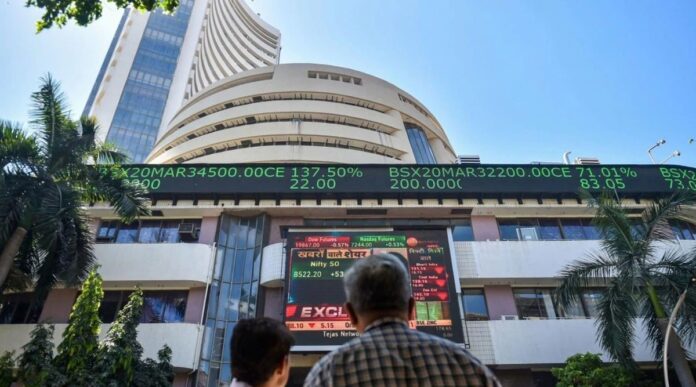

Markets fall in early trade on weak global cues

Equity benchmark indices fell in early trade on Friday amid a weak trend in global equity markets.

The 30-share BSE Sensex declined 236.59 points to 57,985.51 after a weak start. The broader NSE Nifty dipped 69.95 points to 17,261.85.

Among the 30-share Sensex pack, IndusInd Bank, Tata Steel, ICICI Bank, Mahindra & Mahindra, State Bank of India, HDFC Bank, Bajaj Finance and ITC were the major laggards in early trade.

On the other hand, Titan, Maruti, HCL Technologies and Reliance Industries were the winners.

Elsewhere in Asia, markets in Tokyo, Shanghai and Hong Kong were quoting lower, while Seoul was in the green.

The US markets ended lower on Thursday.

“Equity markets could exhibit a cautious trend with a negative bias in Friday trade owing to weakness across the global indices. The US September jobs report to be released later today would be keenly watched by investors the world over as this would set the market direction for the near term,” said Prashanth Tapse – Research Analyst, Senior VP (Research), Mehta Equities Ltd.

The BSE benchmark had gained 156.63 points or 0.27 per cent to settle at 58,222.10 on Thursday. The Nifty advanced 57.50 points or 0.33 per cent to end at 17,331.80 in the previous trade.

Meanwhile, the international oil benchmark Brent crude futures dipped 0.07 per cent to USD 94.35 per barrel.

Foreign institutional investors were net buyers as they bought shares worth Rs 279.01 crore on Thursday, according to data available with BSE.

“An important data which can influence markets globally is the US jobs data expected tonight. The fact that FIIs have stopped selling and have turned buyers, though in small quantities, is positive for markets,” said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.