said in an interview that the forewarning for recruitment at the bank stays increased when questioned about the job given to layoff at other Wall Street banks.

“We are always opening branches, and still hiring bankers around the world, consumer bankers, middle-market bankers, small-business bankers, folks overseas… We have new clients to cover,” he stated.

Credit Suisse went ahead and slashed 2,700 jobs in the 4th quarter and was planning to terminate about 9,000 positions by the year 2025-Reported Bloomberg last November. Later in December last year Morgan Stanley allegedly sacked around 2% of its employees.

The new layoffs affected 1,600 staff out of a strong workforce of 81,567 investment management companies worldwide.

Small business owners were surveyed in majority by JP Morgan which awaits a recession this year, at the same time, they are optimistic, as 2/3rd saw heightened sales and 65 percent predicted higher profits.

Lori Beer, JP Morgan’s global chief information officer told Reuters in September that the company had planned to include around 2,000 engineers from around the world amid aggressive competition for tech aptitude. The worldwide census of the Bank increased 8% last year to 293,723.

Wall Street Giants like Morgan Stanley and Goldman Sachs Group Inc, have slashed thousands of jobs solely, as deal-making was depressed because of the heightened economic outlook, along with these giant mortgage lenders also reduced their personnel.

The tech industry also respected this and followed in their footsteps; tens of thousands of layoffs were disclosed as a probable recession emerging.

Disney also declared layoffs, about 7,000 personnel are believed to be affected because of a decline in the number of subscribers.

In the month of January at the beginning of the year, JP Morgan’s closest competitor Goldman Sachs also slashed 3,200 Jobs, which was followed by David Solomon, the CEO taking a 25% pay cut.

Co-head of North American Equities and Director of research Allison Williams at Bloomberg Intelligence, said: “she thinks it’s a natural, anticipated cut in capacity.

We had two massively strong years of mortgage capacity. And that was reduced in the previous year, 2022.

Williams also called attention to JP Morgan’s statement about their intention to hire about 500 small-business bankers through 2024 in their retail branches, which will boost the company’s staff which serves small enterprises by 20 percent.

“She said that it wasn’t a broad statement of weakness out there.” (Williams) “She also said that she thinks the bank is adjusting to few cyclical pressures in the mortgage business but further considering to construct over the long term.”

JP Morgan Chase and Co’s (JPM.N) chief executive, warned against announcing victory against inflation way ahead, cautioning that the Federal Reserve Could increase interest rates more than the 5 percent mark if excessive prices ended up “tacky.”

The aftermath of the Federal Reserve Officials’ statement about additional rate hikes being on the cards, was Jamie Dimon’s warning, however, they were not ready to hint that January’s new job reports have a possibility of pushing them back to a more rigorous monetary policy standpoint.

Dimon said, “It is very reasonable to wait a while as the Fed goes to 5%.”

However, if inflation drops down to 4% or 3.5% and remains there, “you might need to go higher than the 5% mark and that might alter longer rates, short rates.” he said.

The Fed’s desired measure of inflation from a peak of 7% in the month of June stood at 5% in the month of December- way above its target of 2% but pacing downward steadily.

In an interview with Reuters which was wide-ranged, Jamie Dimon cautioned stricter command of credit card fees could give rise to lenders to stretch low credit. He also talked about his plan to visit China, stating it was necessary to maintain a connection there.

The Indian equity market has outperformed new markets last year bountifully by virtually doing nothing. The index furnished 4.8% returns in rupee terms which were below 0 or negative in dollars, it still outperformed because North Asia did poorly- said JP Morgan India.